Warning for China as electronics giant Foxconn plugs into US incentives

The decision by electronics giant Foxconn to spend US$10 billion building a flat-panel screen plant in the United States won’t revive US manufacturing but it is a warning for China, analysts said.

Foxconn, the Taiwan-headquartered assembler of iPhones and iPads, still has plans to expand in mainland China – it announced in December it would plough US$8.8 billion into a new plant in Guangzhou.

It remains one of the biggest private employers in the country, with about a million workers from Zhengzhou to Chongqing.

But its announcement on Thursday of a high-profile greenfield investment plan for a site in Wisconsin is a blow for China, where authorities have been concerned about the country’s ability to continue to attract foreign direct investment (FDI).

At a leadership meeting earlier this month, President Xi Jinping said the government should create a “stable, fair, transparent and predictable” environment for foreign businesses operating in China, once the darling of global investors.

Rising costs, red tape and an end to incentives are eating away at China’s attractiveness as a destination for investors, with FDI falling 0.1 per cent in the first half compared to a year earlier. Contractual FDI into Shanghai fell 47.1 per cent in the first half, its biggest half-yearly drop in inflows since 2010.

On Thursday, Yang Weimin, a vice-minister in the Office of the Central Leading Group for Financial and Economic Affairs, the ruling Communist Party’s economic policy decisionmaking body, said stabilising investment from the private sector and foreign investors would be a key priority for Beijing in the second half.

ING greater China economist Iris Pang said one of the big concerns for foreign investors in China was how to remit profits to home due to Beijing’s draconian curbs on outbound payments.

Another long-term fear was “they could be kicked out from their Chinese joint venture after the Chinese partners grasped their technologies”.

Pang also said automation technology had greatly cut the reliance of big manufacturers like Foxconn on masses of employees, making China’s labour-cost advantages less relevant.

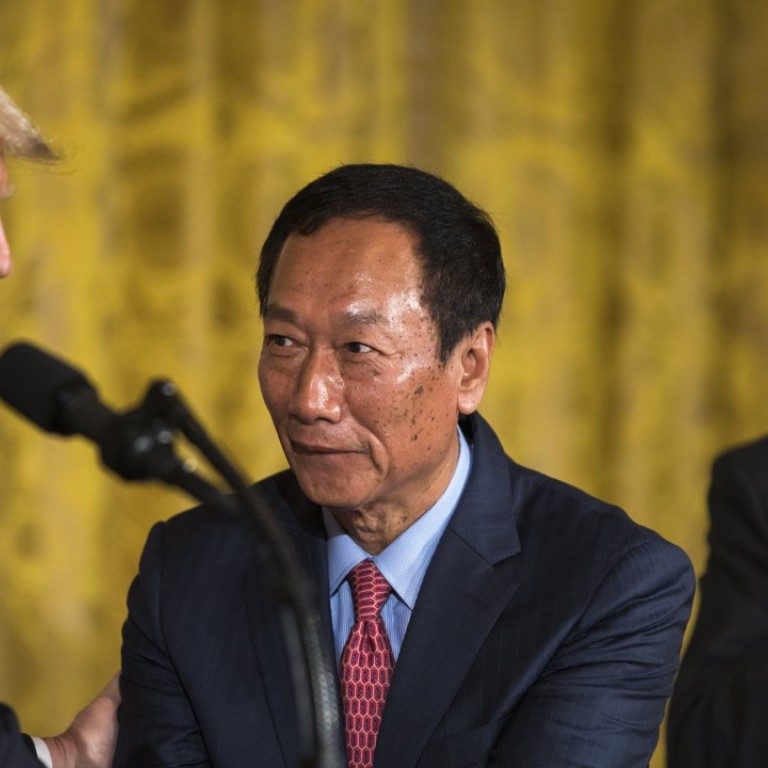

US President Donald Trump hailed Foxconn’s decision as a sign that his policies were working.

“This is a great day today for American manufacturing and American workers and for everybody who believes in the concept, in the label, Made in the USA,” Trump said.

Part of the allure the US is the big incentives on offer for investers. Wisconsin governor Scott Walker said Foxconn would receive US$3 billion in tax breaks and other subsidies from the state over the next 15 years.

However, it’s not lights out for foreign business in China.

Shen Jianguang, chief economist at Mizuho Securities Asia, said the US would not have much impact on China’s FDI and there still was not a serious offshore shift in labour-intensive industries from China.

“China still has the supply chains, good infrastructure and a big market,” Shen said.