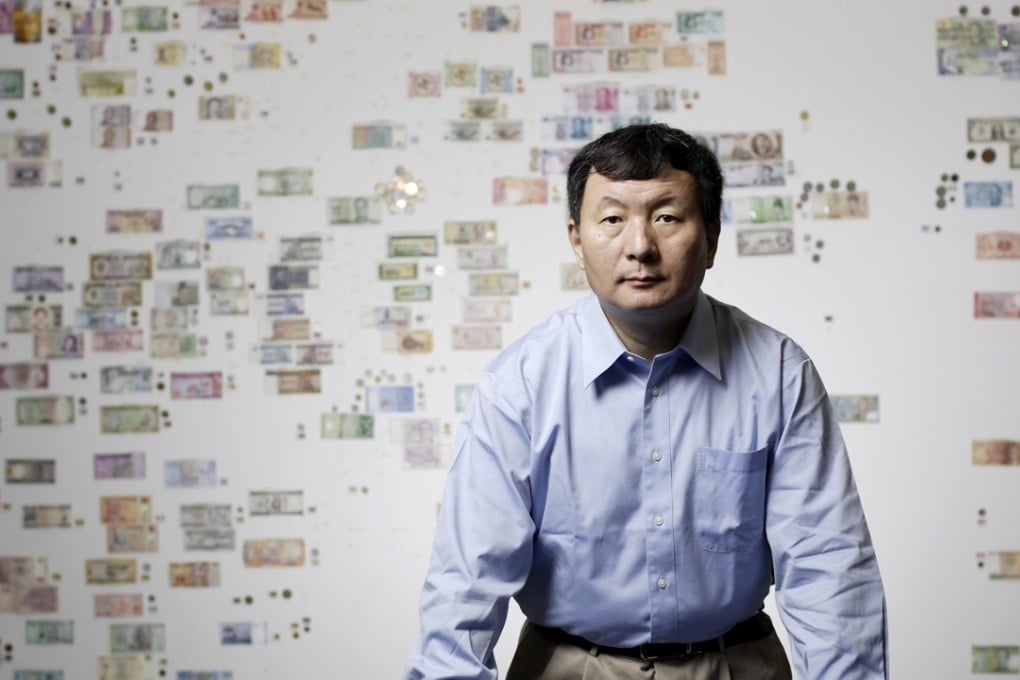

Inside the operations of China’s top credit risk start-up: Zane Wang talks about the growth of China Rapid Finance

Zane Wang, a former top credit analyst for American retail giant Sears, says his China Rapid Finance platform is helping millions of mainlanders obtain credit for the first time in their lives. He spoke to Bien Perez

Zane Wang Zhengyu, the founder and chief executive of China Rapid Finance, says his company has helped some of the largest banks in mainland China underwrite more than 100 million credit cards. His 15-year-old, privately held company was the country’s first supplier of a Chinese-language credit decision engine, which has been implemented by large domestic banks and remains invaluable to determining the creditworthiness of local banking customers.

With its grasp of advanced technology and broad understanding of domestic consumers, China Rapid Finance entered the country’s hot new market for peer-to-peer lending. This nascent industry on the mainland allows third-party investors to lend money to unrelated individuals, or peers, through online marketplaces, not traditional banking channels.

Wang, who previously worked as the global head of analytics at the credit unit of US department store chain Sears, made a big splash in the peer-to-peer lending market early last year by partnering with internet giant Tencent Holdings to launch a unique mobile-based, pre-approved borrower campaign for loans of up to 500 yuan (HK$600).

China Rapid Finance has so far facilitated more than 3.5 million in loans. Its business model generates recurring fee revenue from its borrowers and investors, including transaction and service fees for loans facilitated on its marketplace.

How does your lending platform operate on the mainland?

We help the so-called emerging middle class in China get access to credit. Most of these people would be considered financially active, yet have no access to credit because they don’t have any kind of updated data coverage with the central credit bureau [the state-controlled Credit Registry Centre]. So the traditional banks won’t be able to provide any credit to them.That leaves us with a huge opportunity to provide service. We’re not really a lender, but we help these people get access to loans.