China’s mass-affluent men wield massive purchasing power in the global luxury market

Luxury brands hoping to make waves in China should pay attention to the country’s new mass affluent male class

This article was written by Yiling Pan and was originally published in Jing Daily

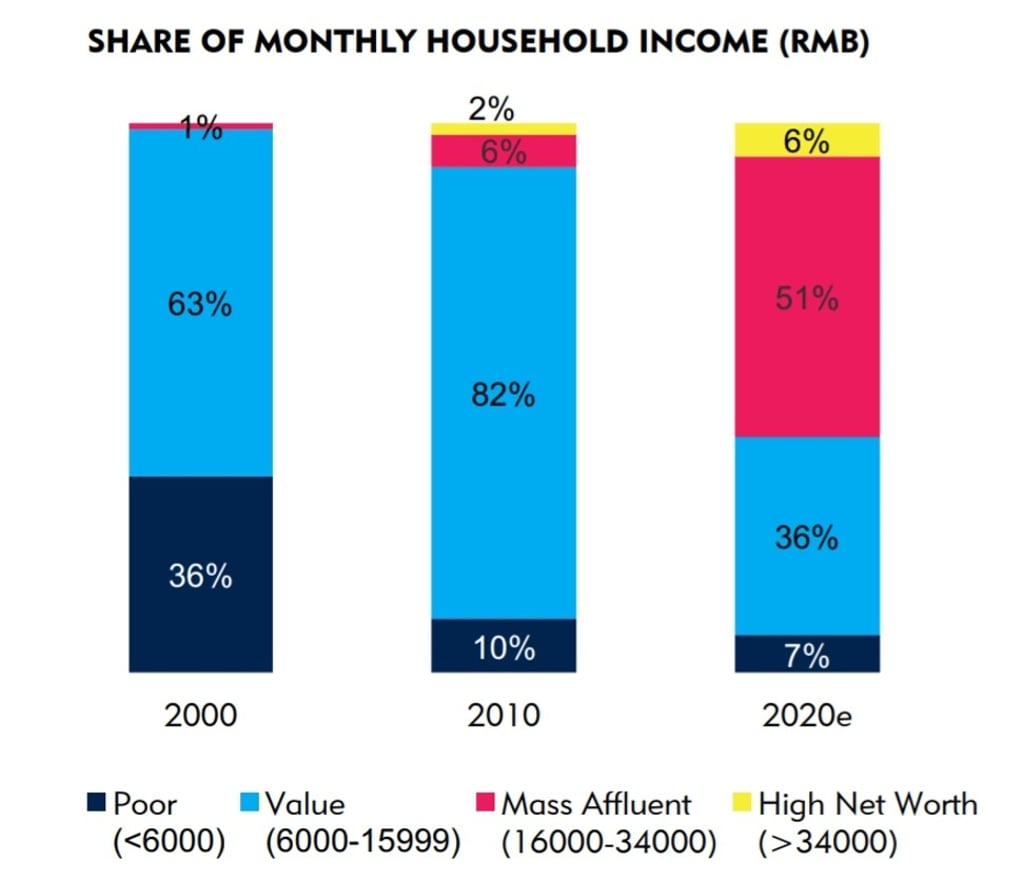

The rapid expansion of China’s wealth in recent decades has given birth to the country’s mass affluent male class (MAC), which wields massive purchasing power and directly affects luxury brands. However, research focusing on uncovering this group’s tastes and habits of luxury consumption is scarce.

In the report, Jing Daily and Carat defined MAC males to be people between the age of 25 and 40 years old whose monthly household income ranges from 16,000 to 34,000 yuan (US$5,139). By 2020, the size of this class is expected to account for 51 per cent of China’s total male population. Compared to the generations before, MAC males are much more educated and westernised. Their approach to luxury consumption has been refined and enhanced constantly through their daily interaction with luxury brands and retailers. Some traditional notions associated with luxury consumption, such as status and power, have been replaced by experience and self-expression.

To further expand our knowledge of this group, Jing Daily spoke to eight Chinese MAC males based in the United States and China to gain insight into their luxury shopping habits. Jing Daily and Carat summarised three trends that they observed, which have a direct impact on luxury brands and retailers:

China’s MAC males look for shopping ideas from e-tailers’ editorial content

Conventional wisdom holds that the decision-making process of male consumers is more straightforward and practical than that of female consumers. When the need to purchase a product arises, men like to meet it quickly without doing too much research to compare and contrast different options. However, our discussion with our interviewees paints a very different picture of China’s MAC males.