As gold smuggling runs rampant, Vietnam casts around for ways to tame market

- The rise in gold smuggling is being fuelled by a combination of a lack of official supplies and flight-to-safety demands amid a struggling economy

- Economists say demand for dollars to pay for gold imports has pressured the dong to drop, making it hard for the central bank to curb inflation

Stabilising the gold market is a pressing issue for the Vietnamese government with smugglers taking advantage of higher local prices to slip in the precious metal, leading to exchange rate distortions and weakness in the dong that’s hurting the economy.

Prime Minister Pham Minh Chinh and members of the National Financial and Monetary Policy Advisory Council are among top authorities who have been urging for solutions in recent months. The price gap of the metal locally over the international rate must be narrowed “to avoid adverse developments”, Chinh said last week as he ordered the central bank to step up measures to calm the market.

Vietnam tries to stabilise relations with China after ousting of president

The rise in gold smuggling is fuelled by a combination of a lack of official supplies and flight-to-safety demands amid a struggling economy. This influx exerts pressure on the dong as smugglers need to buy dollars in the so-called black market to pay for the commodity.

The dong closed at 24,962 on Friday in Hanoi, near a record low against the dollar, according to a compilation of daily fixings from banks. It has weakened 2.9 per cent this year.

Demand for dollars to pay for the gold imports “has pressured the dong to drop further, making it hard for the central bank to curb inflation and negatively impacts the economy,” according to economist Nguyen Tri Hieu, general director at Toan Cau, a research institute for finance and real estate.

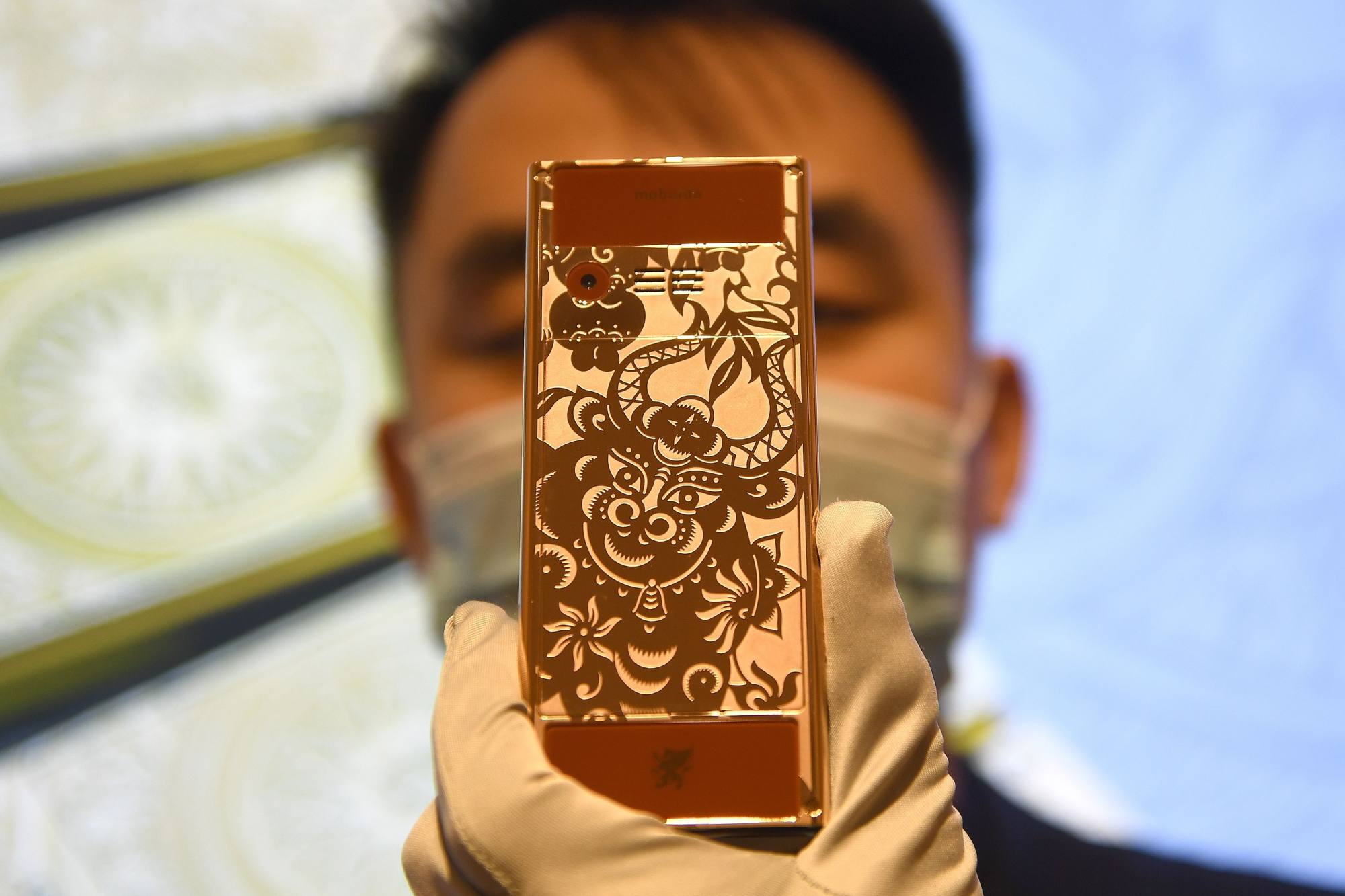

The price of gold in Vietnam was US$3,263.26 per tael as of Friday afternoon, or about US$2,719 per ounce.

Decades of war, revolution and economic turbulence fostered an affinity for gold in Vietnam. Banks were accepting deposits and lending in gold until the central bank banned the practice in 2012. It made itself the sole importer and Saigon Jewelry Co. the only legal producer of bars.

The local premium over the international rate has been as much as 15 million dong (US$600) per tael in recent months, comparing with 2 to 3 million dong about a decade ago following the implementation of the monopoly, according to Huynh Trung Khanh, vice-president of Vietnam Gold Traders Association.

The National Financial and Monetary Policy Advisory Council last month proposed ending the state monopoly on gold imports and bullion production. The 12-year-old regulation “has achieved success and fulfilled its mission”, the council said.

Vietnamese gold buyers such as jewellery producers have long been known to purchase from illegal sources due to the lack of import permits. Ending the monopoly means more legal avenues to access gold, which will narrow the local premium, according to Khanh.

“If the monopoly won’t be ended, the local premium will keep rising for sure and it will have very negative effects on the dong and the economy,” he said.

Fake gold, investment scams rise as China’s middle class seek safe-haven assets

Khanh forecasts the gap could widen to 25 to 30 million dong later this year if the monopoly is maintained.

“Ending the monopoly will definitely reduce smuggling and can help the government to boost tax revenue from official imports,” Khanh said.