Moody's downgrades Japan's credit rating, citing 'rising uncertainty' over country's debt situation

Ratings agency cites the 'rising uncertainty' over debt and failed efforts to rekindle growth after economy sank into recession last quarter

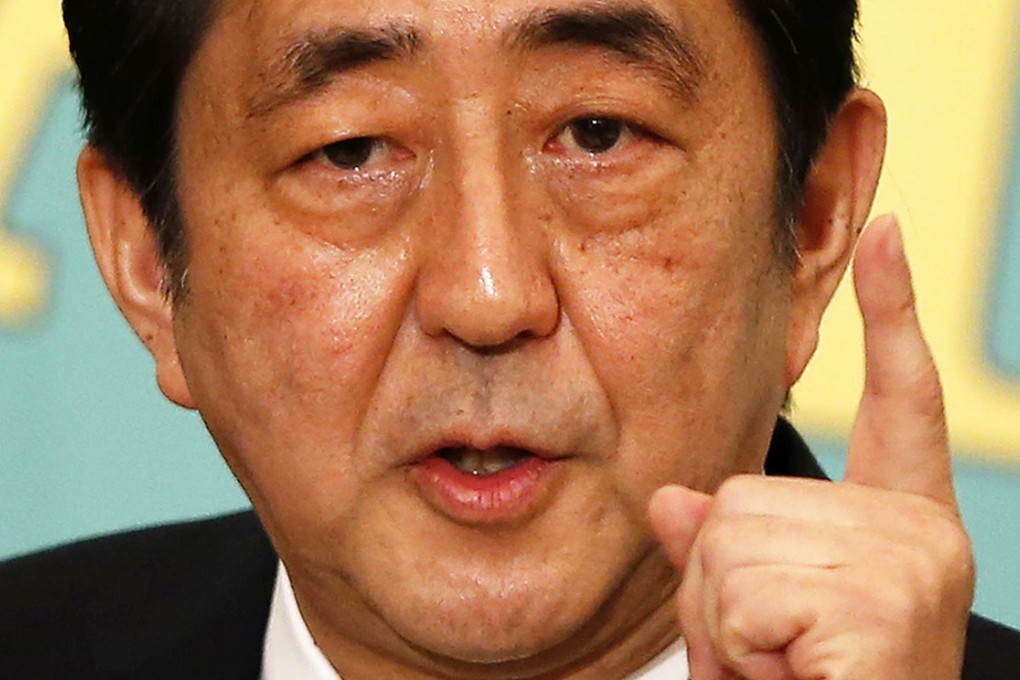

Moody's downgraded its credit rating for Japan yesterday, citing "rising uncertainty" over the country's debt situation and Prime Minister Shinzo Abe's faltering efforts to kick-start growth.

The ratings agency said it cut Japan's rating by one notch to A1 from Aa3, just two weeks before an election and after the economy sank into recession during the July-September quarter.

Last month Abe announced that a planned sales tax rise set for next year would be delayed, as he called a snap election described as a referendum on his "Abenomics" growth blitz - although observers said it was more likely aimed at consolidating his power ahead of a party leadership vote next year.

Tokyo raised the sales levy in April - to 8 per cent from 5 per cent - for the first time in 17 years, to help pay down one of the world's largest public debt mountains.

The levy rise delivered a body blow to Abe's efforts to rev up growth, just as the world's number three economy appeared to be turning a corner after years of deflation.