How Hong Kong can benefit from a rising Asia and growing metaverse

- The metaverse is rich with opportunities for digital design and trade, while Asia already boasts high numbers of users and creators

- As an innovation hub and key player in the Greater Bay Area, Hong Kong can lead the regional development of a tech-enabled creator economy

In Hong Kong, the metaverse represents a lucrative opportunity for building a tech-enabled creator economy. Content creation for the metaverse and technologies like blockchain and NFTs could be a source of new jobs in the area.

The metaverse is an increasingly immersive evolution of the internet, made up of always-on digital worlds. Avatars – digital versions of ourselves which are our “presence” in these worlds – are infinitely customisable. The metaverse is also a space where people can interact and trade their assets using blockchains.

Accessing the metaverse through headsets like Oculus can feel pretty clunky. But, in the future, technology could well enable a sense of physical embodiment that rivals our experience of the real world.

But, unlike an artist who sells a painting in the physical world, NFT creators receive a percentage of the sale price every time their creation is traded. In 2021, despite the pandemic – or maybe because of it – the NFT market hit US$40 billion, according to blockchain data platform Chainalysis.

Bubble or not, large incumbent players emphasise the crucial role user-generated content plays in their long-term plans for the metaverse. Meta, for example, is developing design tools that will enable it to expand is current creator pool of 600,000 people, helping designers with no prior experience design in immersive formats.

There are nearly 6 million Meta users in Hong Kong and some 1.28 billion monthly active users in Asia, so there is a ready audience for new content.

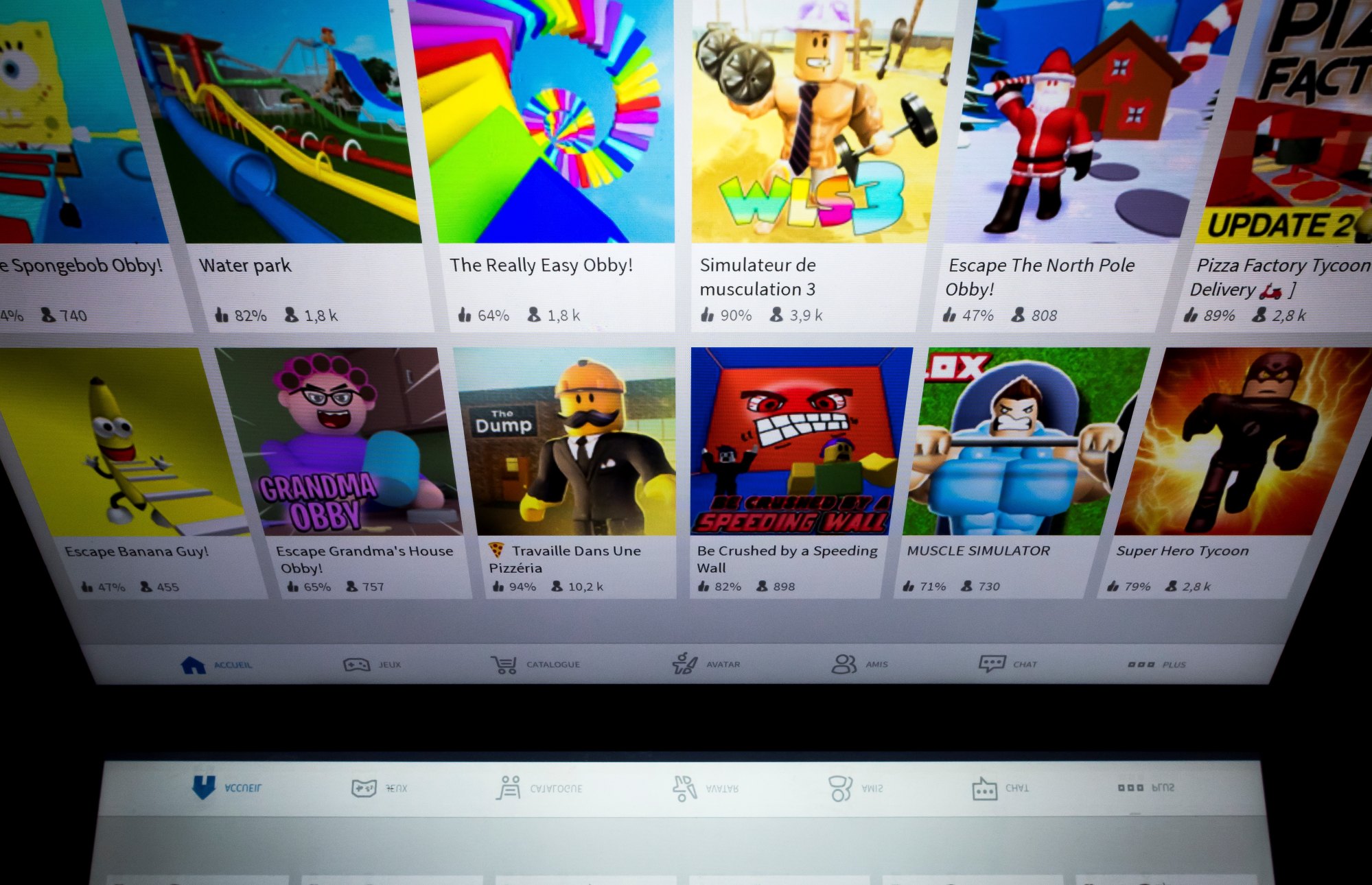

The gaming platform Roblox, meanwhile, with a base of 55 million daily active users, relies entirely on independent designers and creators to develop content. There is a growing demand for its content in Asia, the platform’s fastest-growing market.

In 2021, Roblox paid out over US$500 million to its game designers around the world, a figure that grew 52 per cent from 2020.

Metaverse creators will develop their skills alongside the evolution of creator tools like Unity, the design tool behind some of Asia’s most popular games, including Call of Duty.

AI and machine learning will also assist user-generated content creation. For example, Roblox is experimenting with using AI and machine learning to automatically translate games developed in English into eight other languages, including Mandarin, French and German.

Beyond the consumer side, tools like Nvidia’s Omniverse offer Hong Kong-based designers access to commercial applications like digital twinning, a process of advanced simulation that allows companies to run tests on physical assets like factories using digital versions.

This does not extend to Hong Kong yet. To underline how this difference in policy affects users, the top three sites in Hong Kong – Google, You Tube and Facebook – are not available on the mainland. Content, therefore, would have to be tailored accordingly.

The Hong Kong Monetary Authority plans to have the city’s new regulatory regime for crypto assets ready by July. Beijing allows NFTs, but in a much more limited way than Hong Kong. On the mainland, they are completely decoupled from cryptocurrency, with little secondary market trading.

Although Hong Kong has not banned cryptocurrency or tightened restrictions on NFT trading yet, the government-run cybersecurity watchdog, the Hong Kong Computer Emergency Response Team Coordination Centre, has warned that risks involving NFTs and the metaverse are among key security threats in 2022.

Once regulatory boundaries are clarified, the outlook for user-generated content will become clearer, too. Regardless, the Hong Kong spirit of innovation and creativity will doubtless find ways to make the most of the metaverse.

Jill Baker is adjunct fellow at Asia Business Council