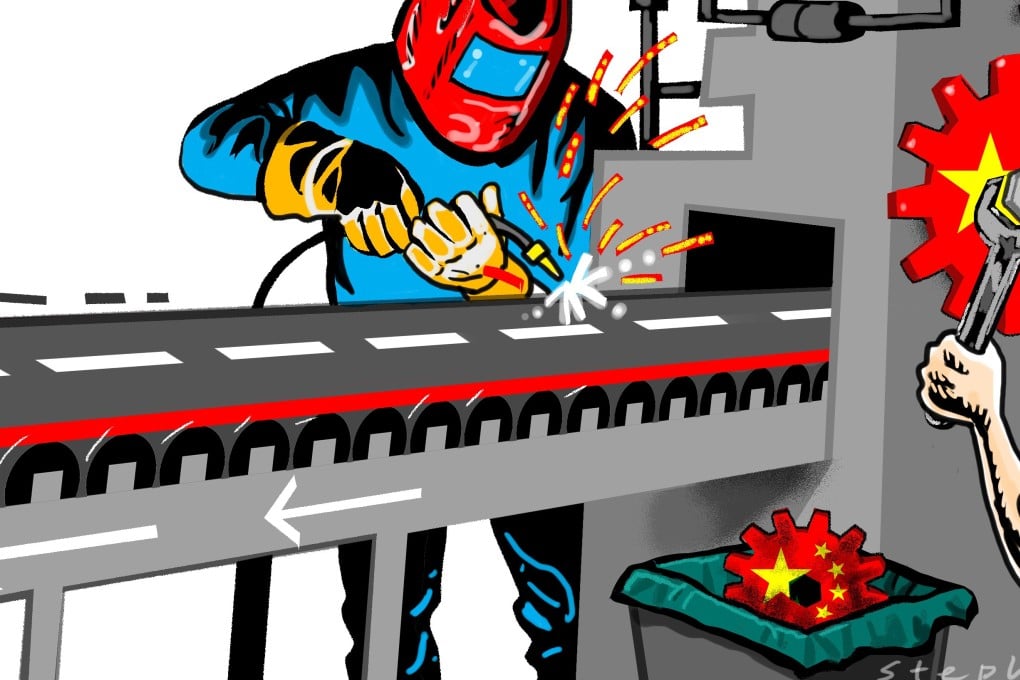

China must reform at home to ensure its belt and road plan succeeds abroad

Andy Xie says to realise its vision of a new economic order, China must have a domestic economy big – and open – enough to anchor the region. Otherwise, the infrastructure projects will become mere islands of modernity amid a sea of backwardness, and fail to generate sustainable growth

China is promising a huge amount of financial resources for the initiative, dwarfing what the existing international financial institutions could deliver. This huge amount, however, is still small, relative to the overall infrastructure needs of these countries. If the China-financed projects become mere islands of modernity amid a sea of backwardness and poverty, they will fail to generate sustainable trade growth – the primary objective of the belt and road.

Vision or mirage? Cashed up and keen, China faces long haul along new Silk Road

The belt and road has sometimes been compared to the Marshall Plan, which the US initiated to help Europe rebuild after the second world war. That worked well because the US was a huge market. Europe and Japan, which also received aid, were too poor to justify the early investment on domestic demand. Export to the US market anchored their investment-led development.

Also, Europe and Japan were advanced economies before they were bombed out. The recovery was about capital only, not culture, labour quality or government institutions.

Multimedia: The five main projects of the Belt and Road Initiative

The belt and road countries are much poorer and less developed than Europe and Japan were. Labour quality and government institutions are works in progress. Their productivity will increase gradually under the best circumstances. Their investment will need an external anchor for demand. But, to where could they export their products? If the investment is only for domestic demand, the development strategy would work too slowly.