Advertisement

Macroscope | Why MSCI’s inclusion of A shares should be a clarion call to foreign investors

Aidan Yao says although it may take years for the inclusion of A shares in the MSCI index to generate significant foreign capital inflows, the move is still worthwhile

Reading Time:3 minutes

Why you can trust SCMP

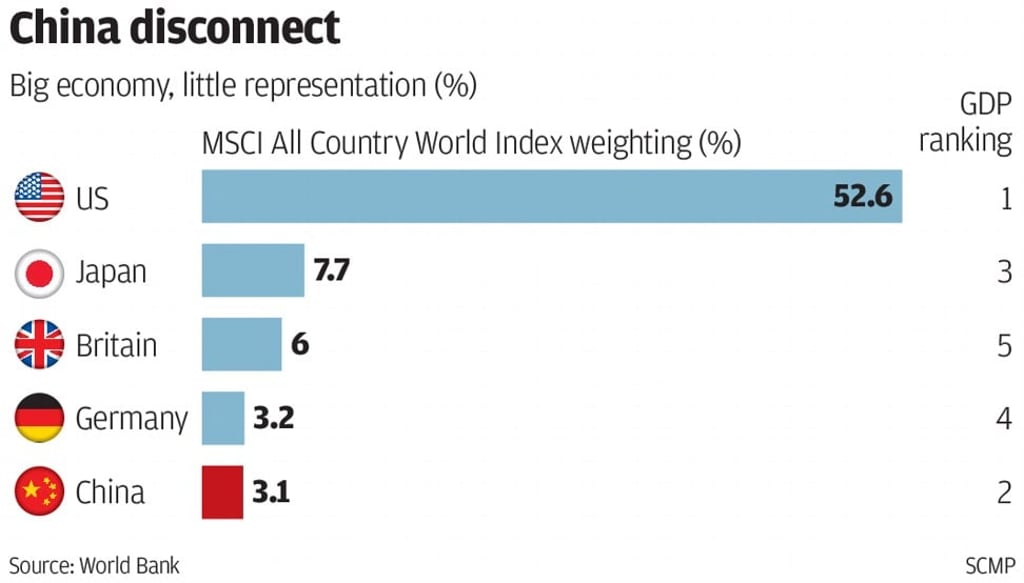

The internationalisation of China’s equity market is about to receive a major symbolic boost as the Morgan Stanley Capital Index (MSCI) will soon add A shares to its index universe. This is a milestone in the integration of Chinese equities into the world market that will put A shares on global investors’ radar.

Capital inflows to the onshore equity market, via the Stock Connects, have already picked up in recent weeks, despite the Sino-US trade tensions and rising economic headwinds. Nevertheless, the MSCI entry might not create an immediate liquidity windfall large enough to change onshore market dynamics.

The primary reason is the limited inclusion at the start. The MSCI will add only 2.5 per cent of the 234 stocks eligible for inclusion on June 1, which will be raised to 5 per cent on September 3. Once completed, A shares will account for 0.8 per cent of the MSCI Emerging Market (EM) index and around 0.1 per cent of the MSCI World index.

Advertisement

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x