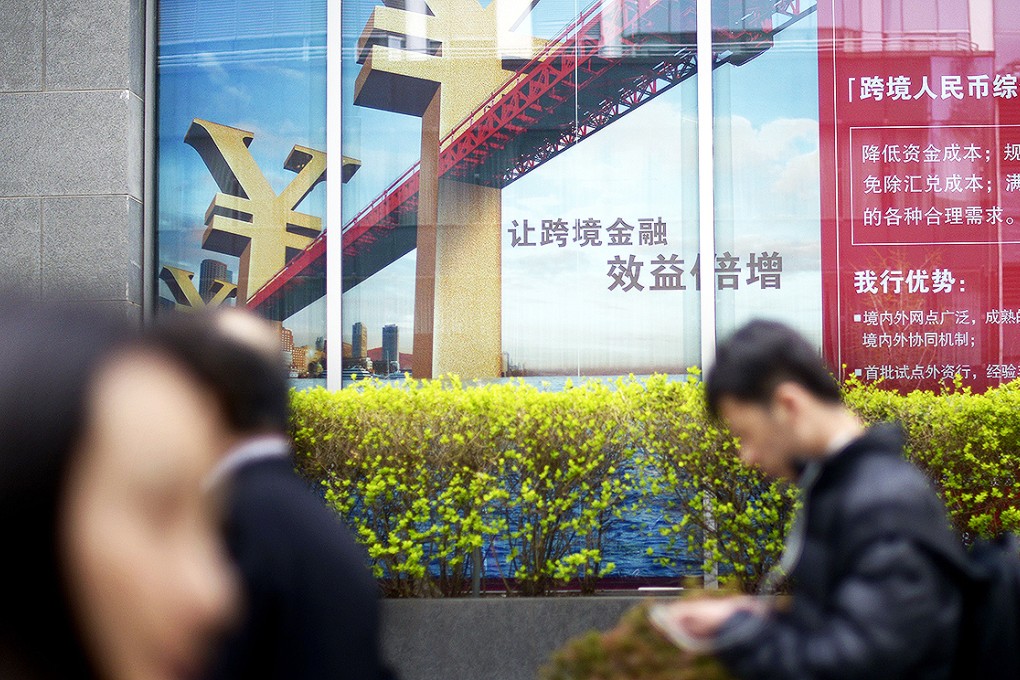

China seeks role for yuan in AIIB to extend currency’s global reach

Effort part of ongoing drive to extend the yuan’s international reach and challenge the greenback’s global dominance in finance

Beijing will push for the yuan to be included in a basket of currencies used to denominate and settle loans from the Chinese-led Asian Infrastructure Investment Bank (AIIB), according to think tank sources.

Beijing will also encourage the AIIB and the Silk Road Fund to set up special currency funds and issue yuan-denominated loans through both institutions, the sources said.

If the US dollar is used, it weakens China’s bid for the yuan to be a global currency

The efforts are part of a drive to internationalise the Chinese currency and come as the International Monetary Fund prepares to discuss the possible inclusion of the yuan as its fifth reserve currency and as part of the basket that forms the IMF's Special Drawing Rights.

The sources' claims appeared to be confirmed by a state media report, which said that a basket of currencies called the "AIIB currency" would most likely be adopted as the bank's currency of settlement.

In an article headlined "The five key questions facing the AIIB", the state-run Outlook magazine said yesterday that the biggest unanswered question about the bank was what currency - or currencies - would be used for settlement. The article said there were three options: the yuan, the US dollar or an AIIB currency basket.

It said that of the three the US dollar would be the most cost-efficient and convenient, and the yuan the most expensive and least convenient.

A currency basket was the most attractive option, it said, because it would be more resilient to market shocks.