Digital and streaming dominate as music revenue grows at record pace, but executives warn of complacency

The 15-year decline seems to be at an end as global digital sales show the strongest ever gains due to new revenue from services such as Spotify. Physical sales continue to fall, with the exception of the niche vinyl market

How we consume music today through online streaming means a big chunk of the global music industry revenue is now coming from digital sales, according to a new report.

Recorded music grossed US$17.3 billion in 2017 with digital music – until last year roughly equal to physical sales worldwide – amounting to 54 per cent of the revenue, the International Federation of the Phonographic Industry (IFPI) said in its annual report.

‘It’s big for hip hop’: Pulitzer jury on Kendrick Lamar album Damn’s historic win

The growth marks the third consecutive year of expansion and the fastest pace since the IFPI began compiling data, said the the body’s chief executive Frances Moore.

But the industry is still only worth about two thirds of its value in the 1990s before the rise of the internet and the scourge of pirated music sent the business into a 15-year slump, Moore said.

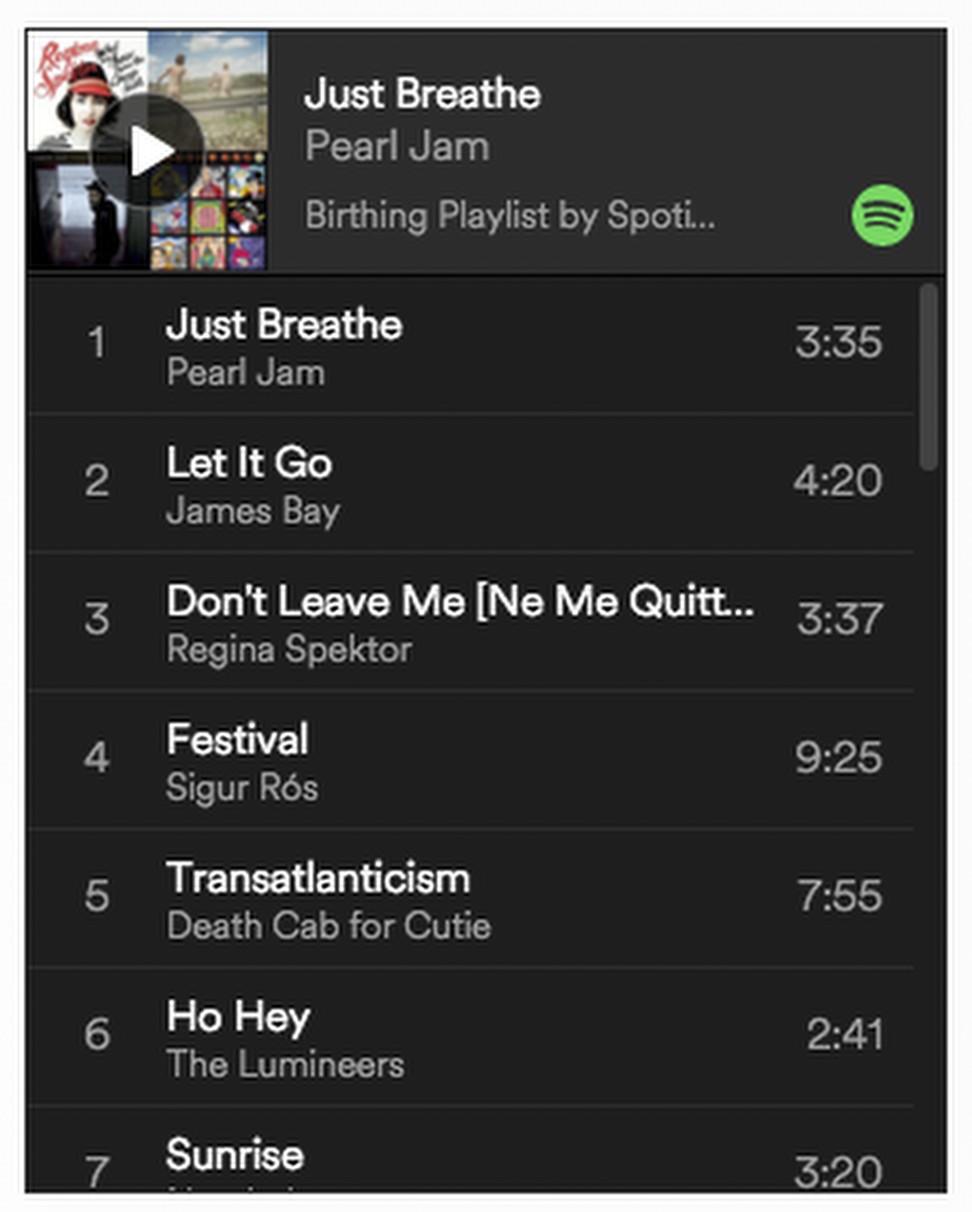

The resurgence is almost entirely due to the rapid growth of streaming services including Spotify, Deezer and Apple Music, which have given the industry a badly needed new source of revenue.

The IFPI released its data hours before Spotify announced a major expansion of its free, advertising-backed level, which the Swedish company sees as crucial to its hopes of making streaming universal, especially in emerging economies.

The industry voiced guarded optimism about China, where revenue jumped 35.3 per cent as international labels increasingly penetrate the billion-plus market.

The growth, however, comes from a small base, with China only the 10th largest music market.

The slump was paradoxically due to the continued strength of CD sales in Japan, where physical music makes up 72 per cent of the market, with digital revenue not providing the same injection of growth as elsewhere.

“It’s just a question of time. It’s a traditional society and the move toward digital is slower than in some countries,” Moore said.

China’s hip-hop culture ban: authorities send mixed messages

Latin America saw the biggest growth among regions.

Revenue there jumped 17.7 per cent on the back of streaming and particularly strong showings in Brazil, Chile and Peru.

The report, however, warned that more needed to be done to reach Latin American music consumers who lack credit cards – generally a requirement to subscribe to streaming services.

Is Asia Spotify’s weak spot?

The report estimated that record companies earned US$20 per year from each Spotify user, while YouTube, owned by search engine giant Google, paid less than US$1.

“We can’t deliver the path to recovery alone. There is a structural fault in the market,” Moore said.

Despite the industry’s efforts to expand in emerging economies, the top 10 most popular artists of 2017 were all Western, led by English singer-songwriter Ed Sheeran.

Stu Bergen, the chief executive for international and global commercial services at Warner Music Group, warned that the music industry should not become “complacent” and pledged that record labels would invest their revenue to develop new talent.

“We’ve fought too hard to get here and, after 15 years of decline, there’s still plenty of room to grow,” Bergen said on the conference call.

.png?itok=arIb17P0)