How India became China-led development bank’s main borrower

Almost 28 per cent of the money lent by AIIB in first two years of operation has gone to projects in India

Territorial disputes between China and India have not stopped India becoming the China-led Asian Infrastructure Investment Bank’s (AIIB) top borrower.

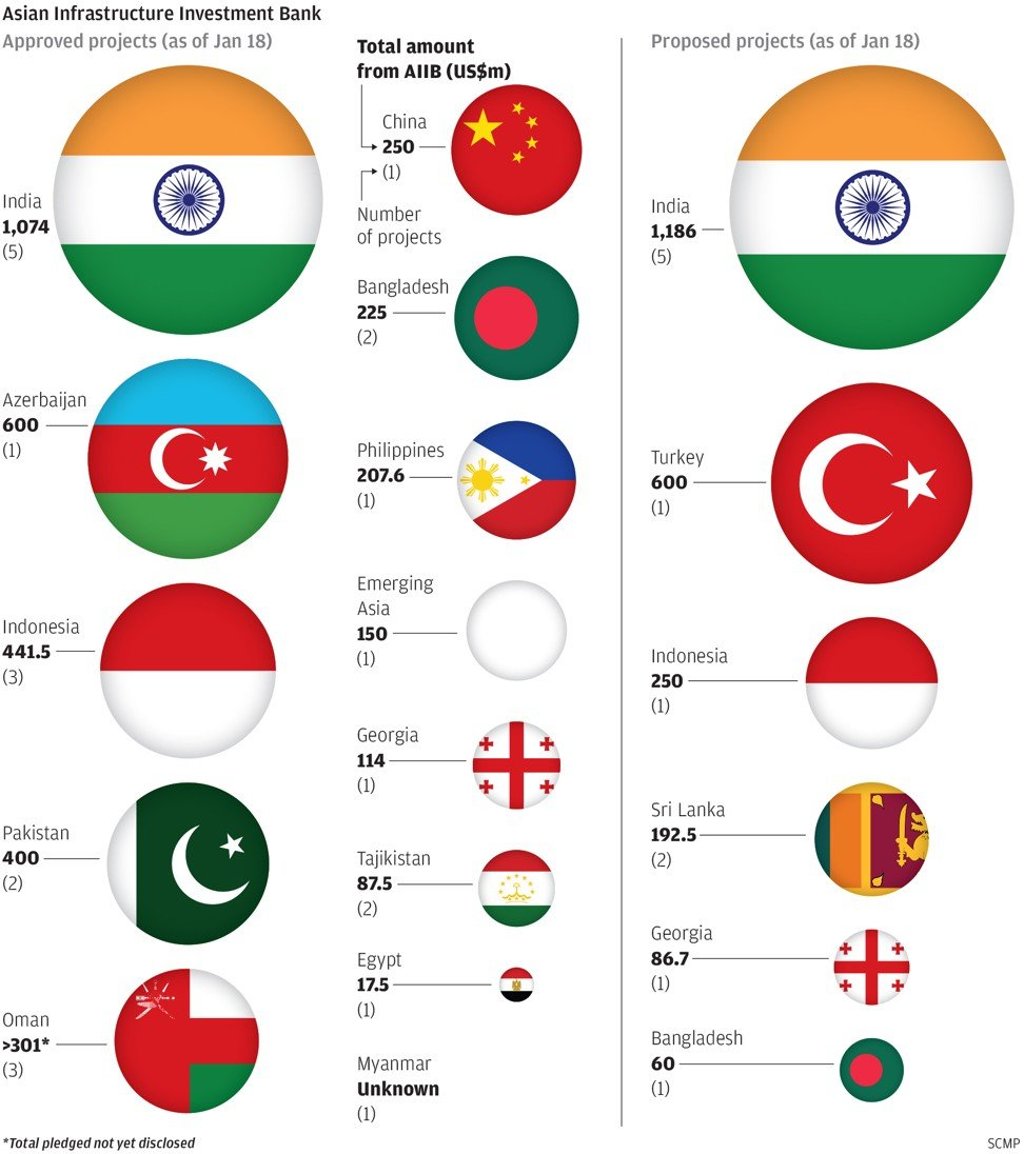

The AIIB, which celebrated it second anniversary this week, has approved funding for 24 infrastructure projects, five of them in India, bank data shows, with its loans to the Indian projects – totalling US$1.074 billion – accounting for almost 28 per cent of the money it has lent.

“India and China may have disputes – a common scenario for big neighbouring countries – but business is business,” said Zhao Gancheng, director of South Asia studies at the Shanghai Institute for International Studies.

Indian and Chinese troops were engaged in a tense border stand-off on the Doklam plateau, in the Himalayas near Bhutan, for months last year, while New Delhi also boycotted Beijing’s “Belt and Road Initiative” forum last May and warned countries involved in the trade-development scheme they risked being saddled with “unsustainable debt burdens”.