The Collector | Hong Kong Art Basel week sales boom despite global stock-market decline

Galleries and auction houses cash in on bullish Asian demand for art, antiques, even wine

Hong Kong’s Art Basel week opened at the same time as the start of a global stock-market sell-off, but collectors’ appetites seemed undiminished. For example, Hauser & Wirth promptly sold out the Mark Bradford exhibition at its new gallery in H Queen’s, and Tina Keng Gallery’s booth at Art Basel also sold everything, including works by Chinese artists Peng Wei and Su Xiaobai.

The bullishness survived even when the United States and Hong Kong stock markets tanked further. By the time the first of the spring auctions were in full swing, the Dow Jones and Hang Seng indices had each dropped about 10 per cent since the middle of January.

Still, Sotheby’s managed to hold three “white-glove” wine sales on March 30 and 31, fetching HK$228.3 million in total. All 1,758 lots were sold, including those from cellars of both an anonymous Asian collector and late American billionaire Jerry Perenchio. The latter’s estate sale included two three-bottle lots of Henri Jayer Richebourg (1985 vintage) that sold for the equivalent of HK$328,000 a bottle, three times the pre-sale estimate when including commissions.

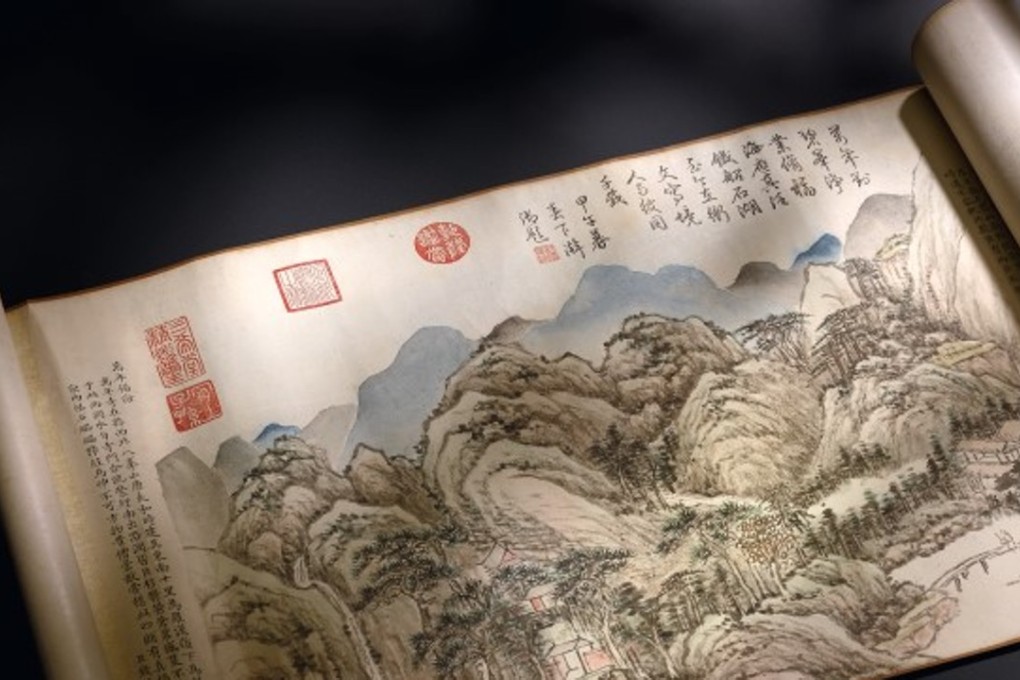

The scroll was smuggled out of the Forbidden City by Puyi, the last emperor, and his younger brother Pujie, and only recently resurfaced after being held in a European collection for three generations. Its sale on April 3 attracted more than 100 bids and lasted for about 40 minutes. That final day of auctions took Sotheby’s’ tally – excluding private sales – to HK$3.64 billion, nearly 15 per cent more than in the spring of 2017.