Advertisement

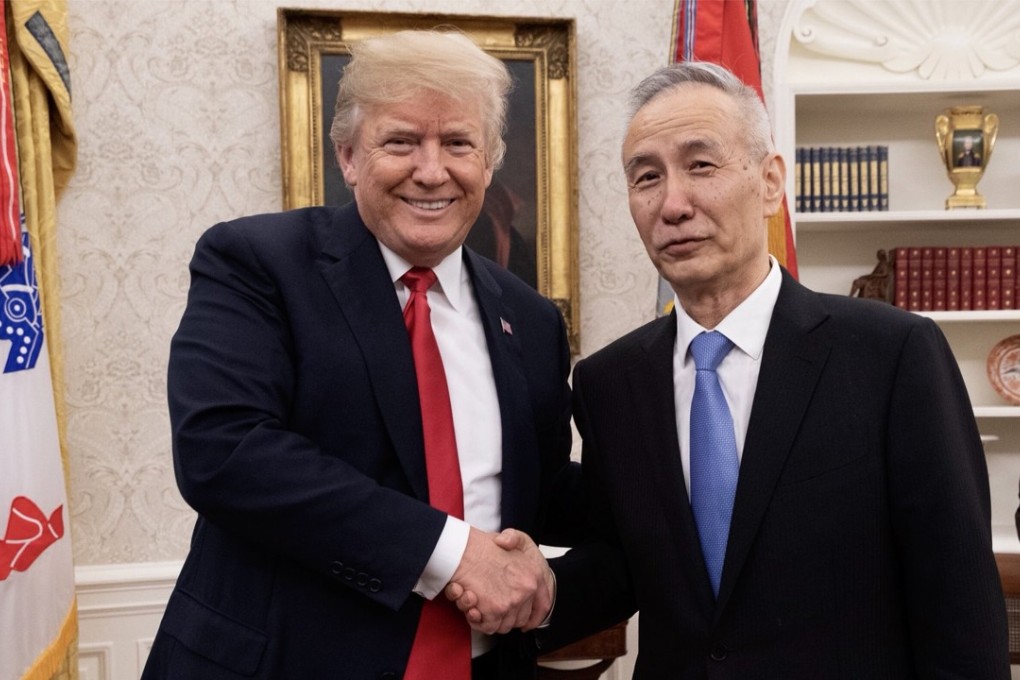

The View | Donald Trump’s art of the deal is taking its toll on US and Chinese stock markets

Richard Harris says Trump’s desire to reduce the trade deficit with China may be justified, but his chaotic negotiating style is not

Reading Time:3 minutes

Why you can trust SCMP

Rarely can two sides that have reached agreement be so far apart. US President Donald Trump started the trade fight emboldened by his victory in reducing US taxes – and to many he had a point. The trade deficit of US$335 billion is huge when you consider that total US exports to China are just US$130 billion.

There is no doubt that the United States has a rampant hunger for Chinese products. And it is equally true that the Chinese people have a huge desire for things American and European to satisfy an enriched population’s demands for the high-quality end of the Chinese consumer economy.

Watch: Foxconn said it will help balance the trade deficit between the US and China

Advertisement

To allow the free ingress of “foreign” products and services in the early days of China’s development would have totally swamped that market. If you think Amazon, Apple, Cisco, Facebook and Google are big, think of how huge they would be if the Chinese government had not blocked their expansion and encouraged the rise of Alibaba, Baidu, Huawei, Tencent, Xiaomi and ZTE. That was a Chinese government policy that, at a stroke, lifted China into both super-economy and superpower status.

Sensible national leaders know that beggaring one’s trade partners is only going to hurt one’s own interests longer term

But cutting China some slack as a developing economy is not the same as standing aside when Chinese companies are financially able to buy the commanding heights of the US and everybody else’s economy. Trump coming into the game late sees China “raping” the US and being a currency manipulator. Yet his wild calls to open up the Chinese economy fall on a lot of sober ears, not only in the US but also in Europe.

Advertisement

They also fell upon the ears of President Xi Jinping who has announced a further opening of the Chinese economy. Sensible national leaders know that beggaring one’s trade partners is only going to hurt one’s own interests longer term – look at how the Saudi authorities manage the oil price both up and down.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x