Technology turbocharges China’s access to health insurance amid coronavirus pandemic – for the price of a Starbucks coffee

- Mutual-aid platforms offering insurance-like have garnered some 300 million members sharing the burden of medical claims

- Online sales of insurance products are likely to accelerate as technology takes centrestage during Covid-19 pandemic

“I cried,” the 35-year old mother of two said in an interview by email. “While cancer can be treated, the medical cost is just so high that my family simply could not afford it.”

Thanks to Xiang Hu Bao, though, Xiao’s medical bill was collectively paid by more than 104 million members of the so-called mutual health protection platform, a trailblazing hybrid product of technology and commerce in China’s burgeoning sharing economy.

Members of Xiang Hu Bao pay nothing to enjoy up to 300,000 yuan of insurance-like coverage each for some 100 serious illnesses on the platform launched in October 2018, and split the bills whenever one goes for treatment.

What has China’s public health care system learned from the twin coronavirus outbreaks of Sars and Covid-19?

In its first full year of operation in 2019, each member paid 29.17 yuan, less than the price of a cup of Starbucks coffee in Shanghai or a mid-sized Big Mac in London. This year, the operator Ant Financial Services has capped the cost at 188 yuan per head, and provides free Covid-19 coverage for up to 100,000 yuan.

Ant Financial, which also runs the nation’s biggest online payment system known as Alipay, is an associate of Alibaba Group Holding, the owner of South China Morning Post.

As a peer-to-peer business model, mutual-aid insurance platforms have now grown into a mini industry on its own, with more than a dozen companies corralling an estimated about 300 million members – approaching the entire population of the US.

Among them are Waterdrop, a venture backed by Tencent Holdings with 109.3 million members and Ehuzhu, part of Nasdaq-listed Fanhua Inc with 3.4 million members. The 360Huzhu platform by Qihoo360 has 2 million users.

The growth in insurtech – as the use of technology to enhance insurance is dubbed – is disrupting the health care industry in the world’s most-populous nation, which rang up 5.16 trillion yuan (US$727 billion) in medical bills in 2017, according to government data.

“The newly emerged mutual-aid platforms are going to disrupt the health insurance industry in a big way,” said Kenrick Chung, general manager of employee benefits at Realife Insurance Brokers. “These new players offer a protection like an insurance policy while it is much cheaper and does not require the member to pay upfront fee or to do any medical check ups.”

Four decades after China embarked on the road of market economic reforms, the cradle-to-grave social welfare infrastructure has been mostly replaced with private-sector and for-profit companies. The insurance industry has blossomed from a single state-controlled insurer into a market of 90 life insurers, and 82 general insurers.

Even foreign insurers and reinsurers have entered China since the country’s World Trade Organisation (WTO) membership in 2001 with joint ventures.

AIA expects sales in China to take a significant hit from coronavirus pandemic after profit doubles in 2019

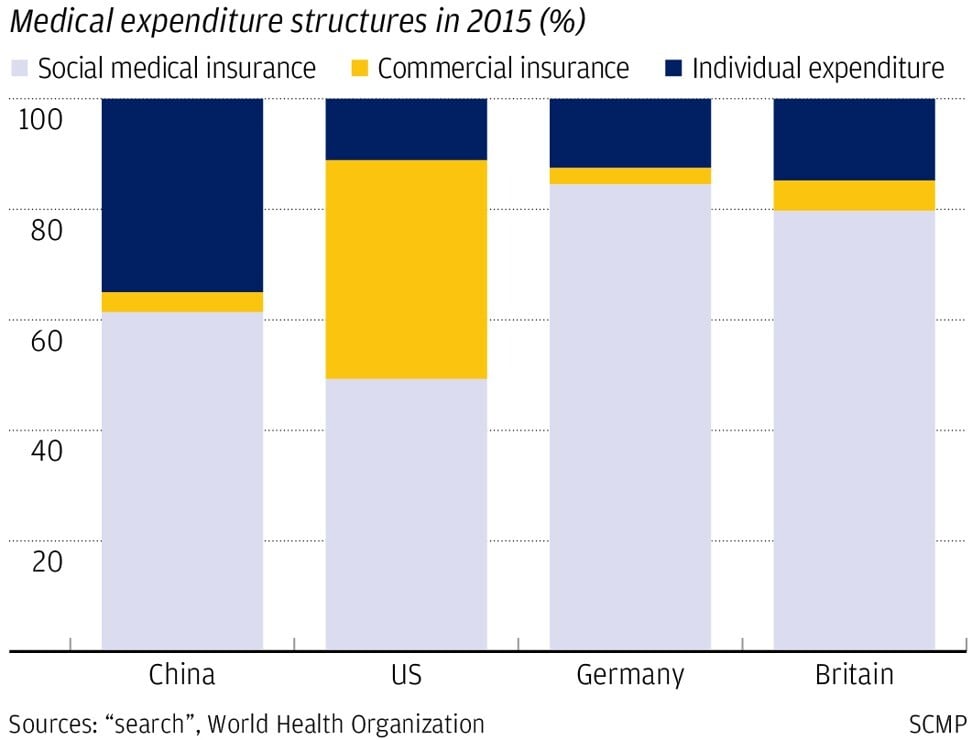

Still, private insurers covered only 3.6 per cent of medical bills in China in 2015, a drop in the bucket compared with 3 per cent in Germany and 5.5 per cent in the UK, according to the World Health Organisation. The level in the US was 39.6 per cent.

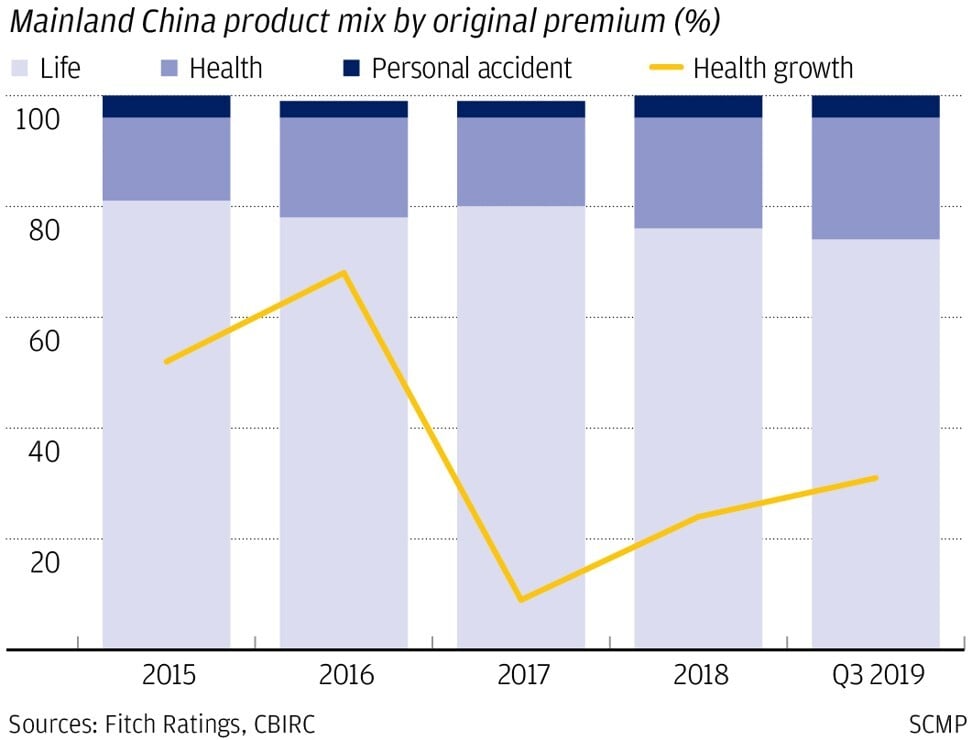

Sales of health insurance policies in China rose by about 30 per cent to 706.6 billion yuan last year, according to government data. By 2025, the size should reach 2 trillion yuan, according to a report by the China Banking and Insurance Regulatory Commission and 12 government departments.

Against these numbers, privately-run health insurers are expected to enhance their role the coming years, according to Anthony Wu Ting-yuk, a member of the State Council’s Medical Reform Leadership Advisory Commission, who helps advise the Chinese government’s cabinet on health care reforms.

“The rising middle class in China, at about 500 million people, will create a huge demand for health insurance coverage,” said Wu, the first Hongkonger to join the commission in 2015. “As a policy, China wants more private hospitals and clinics to offer better care and services” to complement the state-run social safety-net system, he said.

That demand for more and better health care coverage is on the throes of explosive growth because of the coronavirus pandemic, similar to the aftermath of the 2003 outbreak of the severe acute respiratory syndrome, or Sars.

“The pandemic will raise the consciousness of health risk and boost the demand of medical insurance coverage,” said Rick Huang, Greater China insurance leader at EY in Hong Kong. “Traditional insurers will need to invest in their technology capabilities” to compete with emerging players, he added.

China’s Big Tech companies are using their roles in fighting world’s largest health crisis to turbocharge HealthTech

The Covid-19 disease, first detected in the Hubei provincial capital of Wuhan in central China, has infected more than 1 million people worldwide and claimed 51,000 lives. It has also overwhelmed state workers, medical supplies and treatment facilities around the world.

China has three public health insurance schemes, expanding from covering urban workers in 1998 to rural folks in 2003 and included homemakers, children and the elderly in 2007 – funded by employers and employees and the government.

The system could cover 50 to 70 per cent of a patient’s medical bills, up from about 40 per cent before China reformed its health care system in 2009 that included a 850-billion yuan of fund injection to widen coverage, drugs and treatments.

“Still, individuals need to pay around 30 per cent of the cost from their own pocket,” said Wu of the Medical Reform Leadership Advisory Commission. “If they want some imported drugs or better medical procedures or treatment, they need to get the private insurance coverage.”

The state-run social insurance programme, though, is also in need for a revolution of sorts, especially in funding. The urban workers scheme, for example, is forecast to accumulate 735.3 billion yuan of losses by 2024, according to the China Medical and Health Services Development Report in 2014.

“Besides improving our state insurance system, we also need to support our commercial health insurance industry to grow,” Song Ruilin, executive chairman of the China Pharmaceutical Innovation and Research Development Association, said in January.

Besides, poor coverage has also led mainlanders to buy “better quality” policies from providers in Hong Kong. Those sales peaked in 2016 at HK$72.68 billion (US$9.4 billion), or 39 per cent of all premiums in the city, before tailing off in recent years.

Before the inception of mutual-aid health platforms like Xiang Hu Bao, private insurance companies, local and foreign, were also expanding in the mainland market as the government eased entry barriers to market.

Mainland insurance needs to compete with international insurers who gained more access to the home market. Traditional insurers such as China Life Insurance and Ping An Insurance have committed to invest more to improve their online sales and other technology-driven product offerings.

The Ping An Good Doctor app, which offers online medical consultation, saw a 10-fold increase during the coronavirus outbreak to 1.11 billion accumulative visits in January. The firm spent 1 per cent of its revenue to invest in technology to cut down cost and improve services.

“Health care has been one of the major focuses of the development of Ping An in recent years,” Tan said in a telephone interview. “The next step forward is to invest more in technology to bundle our insurance products together with our health care services.”

China will become world’s biggest insurance market by mid-2030s, speeding past US on the way, says analyst

Peer-to-peer insurance platforms come with risks, according to Chung at Realife Insurance Brokers. They are not licensed by the CBIRC, and do not need to follow the tough capital requirements or other risk management rules like traditional insurers.

Still, Xiang Hu Bao can only grow, based on the current trends. Having reached its first 100 million members in about 13 months, the Ant Financial unit is aiming for 300 million users within the next two years, it said last April.

Beijing-based platform Shuidihuzhu, or Waterdrop in Chinese, has garnered more than 109 million members since its launch in 2016, according to data on its website. Members pay 3 to 9 yuan each to join and get cancer and personal accident covers.

The platform, which counts Tencent and Meituan Dianping among its biggest backers, has provided 1.41 billion yuan of mutual aid to some 10,300 families. Each member needed to pay less than 100 yuan last year for their cover.

The growth in mutual-aid insurance platforms in China will depend on level of industry penetration and lessons from China’s peer-to-peer business model, according to Elaine Tung, head of insurtech research in Tokyo at justInCase Inc. At an annualised rate of 3 per cent, the Chinese market could reach 700 million members in 10 years, she said.

One of the success factors for peer-to-peer platforms is to build credibility and gain trusts from customers. The issues of abuses and corporate governance lapses of P2P lending, or peer-to-peer lending, triggered millions of losses in China. Only platforms run by reputable and financially strong groups can endure.

“What we know is that these mutual-aid platforms offer pseudo-insurance protection, they are not substitute for traditional insurance policies,” Tung said in an interview. “This is an unregulated industry.”

The firm pioneered a similar platform in Japan in January 2020 to experiment it for one year by offering cancer coverage for members. As industry penetration rate is relatively high and buying insurance online is yet to receive wide recognition in Japan, justInCase said it would deem it a success if we can attain the milestone of 10,000 customers during the test period.

“With the Covid-19 outbreak, there is generally a heightened awareness for health insurance and protection,” Tung added. “Many insurers have raised their game on the online arena and stepped up the cross- and upselling of such products.”

Additional reporting by Eric Ng and Yujing Liu

Sign up now and get a 10% discount (original price US$400) off the China AI Report 2020 by SCMP Research. Learn about the AI ambitions of Alibaba, Baidu & JD.com through our in-depth case studies, and explore new applications of AI across industries. The report also includes exclusive access to webinars to interact with C-level executives from leading China AI companies (via live Q&A sessions). Offer valid until 31 May 2020.