New | China's yuan effect: is this a currency war or a free-float push?

Some see export gains from the yuan's fall but others believe it could be part of a bigger drive to let the currency float freely

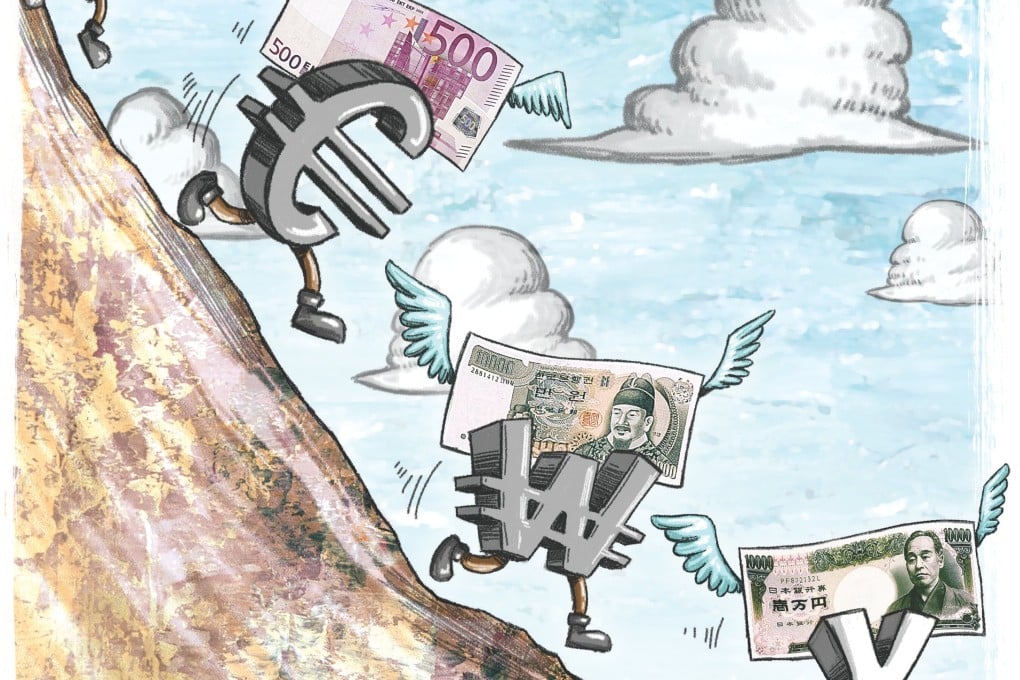

Beijing's moves over the past two days to weaken the yuan have raised speculation that China is embarking on a currency war to boost the country's exports and growth.

But many disagree, saying the move is part of the government's efforts to allow the yuan to float more freely on the international market.

China allowed the yuan to fall nearly 2 per cent against the US dollar on Tuesday and by a further 1.6 per cent on Wednesay.

Tuesday's fall was the sharpest daily devaluation since 1994 and followed weekend data that showed China's exports tumbled 8.3 per cent in July.

The world has long expected the yuan to eventually become a freely floating currency; the highly managed exchange rate is inconsistent with Beijing's other moves towards capital account liberalisation, internationalisation of the yuan, and to have the currency included in the International Monetary Fund's reserve currency basket.