China central bank paper claims Beijing can make ‘impossible trinity’ possible

The nation has found a way to balance the competing goals of a stable yuan, a free market and central bank independence, researchers say

Chinese central bankers have done the economic “impossible”, finding a way to have a stable yuan, a free market and effective monetary policy.

That is the assessment of two central bank researchers, who claimed in a paper published on the People’s Bank of China’s website on Thursday that Beijing would continue to realise the “impossible trinity”.

China is trying to keep the yuan exchange rate steady, create an open domestic market and ensure the independence of the central bank – goals that many observers see as conflicting and destined to fail.

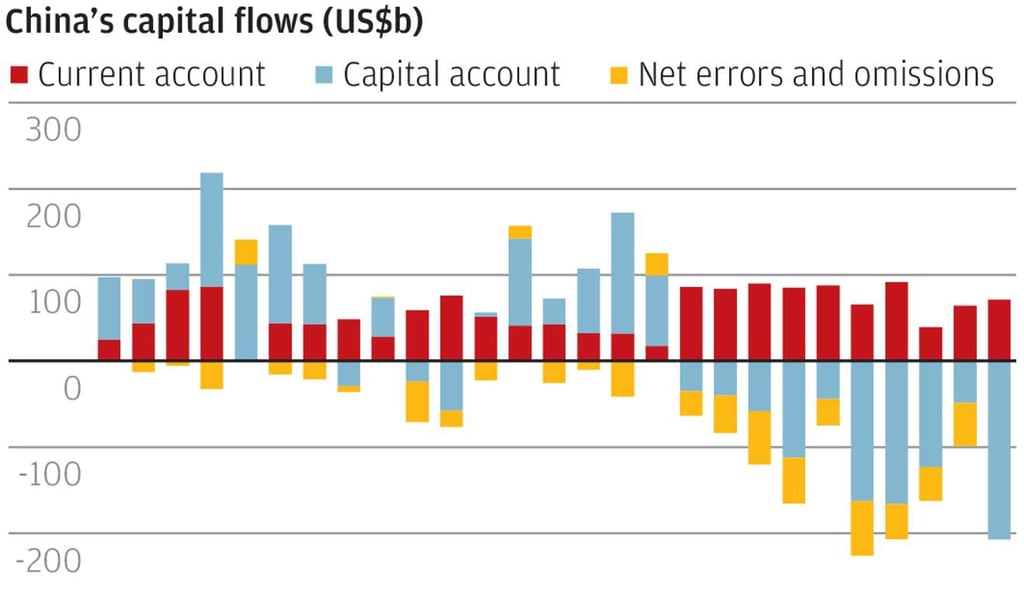

But in their paper, Sun Guofeng, head of the central bank’s financial research institute, and Li Wenzhe, a researcher with the PBOC’s monetary policy department, said policymakers had already balanced these targets through careful management of capital flows, partial liberalisation of the exchange rate and better coordination with other central banks, especially the US Federal Reserve.

Sun and Li said the country had coped better than Brazil, Russia and Indonesia with tapering by the Fed, and would continue to do so through “macro-prudential management” of capital flows, a flexible approach to cross-border money flows instead of blanket capital account controls.