Hong Kong’s subdued spring auction sales: too few good lots or too many auction houses?

With most auctioneers reporting results that were flat or below last year’s, some observers point to problems Chinese buyers had accessing funds, but others cite rising competition and unappealing art

China’s ultra-rich are still buying luxury homes in Hong Kong and the Hang Seng index is up 16 per cent so far this year. So why is the local auctions market so subdued?

There were, as in April, a number of star lots that fetched record prices, which only served to deepen the mystery. After all, they clearly showed that the money was there.

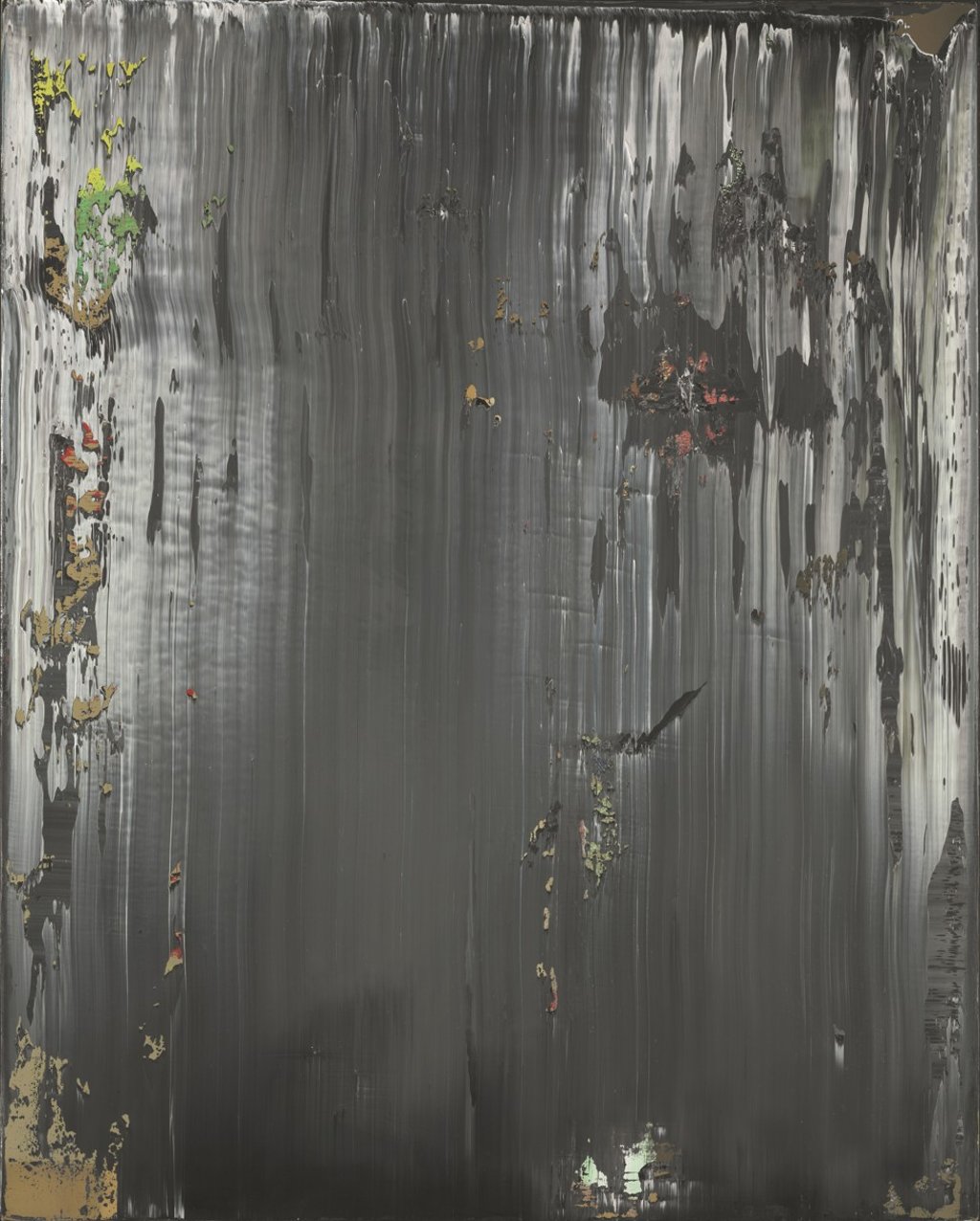

On May 27, Christie’s sold Zao Wou-ki’s 29.09.64 (1964) for HK$152.9 million at the evening sale of 20th century and contemporary art. The selling price quoted includes fees, as are all the figures below unless specified. The sum was several times more than the top estimate and a new auctions record for the artist.