Chinese investors are backing off US assets as economic storm clouds gather

- Investors are taking their cue from the US Federal Reserve as it tries to reduce its holdings of US government debt

- However, there are no signs investors are rushing to the exits on US assets; they are merely adjusting risk preferences ahead of what is likely to be a difficult few months

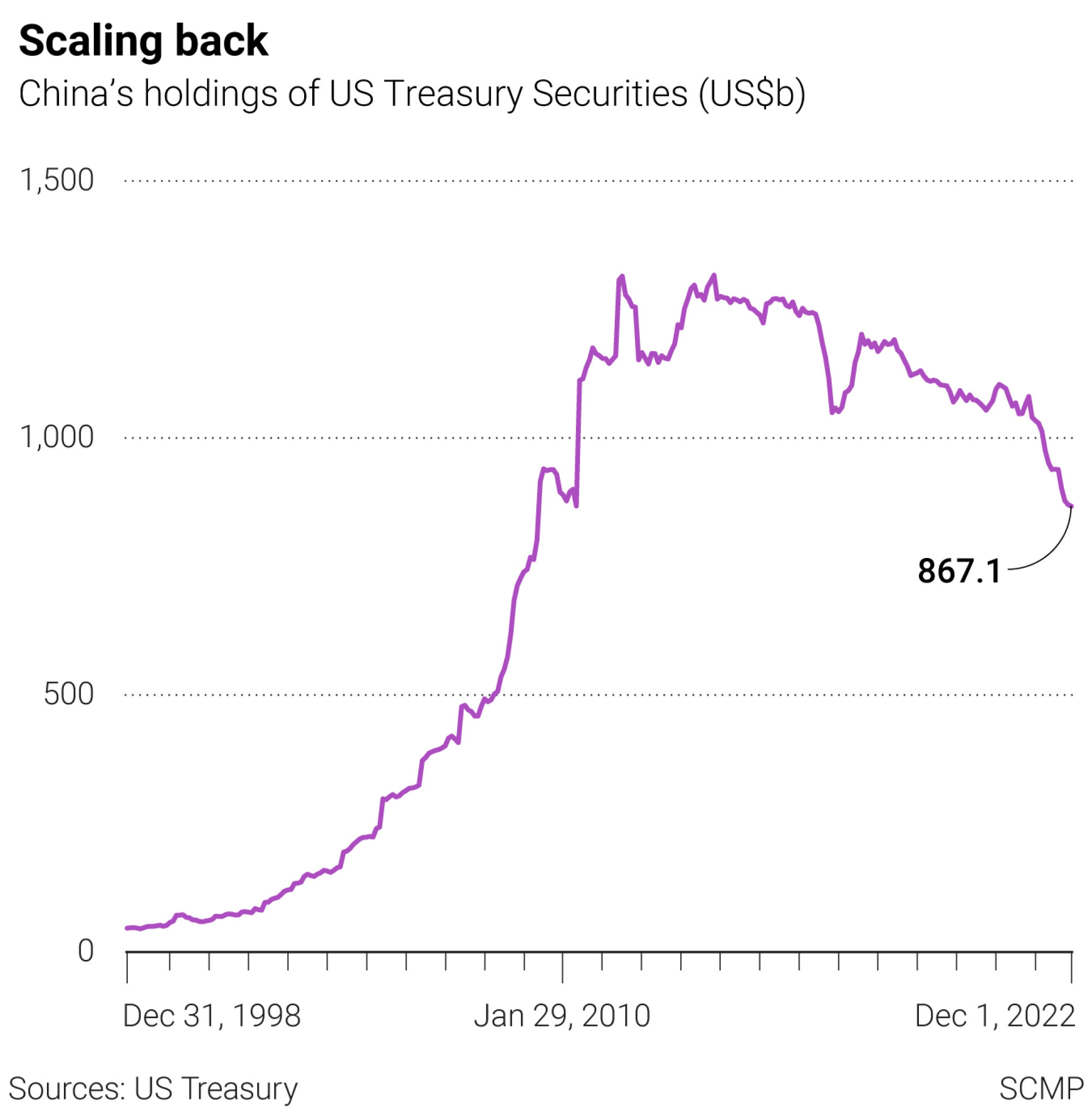

It looks like China’s investors are giving US investments a wider berth as the outlook on US financial stability clouds over. It is not exactly a fire sale right now, but investor confidence is ebbing away with China reducing its holdings of US Treasury securities by 17 per cent in 2022 to US$867 billion, its lowest level since 2010.

It doesn’t bode well for US President Joe Biden trying to reach a budget compromise in the next few months, potentially leaving the US Treasury market at dire risk. In the last year alone, 10-year US Treasury yields have more than doubled to 3.86 per cent.

The chances are the market could see yields breach pre-2008 levels above 5 per cent if the going gets rough. If gridlock deepens and investor confidence implodes, don’t rule out the possibility of double-digit US bond yields.

China is not alone among the major economies taking a more defensive stance towards potential US risk exposures. Investors in Japan have scaled back their holdings of US Treasury securities by about 17 per cent in the last year, while France has cut its holdings back by about 15 per cent during the last 12 months.

According to the latest US Treasury International Capital data, China’s investors are not only scaling back US Treasury bond holdings but also reducing investments in US stock markets at the same time. China’s investments in US equities dropped by 8.4 per cent in the year to December 2022, perhaps reflecting weaker confidence in the US economy’s scope for better recovery this year.

US sees surprise jobs surge, presenting dilemma for Federal Reserve

It’s not all bad news, though. China’s holdings of US agency bonds jumped by a hefty 25 per cent in the year to December 2022, a reasonable mark of confidence in US sovereign risk.

The irony is that if there is gridlock on the US debt ceiling and global financial stability is threatened, investors tend to turn to the US dollar in times of strife. Can China afford to ignore it?

David Brown is the chief executive of New View Economics