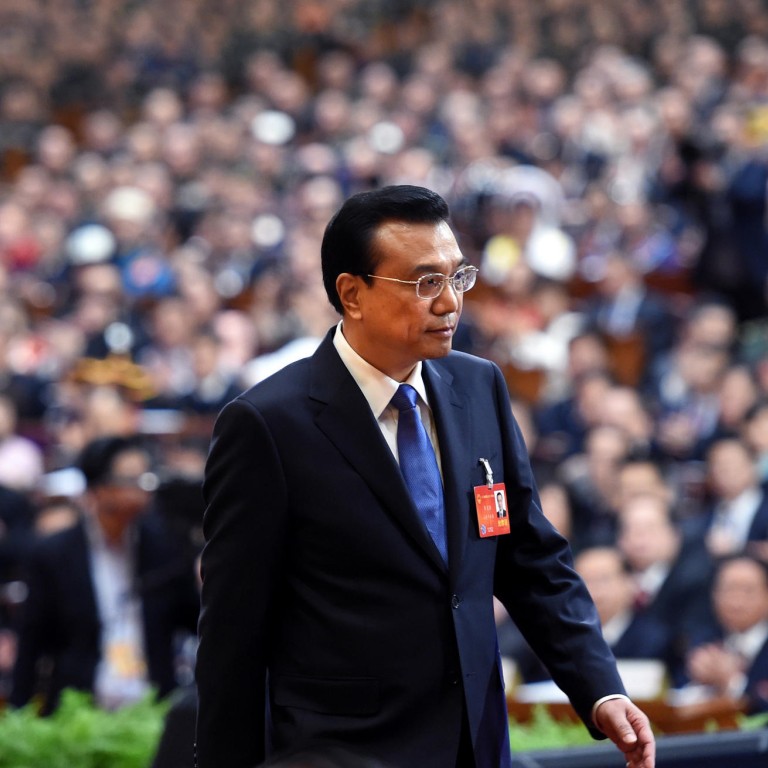

Li Keqiang stresses reducing reliance on fixed-asset investment for growth

Premier says leadership aims to cut economy's reliance on investment in fixed assets such as factories, and lays out financial sector reforms

The leadership has signalled it will try to gradually rebalance the mainland economy away from its dependence on investment in real estate, factories and other fixed assets that have inflated a property market bubble.

Analysts said reforms would take years to bear fruit. Li admitted investment remained "the key to maintaining stable economic growth". Beijing aims to achieve 7.5 per cent gross domestic product growth this year.

"Reform is the top priority of for the government's work this year," Li said yesterday. "We will focus on structural economic reform, advancing it on different fronts in a targeted way, in light of different conditions."

Li was delivering the government work report before the National People's Congress for the first time since taking office last year.

At a press conference later in the day, Xu Shaoshi, the government's top economic planner, said the 7.5 per cent growth target was Beijing's "lower limit" for growth and that the government would not let it fall below that level.

The leadership is aiming for fixed-asset investment (FAI) growth of 17.5 per cent this year, compared with last year's 18 per cent goal.

Actual FAI growth has typically exceeded official targets in recent years. Last year FAI growth was 19.3 per cent.

The premier said the yuan's trading band would be widened this year, confirming market speculation following the yuan's recent depreciation. Last Friday, the currency fell 0.9 per cent to 6.18 yuan to the US dollar, the largest daily decrease since 2007.

The yuan's trading band is currently set at no more than 1 per cent on either side of the reference rate set by the People's Bank of China every day.

Former PBOC adviser Li Daokui, a professor at Tsinghua University, said there was room to double the trading band.

The premier also pledged to set up a deposit insurance scheme to give financial institutions more power to set their interest rates. Li also vowed to "steadily promote" the establishment of small- and medium-sized banks backed by private capital.

In addition, Beijing plans to create a financing mechanism to allow local governments to issue bonds, and to place their debt under budgetary management, according to the premier. That suggests the trials of local government debt sales will be expanded.

Local government debt, the bulk of which is raised via fundraising bodies called "financing vehicles", reached 17.9 trillion yuan (HK$22.7 trillion) at the end of June last year, up 13 per cent from the end of 2012, according to a National Audit Office report.

The pace of debt accumulation has outpaced GDP growth, which was 7.7 per cent last year.

Beijing would introduce more private capital to areas controlled by powerful state-owned enterprises, such as finance, oil, power, railways, telecoms and utilities, Li said.

Analysts said change would take time and warned that pressure on the government to deliver reform was rising.

"Although the reforms are being pushed ahead, it will take time for the dividends of the reforms to be [felt]," said Gary Liu, executive deputy director of the Lujiazui Institute of International Finance. "Therefore, it's impossible for China to significantly cut its reliance on investment during the transition period.

"An optimistic estimate is that it may take Beijing three to five years [to transform the growth model]", he added.

Liu said the progress of reforms last year had "disappointed the market", citing the slow development of the Shanghai free-trade zone.

Work Report Highlights

Cancel or delegate to lower-level governments 200 items that would otherwise require State Council review and approval.

Incorporate all government revenue into budget and disclose budgets at all government levels. Extend trials to replace business tax with value-added tax for the railway, postal and telecommunications services, and proceed with legislation on a property tax and environmental protection tax. Liberalise interest rates by granting financial institutions more power to set their own rates.

Begin trials for investing state capital in corporate operations. Allow non-state capital in areas such as banking, oil, electricity, railway, telecommunications, resources development and public utilities.

Create pilot free-trade zones similar to Shanghai's. Encourage e-commerce.

Speed up the development of 4G mobile communications. Greatly increase internet speeds.

Launch trial to improve yields on 6.67 million hectares of farmland. Spend 70 billion yuan (HK$88.6 billion) on water-conservation projects.

Increase by 10 per cent the number of poor, rural students enrolled in key colleges and universities.

Lower costs for patients at public hospitals in 1,000 counties that serve 500 million rural residents. Expand trial reforms at urban public hospitals.

Strengthen maintenance of public order and crack down on terrorism.

Reduce smog, especially in large cities and regions that regularly suffer poor air quality. Shut 50,000 small coal-fired furnaces.

Cut government spending on official overseas visits, vehicles and hospitality, and make their budgets public. Audit sales of land held under local rights and survey local authorities' efforts to protect existing farmland.

Start building seven million new apartments as part of affordable housing scheme.

Strengthen combat readiness, improve deterrence capabilities and step up border, coastal and air patrols.

Promote long-term stability with other major countries.