China detains Shanghai private equity executive as inquiry goes on into alleged insider trading: Xinhua

Xu Xiang, Zexi Investment's general manager, held as two executives of Hong Kong-owned fund arrested after it allegedly used software to earn billions of yuan from irregular futures trades

Chinese police have launched an inquiry into suspected insider-trading at a leading Shanghai private equity company in the latest move in its crackdown into alleged insider trading following this summer’s stock market slump.

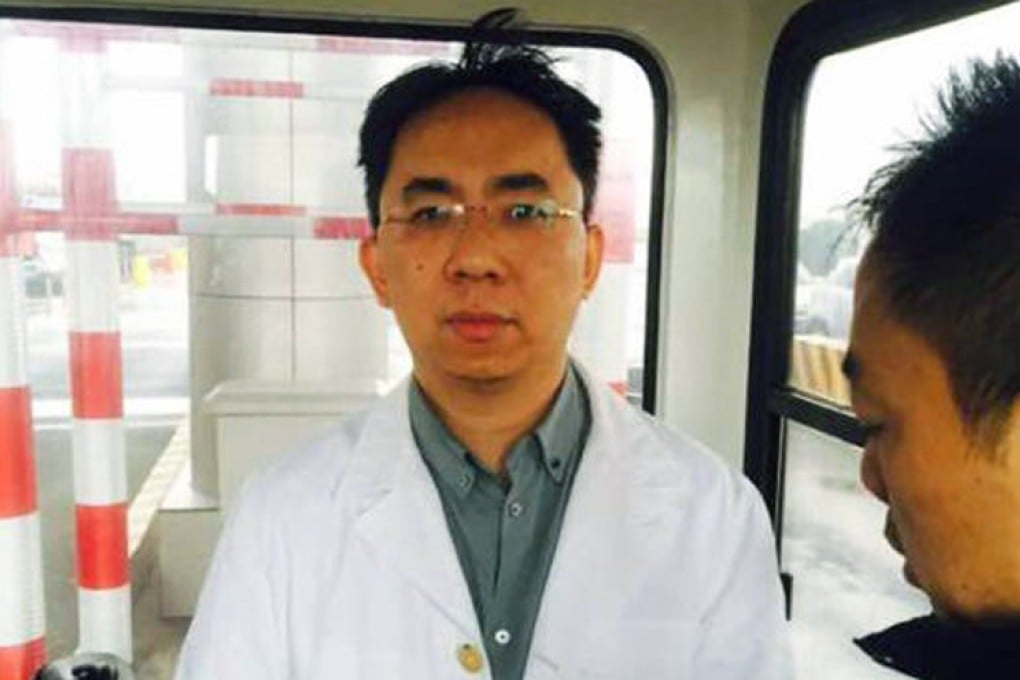

Xu Xiang, general manager of Zexi Investment, a well-known Shanghai-based private equity firm, was detained by police on Sunday as part of the inquiry, the official Xinhua news agency said.

His detention came as officials arrested two executives from a Hong Kong-owned fund that allegedly pocketed billions of yuan from irregular futures trades by using software that in some cases took only one second to buy 31 contracts.

Gao Yan, the general manager of Jiangsu-based Yishidun, and its senior executive, Liang Zezhong, were both arrested for allegedly buying and selling futures in prices that deviated from market standards and illegally made more than 2 billion yuan (HK$24 billion), Xinhua said.

Since China’s stocks plunged in mid-June, the country has intensified investigations into market manipulation, which have so far netted journalists, senior executives in brokerages and even securities regulators.