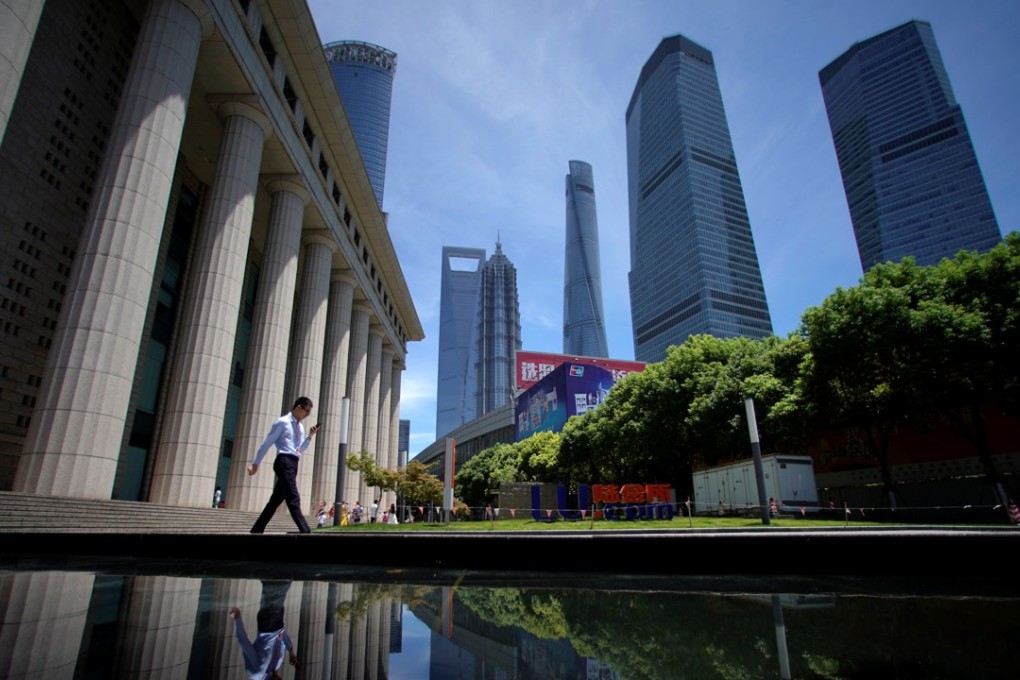

Analysis | Too little, too late? Foreign bankers fall out of love with China as Beijing fails to open up

Overseas investors in the financial sector are weighing their options amid tougher competition, political uncertainty and an unfriendly regulatory environment

Roughly two decades ago China made a momentous decision to win the hearts of global capitalists and gain entry to the world’s biggest club of trading nations.

It promised to deregulate its financial sector and open its banking market to foreign players.

Seventeen years down the track, some rule changes have been made but foreign players are still at the margins, battling regulatory foot-dragging and greater domestic competition.

Banking is a litmus test for the broader Chinese economy. For decades, Beijing took it for granted that overseas investors would be waiting at the gates, keen for a share of a massive market.

But that investment tide could be turning as Beijing tightens its grip on economic activity and its piecemeal deregulation raises doubts about its commitment to free trade.

China’s financial sector has ballooned from a near standing start at the turn of the century. The country’s state banks, once technically bankrupt, are now the world’s biggest and most profitable lenders.