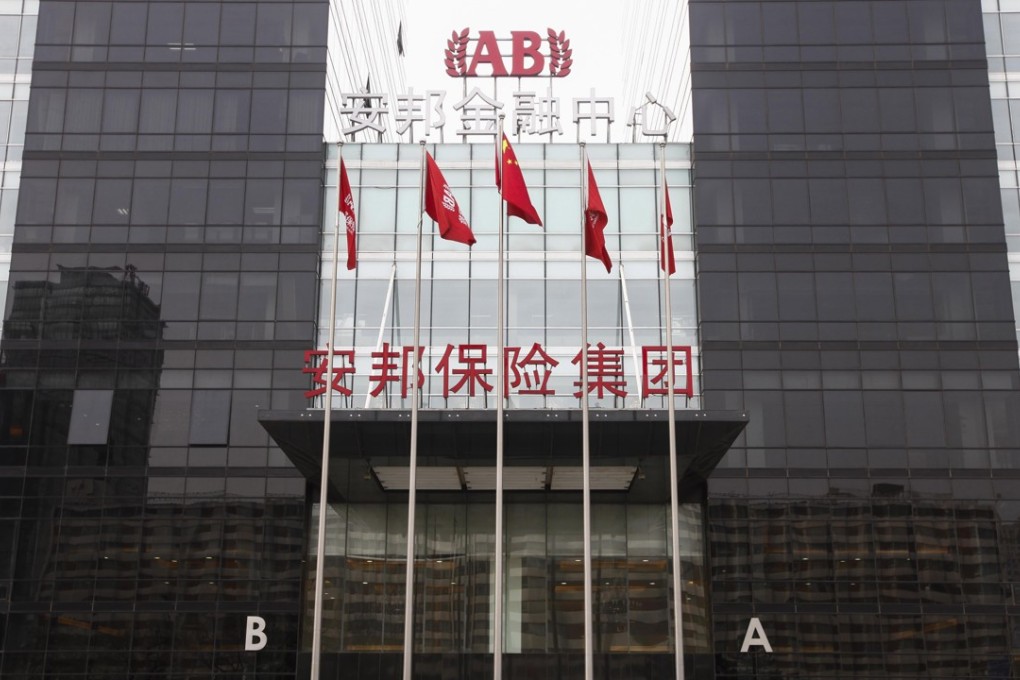

Chinese banks told to stop business dealings with troubled insurer Anbang, source says

Anbang Insurance Group, whose chairman has been detained amid a police investigation, faces an added challenge as authorities asked banks to suspend business dealings with the insurer, according to a person with knowledge of the matter.

That directive came as investigators began a wide-ranging inquiry into Anbang’s operations and detained chairman Wu Xiaohui, said the person, who asked not to be named discussing private information. Separately, at least six large Chinese banks have already stopped selling Anbang policies at their branch networks, according to people with knowledge of their operations.

Wu rose to international fame with a spate of high-profile overseas acquisitions in past years that also raised questions about the sustainability of its funding. Chinese regulators last year began stepping up scrutiny of insurers who rely on sales of short-term policies to fund purchases of illiquid assets like real estate.

Anbang’s life-insurance unit sold 115 billion yuan (US$17 billion or HK$132 billion) of policies through banks last year, double the amount in 2015 and accounting for 88 per cent of total premiums, according to its annual report. At least two of the six banks had stopped selling Anbang policies before Wu’s detention, the people said.