Chinese online lender plans to provide finance to the millions overlooked by banks

The founder of a new online personal finance platform thinks it is time to make changes to the Chinese financial system and make it better

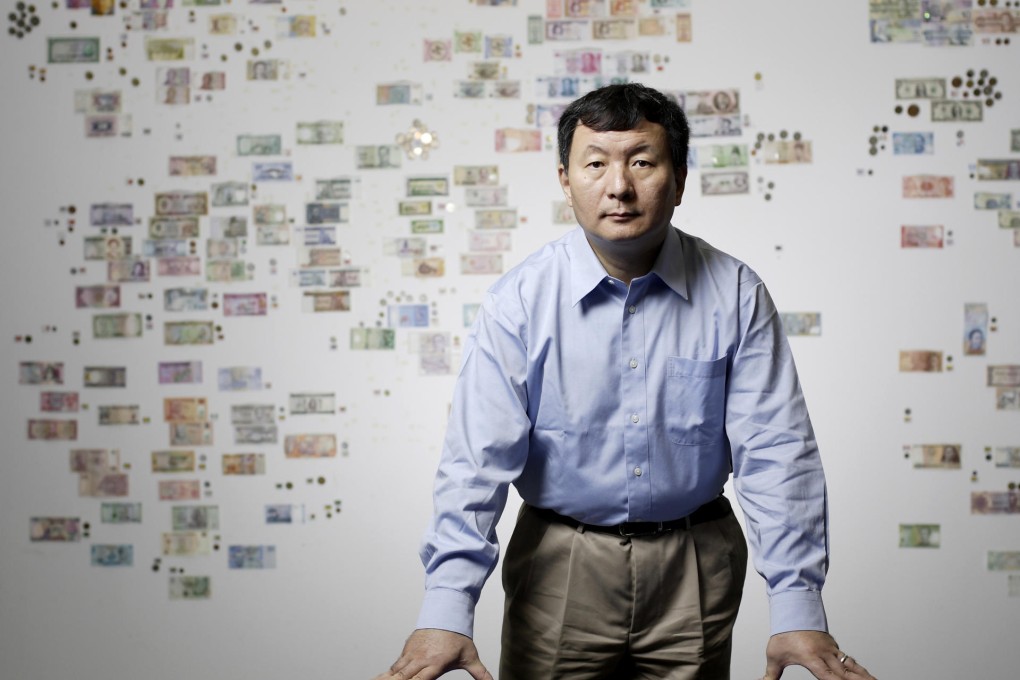

Zane Wang Zhengyu, 58, is the founder and chief executive of China Rapid Finance. He earned a doctorate in statistics at the University of Illinois, and worked for Sears in the United States as a senior analyst and senior manager before returning to the mainland in 2001 to help China create the credit assessment system. He spoke about the company's peer-to-peer (P2P) lending platform, set up in 2010 and the market prospects of the fast-growing P2P businesses in China.

P2P in China emerged after businesses such as the Lending Club in the US proved successful and the model was introduced to China. More importantly, China's finance sector was unable to serve a wide range of businesses and individuals. Since mainland banks, without pricing power, were not allowed to set different interest rates for different borrowers to ward off risks, they shunned small businesses and individuals while focusing on extending credit to only state-owned companies. Fortunately, top policymakers noticed the need to reform the finance sector to give cash-hungry businesses and people access to financing. Advances in technology buoyed by the massive inflow of capital and the freedom provided by P2P businesses to offer loans at different rates appeared to be a cure for China's inadequate financial service sector.

?