Why China’s latest bank reserve ratio cut comes with strings attached

The central bank is trying to walk a fine monetary line to encourage growth and wind back debt, analysts say

China’s latest move to boost lending to the economy’s weakest links highlights the tightrope the central bank is walking to both shore up growth and cut leverage, according to analysts.

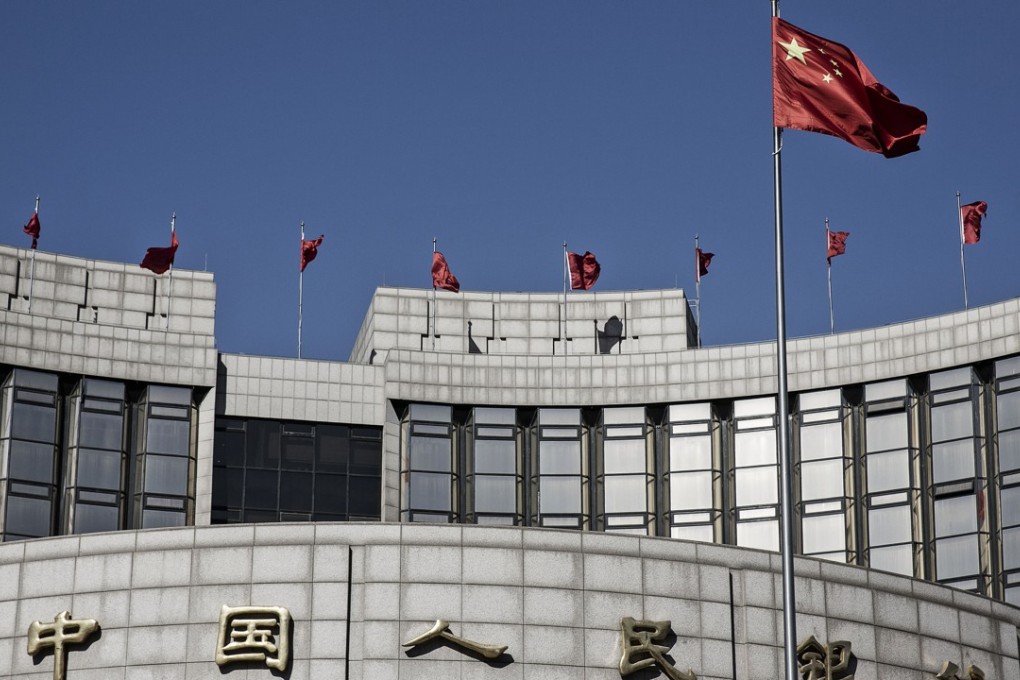

On the eve of the week-long National Day holiday, the People’s Bank of China (PBOC) announced that it would cut the amount of cash banks had to hold in reserve, providing the lenders channelled funds to certain types of clients.

While a cut in the reserve requirement ratio – the share of a commercial bank’s deposits that it must put aside at the central bank as liquid reserves – is not new, it was the first time the PBOC had put conditions on such easing.

The central bank said that from next year lenders could have a 0.5 percentage point cut in the ratio if its lending to small businesses and rural borrowers accounted for more than 1.5 per cent of new loans in 2017. A 1.5 percentage point cut was on offer if such loans accounted for 10 per cent of a bank’s total lending for the year.

With three months to go until the cuts come in, banks have an incentive to boost lending to small borrowers now.

And since most banks will meet the conditions for the first cut, the PBOC’s decision will in theory free up 800 billion yuan (US$120 billion) in funds, based on China’s 160 trillion yuan in outstanding deposits as of the end of August.