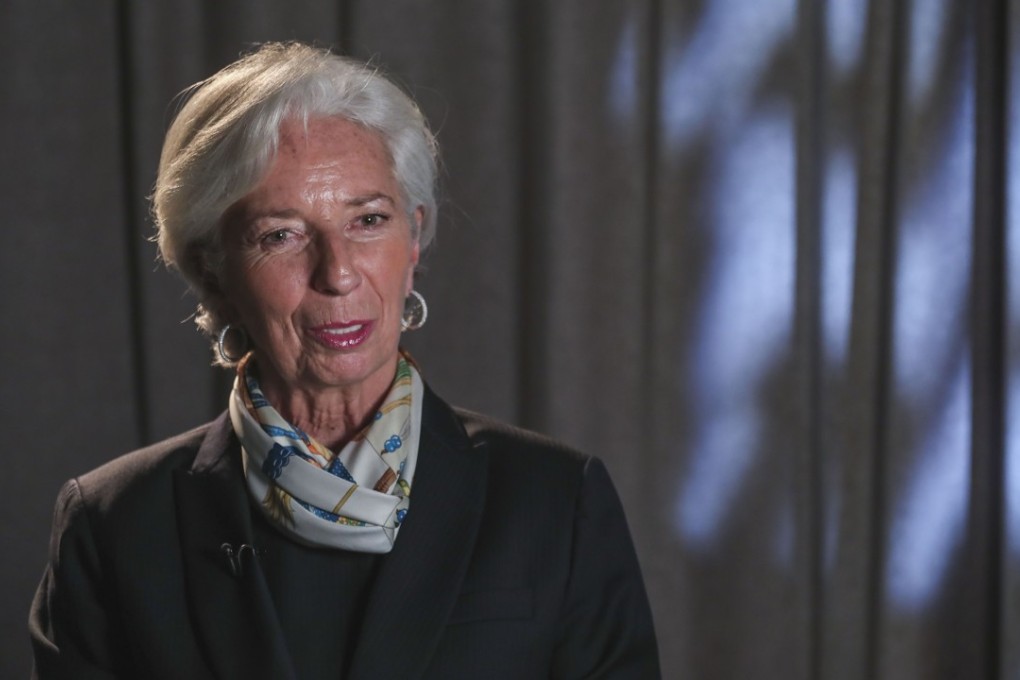

IMF chief Christine Lagarde expresses concern over rising global debt levels, including China’s

Managing director of International Monetary Fund says also that governments must ‘steer clear of protectionism in all its forms’

The head of the International Monetary Fund said on Wednesday that global debt, including that of China, had soared to 220 per cent of global output, a staggering level that did not bode well for member economies.

The Bank of International Settlements, which serves as a central bank to the world’s central banks, last month included China and Hong Kong on a list of economies whose debt-to-GDP ratios had raised “red flags”. The IMF, which employs different numbers to measure indebtedness, was urging its members to pare their debt to serviceable levels to sustain them through the next economic downturn, IMF Managing Director Christine Lagarde said in an interview with the South China Morning Post after giving a speech at the University of Hong Kong.

“There’s a saying in French that we should fix the roof while the sun is shining,” she said.

She said that the world, including Beijing, needed to tackle its debt problems, adding that 40 per cent of the global debt added since 2007 had come from China.

In the world economy, the debt problem was casting a shadow over future growth prospects, she said.

“This is a potential risk that is looming on the horizon of the otherwise quite sunny sky of the global economy,” she said.