Winners and losers from Link Reit’s 2005 takeover of Hong Kong estate malls

The real estate investment trust’s modernisation of malls, wet markets and shopping centres on public housing estates squeezed out some small businesses but created space for others, as well as big retail chains

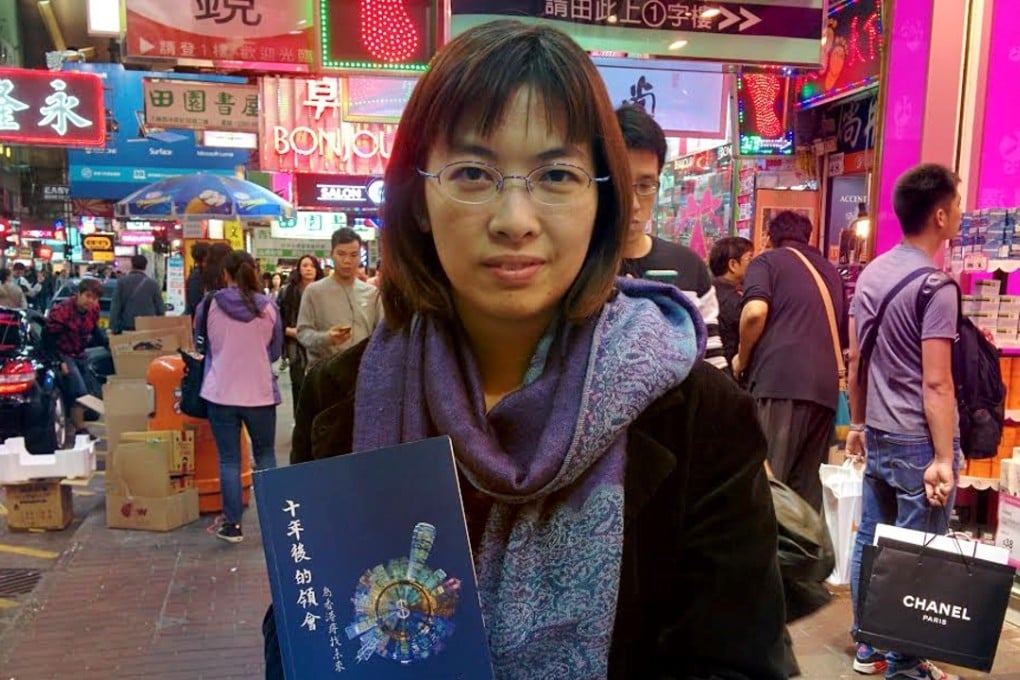

To some in Hong Kong, The Link Reit is the devil incarnate. Hence the image of a demon’s claw reaching from the cover of a book written by its biggest critics examining changes in the decade since the government divested its ownership of shopping centres, wet markets and other facilities in public housing estates to the real estate investment trust.

SEE ALSO: Link Management has proved its worth to investors and shoppers

The move brought HK$30 billion into the coffers of the Housing Authority. But when The Link launched in 2005, many feared that its focus on profits would drive up rents, force out small-business owners and, in turn, put a range of services out of reach of many low-income residents in the surrounding housing estates.

SEE ALSO: Photo essay: shutters come down on a much loved Hong Kong food stall

Over the years, The Link has steadily rolled out an “asset enhancement” programme, spending HK$4.5 billion to implement 41 upgrade projects. A HK$1.25 billion makeover of three flagship properties turned them into the gleaming malls of Lok Fu Plaza, Stanley Plaza and H.A.N.D.S in Tuen Mun. Jewellers, wine shops and department stores such as UNY have displaced the old clothes and stationery shops that once filled Lok Fu.

The Link has also overhauled 10 of the 85 wet markets under its management. In Siu Sai Wan, the market was relaunched with considerable fanfare in August following a HK$25 million transformation. Its floor laid with colourful tiles, the market is now a decidedly upscale operation with a technological edge. To serve customers working long or odd hours, a vending machine called i-Fruit ensures 24-hour access to fresh apples, oranges and the like.

As snazzy as the new operations in Siu Sai Wan are, the makeover comes at a price. Of the 50 stalls operated in the old market, just five remain. The survivors must cope with rent increases of between 30 per cent and 100 per cent: a 200 sq ft stall now costs HK$35,000 a month and a 400 sq ft site about HK$80,000.