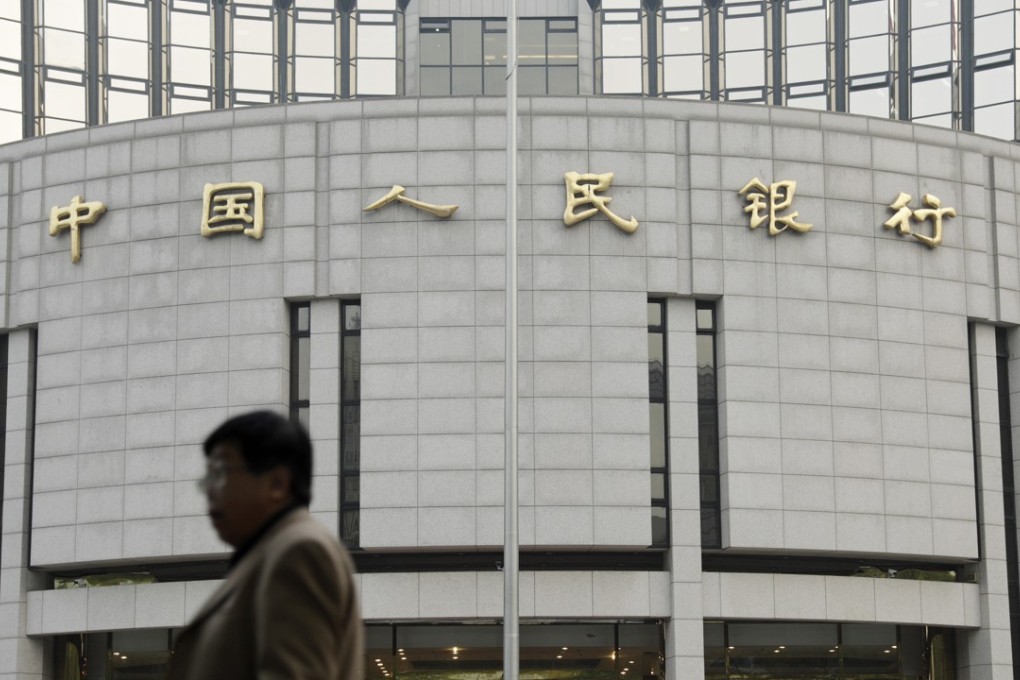

Analysis | The root cause of China’s financial fragility – according to its central bank chief

Constant calls for looser monetary policy are putting the country at risk, says long-standing PBOC boss

China’s central bank chief has lashed out at local governments, saying their constant calls for looser monetary policy in all economic weather are the root cause of the country’s financial fragility.

Zhou Xiaochuan, who has been governor of the People’s Bank of China (PBOC) for the last 15 years, said the PBOC was expected to turn on the cash taps to support growth in good times and in bad.

“[In the good times] all industries and local governments enthusiastically pursued rapid growth and demanded [the central bank] ease money supply,” Zhou wrote in an article on the central bank’s website.

As a result, financing activities boomed, credit supply increased, and market players started to be overly optimistic, “generating asset price bubbles”.

But as risks mounted and financial markets came under pressure, all sides called for the PBOC to come to the rescue with looser monetary policy, Zhou wrote.

He said this distortion of monetary policy, mainly from local governments eager to speed up development, was a source of systemic risk in the world’s second-biggest economy because of the high financial leverage and excessive corporate debt it induced.