Beijing can boost economic growth if it beats the corporate ‘zombies’, IMF says

Economy could grow by another 1.2 percentage points a year if authorities work harder to remove firms dragging it down, according to working paper

If Beijing can successfully tackle an army of corporate “zombies” in the economy, it can boost the country’s growth by up to 1.2 percentage points a year, according to a working paper released by the International Monetary Fund this week.

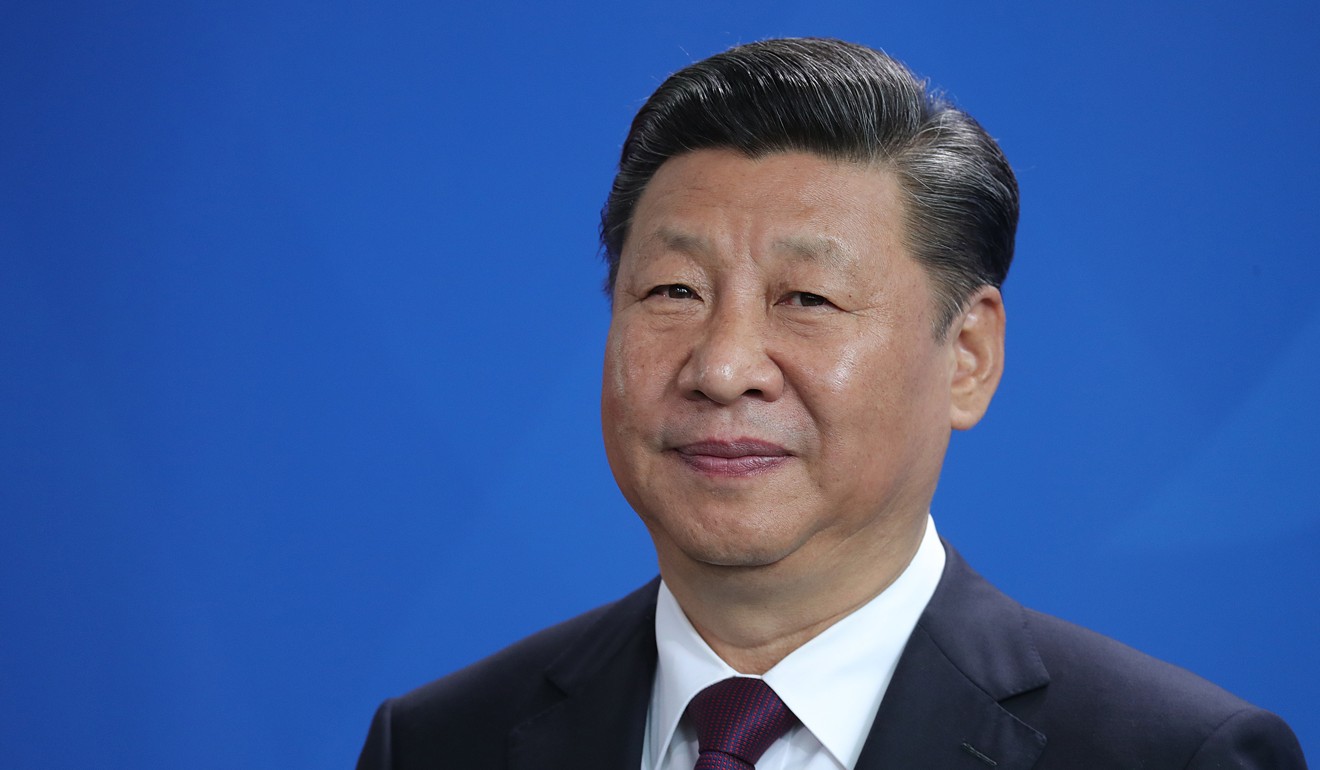

Chinese President Xi Jinping has declared war on corporate “zombies”, or firms being kept afloat by external funding support, as a key part of his supply-side structural reform to phase out unproductive facilities and make growth more efficient.

But loss-making enterprises backed by local governments are still sucking financial resources into their operations and dragging down potential economic growth in the world’s second-biggest economy.

The IMF paper – co-authored by W. Raphael Lam and Alfred Schipke from the IMF and two Chinese researchers – argued that Beijing should work harder to spot “zombies” and accelerate their removal to avoid “debt vulnerabilities” and improve growth potential.

Eliminating zombies could add at least 0.7 percentage points, and at most 1.2 percentage points, to China’s long-term growth every year, according to the paper. It would be a significant boost to China’s US$12 trillion economy, which saw gross domestic product growth slow to 6.7 per cent last year.

But “progress is complicated by the piecemeal exit of zombies and limited progress in state-owned enterprise (SOE) reforms”, the working paper warned.

“Non-viable zombies should be publicly identified and subject to greater use of liquidation. This should be complemented with a clear timetable to resolve all identified zombies within one to two years.”

The two other authors of the paper are Yuyan Tan of the State Administration of Foreign Exchange and Zhibo Tan from Fudan University.

Beijing has identified about 2,000 entities owned by the central government and over 7,000 local enterprises as zombies. Only 20 per cent of them have reportedly been dealt with as employment and social stability remain big considerations.

The State-owned Assets Supervision and Administration Commission – which oversees the largest 98 industrial firms with combined assets of about 150 trillion yuan (US$22.71 trillion) – will encourage more restructuring rather than bankruptcies to reduce lay-offs, its chairman Xiao Yaqing said last month.

Resolving the issue of weak firms, including zombies, is the first and a key step to address the country’s debt mountain and raise productivity gains.

China’s corporate debt – 57 per cent of which is reported by state firms – has risen significantly over the past decade to 176 per cent of the country’s GDP at the end of March.

The proportion of non-viable zombies in total corporate debt also rose to an eight-year high of 6 per cent last year, the IMF paper said. The leverage ratio of zombie firms was 284 per cent, with losses of 1.6 per cent last year.

Corporate governance reforms, deleveraging and tighter budget constraints should be in place to help distressed firms return to viability, it said.

“The state should neither ‘window-dress’ by merging them with sound SOEs nor encourage creditors to refinance, even if that means immediate loss recognition and a mild growth slowdown,” the paper warned.

Beijing should harden budget constraints for zombies and SOEs in general by suspending implicit support on credit access and allowing greater corporate defaults, it said.

The IMF working paper called for market entry barriers and restrictions to be further lifted to foster competition and promote growth.

It also noted that without important factors such as loss recognition and operational restructuring there were concerns that the current deleveraging was just “kicking the can down the road”.

“Without concerted efforts to slow credit growth, there is an increasing risk of superficial financial restructuring to meet a deleveraging ‘target’, such as reducing firm-level liability-to-asset ratios without tackling underlying structural problems,” the paper said.