China ‘will fight to the end’ in trade war, Beijing warns after Donald Trump hits country with $60b in tariffs

The sanctions follow a US investigation into regulations that force American companies operating in China to transfer technology to local business partners

China denounced US President Donald Trump’s plan to levy import tariffs amounting to about US$60 billion on products from China as part of Washington’s effort to fight Beijing’s government support for domestic tech players and long-standing imbalances in the bilateral trade and investment relationship.

“We urge the US to cease and desist” from Trump’s plan to punish China for restrictions on foreign companies operating in the county, Beijing’s embassy in Washington said in a statement. “If a trade war were initiated by the US, China would fight to the end to defend its own legitimate interests with all necessary measures.”

The embassy’s statement came hours after Trump lambasted China for its industrial policy and said he demanded immediate action from Beijing to address a growing deficit, which rattled the markets.

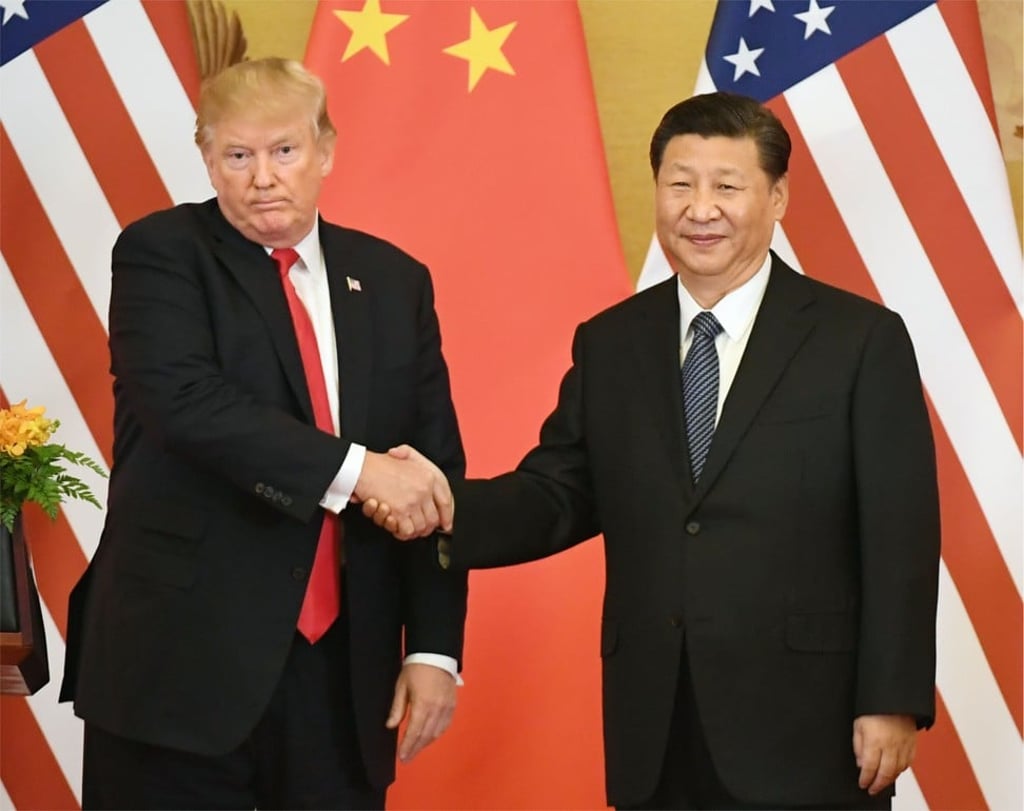

In remarks at the White House before signing his executive order on tariffs, Trump said he had asked President Xi Jinping for an “immediate” US$100 billion reduction in China’s trade surplus with the US as part of efforts to address these issues.

“We have a tremendous intellectual property theft situation going on” in China, Trump said. “We want reciprocal. If they charge us, we charge them the same thing,” he said. “I really believe they cannot believe they’ve gotten away with this for so long.”