Central banks should really not have to play silly games

Beijing’s economic adviser Huang Qifan has outlined another way in which they have become an economic curse that has allowed central bank to release too much cash into the economy

Are China’s US$3 trillion reserves an economic curse?

SCMP headline,

November 17

Yes they are indeed an economic curse and on Thursday a former Chongqing mayor and now Beijing economic adviser, Huang Qifan, outlined another way in which they have become so.

They have allowed the People’s Bank of China to release too much cash into the economy, leading to financial risks and assets bubbles, he said.

How?

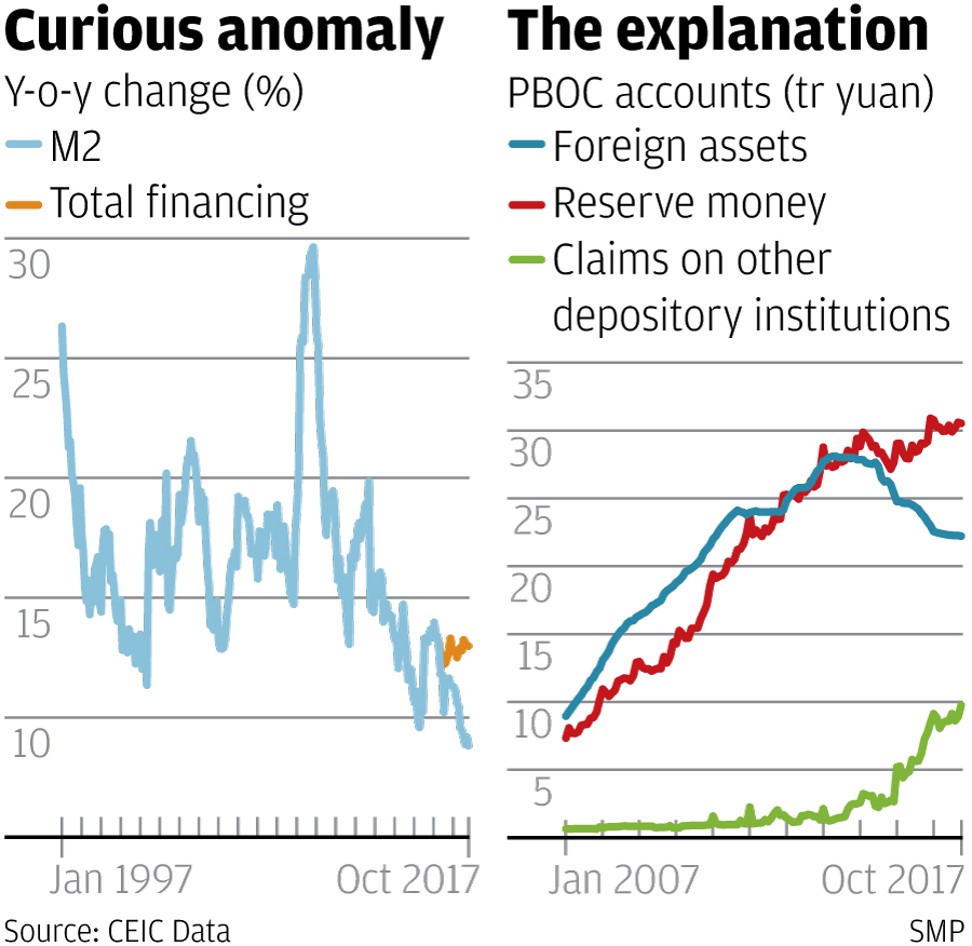

We start with a puzzling anomaly made apparent in the first chart. The M2 measure of the money supply, which measures cash and all deposits held in banks, is at present growing at a meagre 8.8 per cent a year.

This is the lowest figure I can find on record and it is highly unusual for a booming economy that in nominal (not adjusted for inflation) terms is actually growing by 11.4 per cent.

What is more the growth of aggregate financing shows no impact from this M2 slowdown and is still growing at a healthier 13 per cent, another unusual feature of recent financial data.

Now turn to the second chart. The blue line here shows you the foreign assets of the People’s Bank of China.

This is the same as the foreign reserves except that here they are stated at cost and in yuan terms. It is market value and US dollar terms when we call them foreign reserves.

The red line shows you the biggest element of the other side of the PBOC’s balance sheet, reserve money. Part of it represents currency in circulation but by far the biggest element is money simply forced out of commercial banks and tough luck for them if they don’t like it.

The interesting thing about this is the PBOC may have needed to make these exactions when it had to pay for its big buying binge in foreign reserves but this binge is now history. Yet, as the chart shows, the PBOC is still pulling money out of the rest of system.

What is it doing with this money? Your answer lies in the green line on the chart. It is putting the money right back into the banks and calling it “claims on other depository institutions”. We are not talking small beer here. This source of funding has risen by more than seven trillion yuan in just two years, which definitely contributes to the asset bubble.

So, yes, Mr Huang is absolutely right. The PBOC has itself gone into the lending business through the back door by maintaining its reserve exactions at much higher levels than they need to be and giving itself tighter control of where the banks advance the money.

The only other difference is that the banks do not classify these PBOC deposits as deposits but only as “claims” and therefore they do not go into the M2 numbers, which is why M2 growth is so low. Central banks should not have to play such silly games.