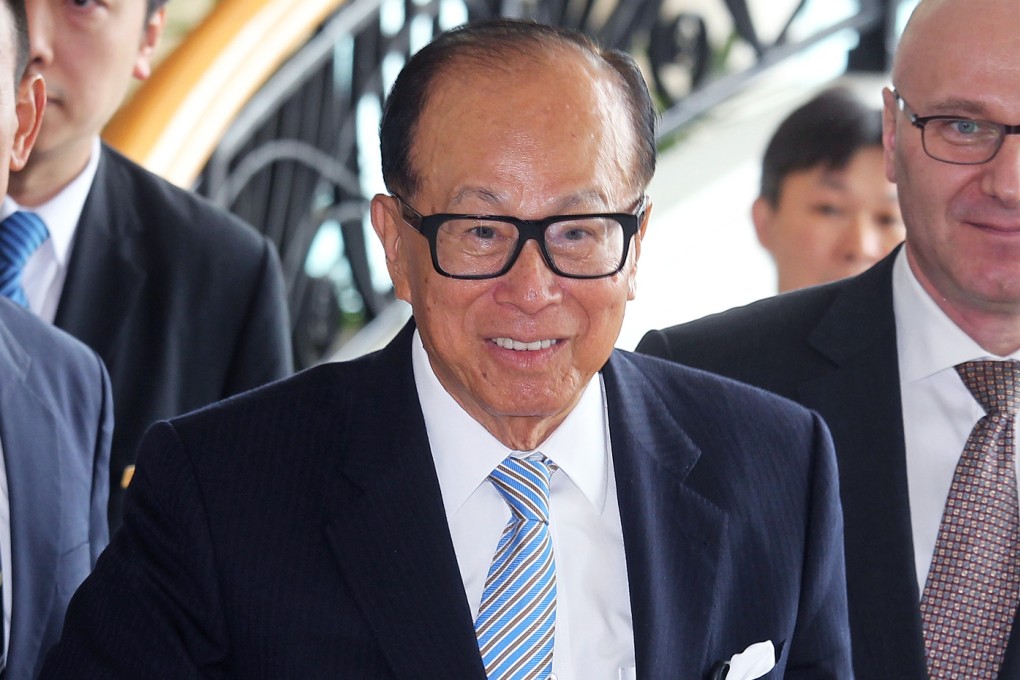

Li Ka-shing tipped to sell Shanghai complex for 20 billion yuan, reigniting speculation of exit from China

Reports reignite rumours tycoon is exiting the mainland to invest in Europe

Li Ka-shing's reported plan to sell a major commercial complex in Shanghai's Pudong area for 20 billion yuan (HK$25 billion) has again set the rumour mill churning on the "superman" flying the coop on China for greener pastures in the West.

Mainland media reported the tycoon is set to sell the 360,000 square metre Century Link, a major commercial complex in the heart of Lujiazui, the new financial hub of Pudong. The property, which sits atop a subway station, was developed by Li's Cheung Kong Property Holdings (CK Property).

CK Property said it did not comment on market rumours.

Comprising a 140,000-square-metre shopping mall and 130,000 square metres of grade-A office space, Century Link is due for completion next year. CK Property kicked off a global marketing campaign to start pre-leasing in June for the project.

In 2005, the company bought the site for 12,000 yuan a square metre. If the deal materialises, the price tag would translate into 55,555 yuan per square metre.

News of the proposed sale added further grist to the rumour mill on Li's supposed strategy of exiting the Chinese market to invest in Europe.

"It has been the firm's strategy. While it is disposing assets at high prices on the mainland, it's making aggressive acquisitions in the West," said Alvin Cheung Chi-wai, an associate director of Prudential Brokerage.