Canton Fair: Chinese yuan gains currency, but export orders fail to beat pre-Covid levels

- Organisers say nearly 198,000 overseas buyers attended autumn session of Canton Fair, a 21-day event which closed on Saturday

- Buyers from eastern Europe and Middle East keen on settling in yuan, but overall export deals fall US$7 billion short of pre-pandemic total

The Chinese yuan is gaining in popularity among overseas buyers, the latest Canton Fair indicated.

Export orders, however, failed to meet expectations of beating pre-pandemic levels, suggesting a bumpy road to recovery yet for the world’s second-largest economy.

Despite hundreds of thousands of foreign participants at the 21-day fair, Chinese exporters expect domestic rivalry to intensify as overseas interest recovers slowly – with geopolitical headwinds and global supply chain adjustments already clouding prospects for orders.

Hosted by the southern manufacturing hub of Guangzhou, formerly known as Canton, the twice-yearly trade fair is regarded as a barometer for China’s export resilience and changes in the supply chain.

We have harvested hundreds of business cards from buyers at the fair, but there’s also a lot of competition

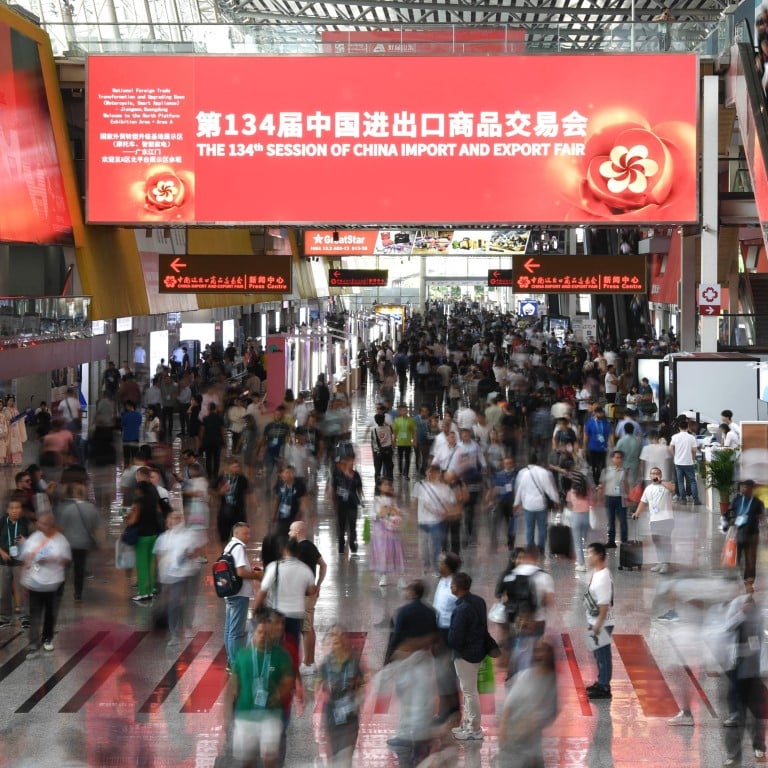

Officially called the China Import and Export Fair, the event has been held each spring and autumn since 1957. The 134th edition closed on Saturday.

Organisers said close to 198,000 overseas buyers attended the fair, up 6.4 per cent from the pre-pandemic autumn session of 2019.

They closed export deals worth US$22.3 billion, a modest 2.8 per cent more than in the spring session in April-May, but still nearly US$7 billion less than in the pre-Covid edition.

“We have harvested hundreds of business cards from buyers at the fair, but there’s also a lot of competition,” a producer and exporter of lighting products said.

“An Italian customer visited our factory this week and, as far as I know, he will go to dozens of other factories as well. To win his order, you can imagine how much competition there would be,” the exhibitor who declined to be identified said.

‘This strength won’t persist’: 4 takeaways from China’s trade data in September

More buyers, meanwhile, showed interest in settling payments in Chinese yuan, Canton Fair exhibitors said.

“Buyers from eastern Europe asked for quotations in Chinese yuan instead of the US dollar, as did several customers from the Middle East,” said Liang Hong, a veteran exporter who has taken part in the fair since 2003.

“Although orders from the two regions do not account for a high proportion of our company’s export volume, we can see the trend of settling payments in yuan is increasing.”

Liang also said his company was eyeing the big market potential of Russia while carrying out strict auditing due to concerns over sanctions relating to Moscow’s invasion of Ukraine last year.

“There is very significant demand from the Russian market, with its population of more than 100 million, both in terms of yuan settlement and export orders.” Liang said.

This comes as China steps up efforts to boost the yuan’s appeal as an alternative currency in global trade and also as a reserve currency, even though it is unlikely to beat the dominance of the US dollar.

Yan Wei, an agricultural equipment exporter based in eastern province of Jiangsu, said buyers from advanced economies such as the United Kingdom were also open to settling payments in yuan.

As China works through yuan tool kit, weak currency hits traders, travellers

“Russian clients settle trade in yuan with us, as do buyers from the UK,” Yan said. “They are willing to do so, and it’s not difficult to buy yuan from local banks in the UK and then remit to us.

“This means we can avoid [losses from] fluctuations in the yuan’s exchange rate with the pound or the euro.”

Kiri Oi, an exhibitor from C&D products Group, a clothing exporter with factories in Bangladesh and Rwanda, said she still preferred the US dollar for payments as her major clients were from Europe and the US, but a growing number of clients from Southeast Asia had been asking for quotations in yuan.

Can China’s pummelled yuan find strength with US Fed pausing interest hikes?

“We are happy to see some new potential customers at the fair, and we do need new orders for our new factories,” Oi said.

Geopolitical tensions, especially China’s rivalry with the United States and US-led de-risking moves have also cast a shadow over Chinese trade.

“Some European and American buyers can accept higher prices as long as we have factories overseas

“The first question that American importers asked was: does your company have a factory overseas?” Jane Wang, an exhibitor producing bags and suitcases, said.

“If you said yes, they would then sit down and continue to discuss cooperation opportunities. If you said no, they would just leave.

“Some European and American buyers can accept higher prices as long as we have factories overseas. The diversification of the supply chain has been a reality. If we want to do business in the markets of Europe and the US, we have to meet their requirements.”

“Vietnamese clients are here looking for parts and components to take back to Vietnam to assemble, or equipment and moulds to upgrade their production lines,” a Vietnamese buyer who planned to shop for motor parts said.