China Briefing | Why China will not sharply devalue the yuan

Beijing faces long battle with speculators, but tinkering with the currency would be counterproductive and at odds with its international stance

Plunging stocks and currency have made a grim start to the new year in China. The closely watched Shanghai Composite Index fell 3.6 per cent on Friday, down more than 20 per cent from its recent high, therefore entering bear market territory.

Concerns over the Chinese economy and a free fall in oil prices have helped trigger a global stock market sell-off. The major US stock indexes fell more than 2 per cent after the Hang Seng Index ended the week with a 4.6 per cent loss.

Currency speculators have started to circle the yuan as China’s capital outflow has accelerated, forcing the mainland’s central bank to take drastic moves to squeeze the speculators by buying yuan and selling the US dollar heavily in the offshore markets last week. The move caused the borrowing costs for offshore yuan in Hong Kong to shoot up by 200 per cent at one point. While the yuan has stabilised following the heavy intervention, expectations are strong that it will continue to weaken amid a slowing economy and massive capital outflows.

Some foreign economists are now saying that China’s economic bubble has already burst.

Indeed, it is hard to be optimistic about China’s economic prospects and some foreign economists are now saying that China’s economic bubble has already burst. The economy is estimated to have grown at 6.9 per cent last year, down from 7.4 per cent in 2014. For the years from 2016 to 2020, the government has set an even lower growth target of 6.5 per cent.

Against this background, the massive sell-off in stocks and yuan has greatly undermined investors’ confidence in the ability of Chinese leaders to steer the world’s second largest economy forward.

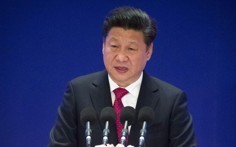

If they are worried, they have put on a good poker face. China had the confidence and capability to ensure sustained and sound economic development, President Xi Jinxing said at the opening ceremony of the US$100 billion Asian Infrastructure Investment Bank in Beijing.

Meanwhile, Premier Li Keqiang has also tried to talk up the positives, saying the economy was up nearly 7 per cent last year, employment had grown more than expected and income had also risen.