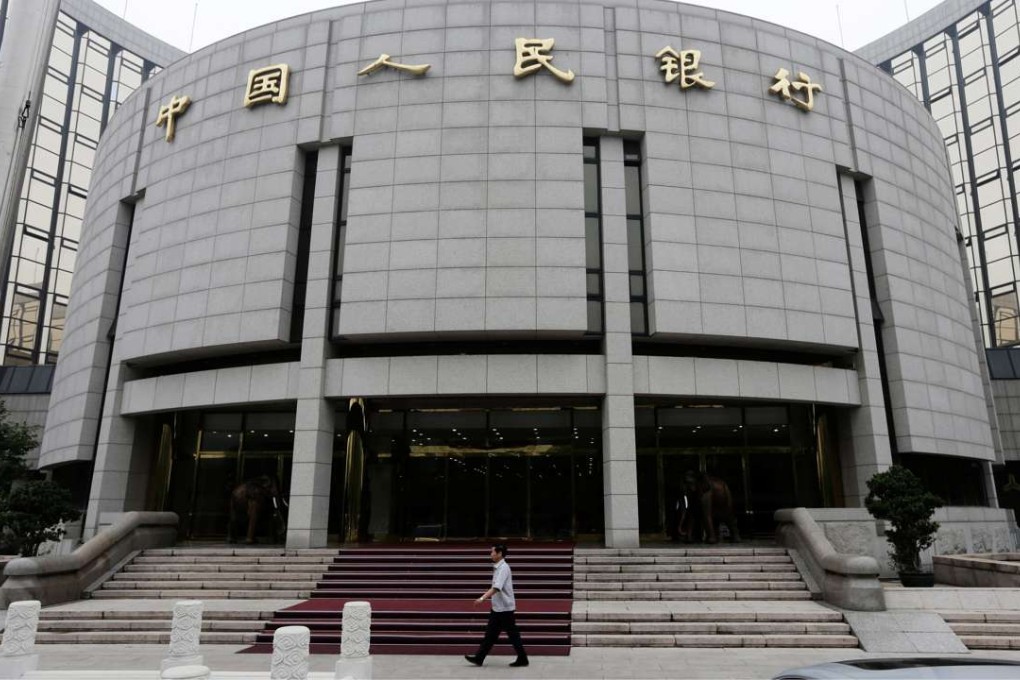

Update | China’s central bank leads charge to shine regulatory light on the risky business of shadow banking

Plan aims to bring responsibility for flourishing sector under one umbrella

China’s financial watchdogs are considering casting a huge new regulatory net over the country’s vast shadow banking sector.

The central bank has spearheaded the drafting of new regulations to tame China’s 60 trillion yuan (HK$67.7 trillion) “asset management” industry.

According to people who have seen the draft regulations, the rules would bring the various kinds of asset management products and investment schemes offered by all kinds of financial institutions under the one regulatory umbrella.

Oversight for the flourishing sector is now split between the securities, banking and insurance regulators.

China Minsheng Banking chief analyst Wen Bin said regulatory standards differed between watchdogs and a unified system would help regulators cut systemic risks and financial leverage.

“China’s financial innovation has grown quickly in the past few years and the blending of financial operations through asset management products has challenged the fragmented regulatory system,” Wen said.