Advertisement

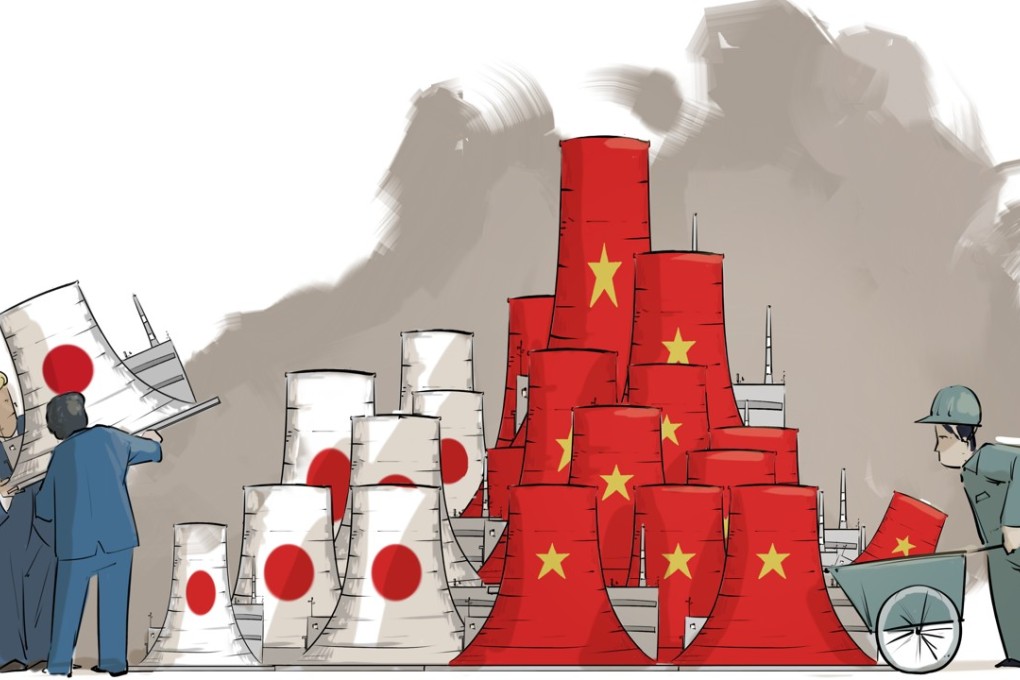

A new coal war frontier emerges as China and Japan compete for energy projects in Southeast Asia

Frederick Kuo says Southeast Asia’s appetite for coal has spurred a new geopolitical rivalry between China and Japan as the two countries race to provide high-efficiency, low-emission technology

Reading Time:4 minutes

Why you can trust SCMP

A joint report by Greenpeace, the Sierra Club and CoalSwarm indicates that Southeast Asia will be the new epicentre of coal production. Asia accounts for 85 per cent of new coal power development in the world’s top 20 coal producing countries, with China as the leader of the pack. However, while tighter restrictions on domestic coal plants have been imposed by the central government to curb pollution, Beijing has pushed the development of high-efficiency, low-emission coal plants across Southeast Asia as part of the “Belt and Road Initiative”.

As China is expanding its influence, Beijing’s foremost strategic competitor in Asia, Japan, is being forced to step up efforts to combat its shrinking influence in the region. The booming energy sector of Southeast Asia, especially coal, is proving to be the new front line in the geopolitical rivalry between Asia’s two industrial giants.

Why China’s winter fuel crisis is a cold, hard lesson in the law of unintended consequences

China’s coal drive is part of a larger energy-driven investment policy that follows its attempt to reduce carbon emissions by clamping down on the coal industry and pledging to increase investments in renewables. However, Chinese energy planners have realised they cannot relinquish coal as a major power source for the foreseeable future. The country remains highly dependent on coal, with coal sources accounting for roughly 73 per cent of China’s electricity production in 2014, according to World Bank numbers. Instead of abandoning coal, China is developing cleaner and higher-efficiency coal plants – and, as a boon to its plan for greater regional influence, aims to export the technology abroad.

China is developing cleaner and higher-efficiency coal plants – and, as a boon to its plan for greater regional influence, aims to export the technology abroad

To that end, the China Development Bank and China Export Import Bank last year lent US$25.6 billion to global energy projects. This figure surpassed even the US$22.6 billion provided by the International Bank for Reconstruction and Development.

Advertisement

From a market perspective, Beijing’s plan to become the world’s primary high-efficiency, low-emission technology provider comes at the right time. Coal consumption across Asia is slated to outpace that of China over the next 20 years, coupled with an absolute increase in global coal demand over the next seven years. The more than 1,600 coal plants scheduled to be built by Chinese corporations in over 62 countries will make China the world’s primary provider of high-efficiency, low-emission technology.

Because policymakers still regard coal as more affordable than renewables, Southeast Asia’s industrialisation continues to consume large amounts of it. To lift 630 million people out of poverty, advanced coal technologies are considered vital for the region’s continued development while allowing for a reduction in carbon emissions.

Advertisement

Clearly, the countries providing this technology will inevitably expand their sway with regional governments. As a consequence, a race between Tokyo and Beijing over the construction of coal plants is already under way.

China has become the new Japan, as nation eschews coal for natural gas in its war on air pollution

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x