Japan faces an urgent economic problem, but a sales tax hike is not the solution

- Tokyo plans to proceed with a sales tax increase in October, despite signs of economic weakness and signals of an end to monetary easing. But, instead of penalising the middle class, it should be solving Japan’s structural problems

The Japanese government’s efforts to rejuvenate the economy are unlikely to bear fruit any time soon.

In December 2012, when the Liberal Democratic Party returned to leadership, Prime Minister Shinzo Abe campaigned on providing massive fiscal stimulus, aggressive monetary easing and structural reform. The devaluation of the yen, critical to Japanese exporters, was the implicit denominator of the proposed changes.

However, international observers have been remarkably optimistic about Japan recently. Last November, the International Monetary Fund reported that Japan “has had an extended period of strong economic growth”.

As the growth rate, supported by huge monetary injections and growing debt, increased to 1.9 per cent in the fourth quarter of 2018 and inflation reached nearly 1.5 per cent, the Abe administration began to flirt with another tax hike. “The sales tax hike to 10 per cent is needed the most to secure stable financial resources to pay for social security for all generations,” said Finance Minister Taro Aso.

In 2018, the BOJ’s bond and stock holdings topped 100 per cent of GDP. Now, the BOJ is adjusting the pace of bond purchases so that its holdings do not exceed 50 per cent of GDP, which some believe may signal an end to monetary easing.

In 2018, foreigners held a record 12 per cent share of outstanding debt, yet most debt is in Japanese hands and in yen. Falling rates in the US and elsewhere have made Japanese bonds attractive, as long as their yields do not fall too much because of BOJ policy.

But times may be changing. At the end of 2018, the BOJ’s ownership of Japanese government bonds fell for the first time in seven years, to 42.99 per cent. In the past five years, Japan’s government debt has climbed to more than 250 per cent of GDP. As long as interest rates remain ultra-low, the cost of servicing the debt is affordable. But nothing lasts forever.

Japan faces a more urgent version of a problem facing advanced economies: how can it support high living standards with low or no growth?

In the past three decades, Japanese living standards, as measured in GDP per capita, have advanced from US$30,000 to nearly US$45,000. Yet, Japan’s trend growth has plunged from 5 per cent to less than 0.5 per cent – by more than 90 per cent.

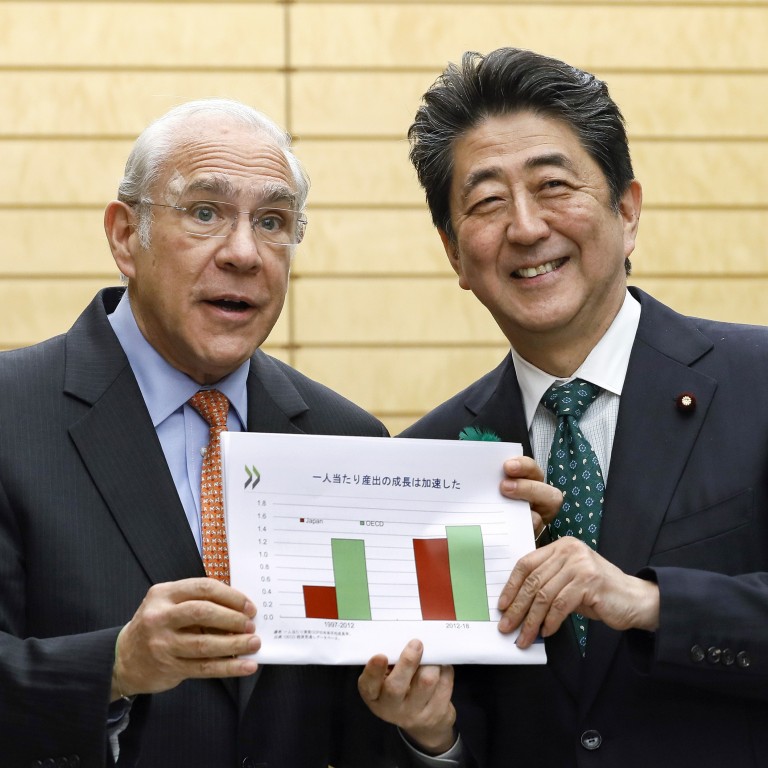

Nevertheless, the Organisation for Economic Co-operation and Development is urging Japan to triple its sales tax, to 26 per cent, to achieve a large primary surplus. It also recommends spending cuts and curbs on health care services. In reality, such austerity could derail remaining support structures for growth, inflation and average prosperity in Japan.

Japan is the first advanced economy in secular stagnation, but others remain on the same path. Penalising Japan’s middle and working classes, while sustaining the kind of privatisation, liberalisation and deregulation that led to the income gap in the first place, is foolish.

As the world’s third-largest economy and second-largest debt market, Tokyo’s future choices will have repercussions for the world – good and bad.

Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Centre (Singapore). See: http://www.differencegroup.net/