Advertisement

Macroscope | How China can improve the global appeal of the yuan and take on the US dollar

David Brown says there is room for the yuan to play a bigger role in the global economy, but for that to happen Beijing needs to loosen capital controls, allow the currency to be freely convertible and show greater transparency

Reading Time:3 minutes

Why you can trust SCMP

At some stage in the future, China’s yuan will give the US dollar a good run for its money as the world’s most dominant currency. But it won’t happen for a very long time, maybe not even this century. The dollar is far too deeply dug in as the world’s top currency of choice for trading and as a reserve currency asset. It is still highly regarded because investors trust it, it has an unparalleled track record as a means of exchange and it holds iconic status in the global economy.

Supplanting the US dollar with the yuan may take a revolution, but it is a goal Beijing aims to win long-term. Even so, the yuan lags a long way behind, as the dollar accounts for two-thirds of global foreign exchange reserves and close to half of all global currency trading. By contrast, yuan holdings by world central banks only represent about 1 per cent of global official reserves, while trading in yuan accounts for as little as 1 per cent of global forex turnover.

Beijing has a major public relations job on its hands to win broader yuan acceptance in world financial markets. To be fair, it is still early days for China’s ambition to internationalise its currency. It was only as recently as 2016 when the International Monetary Fund chose to include the yuan in the basket of currencies which make up the Special Drawing Right unit of account, but this is a major milestone in becoming a recognised reserve asset currency.

Advertisement

It has been a slow start, but China is progressing, with the European Central Bank, Germany and France diversifying small parts of their foreign currency holdings into yuan. And, more recently, African central bank leaders have also considered adopting the yuan as part of their foreign reserves to reflect the growing importance of China to their continent’s economy.

Advertisement

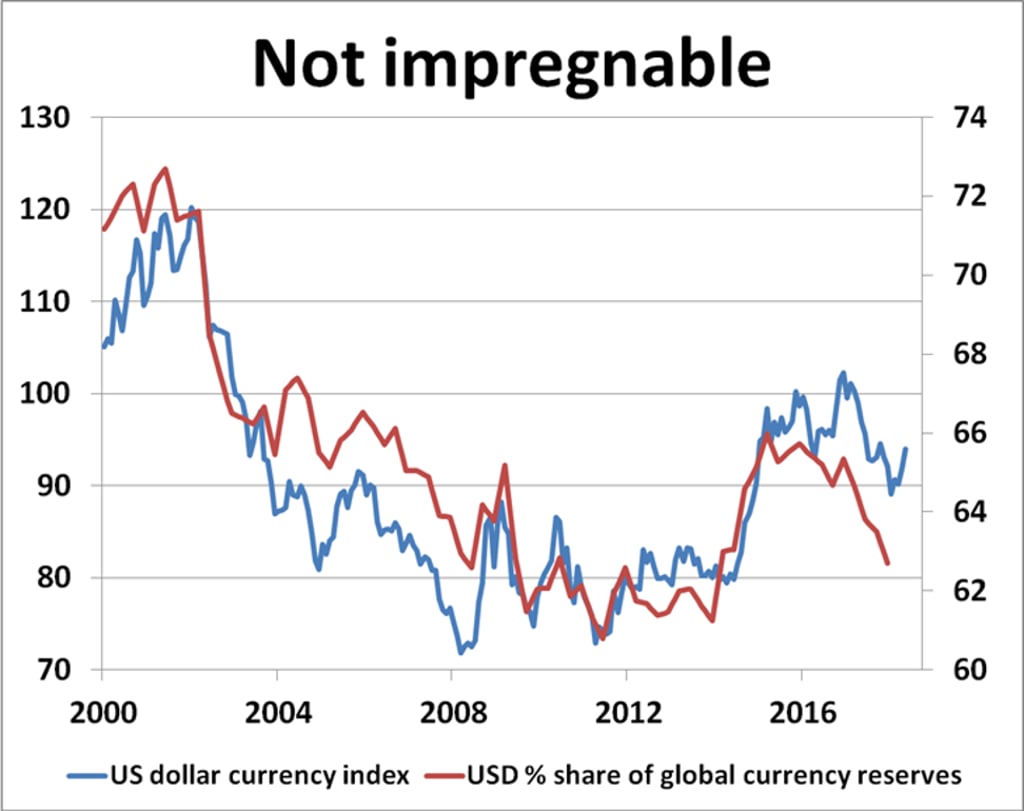

Looking at the relative merits, China has everything to gain and the United States has much to lose. The dollar’s dominance is far from impregnable, with its share of global forex reserves slipping from close to three-quarters in 2001 to 63 per cent at the end of last year, according to IMF data. Concerns about the future direction of US economic policy under Donald Trump’s presidency and weaker dollar sentiment have not helped matters over the past year.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x