Beijing should use ‘first rate’ economic team to launch reforms, former US treasury secretary Henry Paulson says

With Liu He and Yi Gang in the fold, the time is ripe for China to deliver the reforms that Western leaders have been demanding for decades, the former US treasury secretary argued

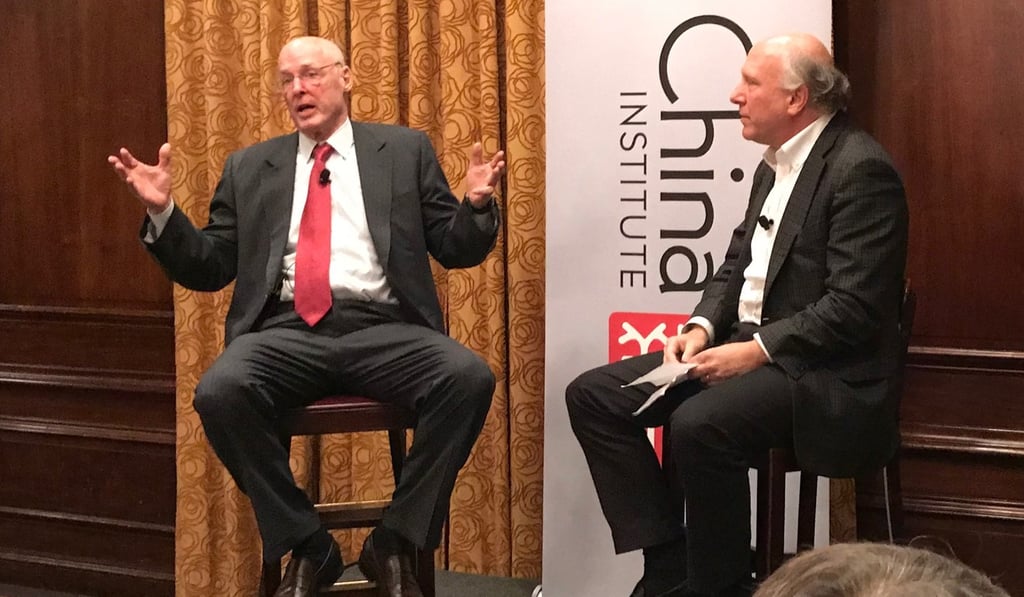

Former US treasury secretary Henry Paulson on Thursday lodged a vote of confidence in the economic team that President Xi Jinping established in his recent leadership reshuffle, and said Beijing needs to take this opportunity to launch delayed reforms.

Harvard-educated economist Liu He was elevated to vice-premier of economic and financial affairs last month, alongside newly appointed central bank governor Yi Gang, making it more likely that Xi’s government will forge ahead with economic reforms that Western leaders have been demanding for decades, Paulson said in a discussion at the China Institute Executive Summit in New York.

“Liu He and the whole economic team is first rate,” Paulson said. “So now that he’s got them in place, he has got a much better ability to deliver and to get things done that benefit both [the US and China] and there are a lot of areas of complementarity and shared interest.

“Xi has been saying, ‘I want to reform and I want to open up.’ He’s saying, ‘I want the markets to be decisive when it comes to allocating resources.’ I look at people in key spots around him. The team around him understands the merits of competition and understands the benefits of opening up.”

Restrictions that foreign banks, asset managers and other financial firms face in China is one of the sore points that prompted US President Donald Trump to launch punitive tariffs against Beijing last month.