Billionaire hedge fund manager known as 'China's Warren Buffett' in dramatic highway arrest for insider trading

Investment wizard likened to Warren Buffett is latest casualty in probe of market irregularities

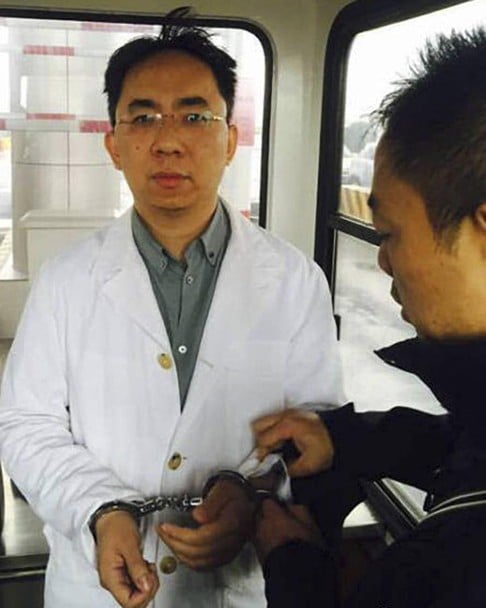

On Sunday night a squad of Chinese highway patrol cars sealed off the Hangzhou Bridge for more than 30 minutes while officers surrounded Xu’s car, eventually leading the Armani-clad billionaire off in handcuffs.

Simultaneously, police moved in on Xu’s company offices in Shanghai and Beijing, confiscating documents and computers as well as interviewing employees.

Police and regulators have had their eyes on Xu Xiang, general manager of Zexi Investment and regarded by many as China's No 1 hedge fund manager, ever since the losses caused by the chaos in mainland stock markets this summer climbed into trillions of dollars.

READ MORE: ‘China’s Warren Buffett’ mocked by internet users in China after he is arrested in ‘dodgy jacket’

And now they have pounced. Xu and several other executives of Zexi were arrested on Sunday on charges including insider trading and stock market manipulation, Xinhua reported yesterday, citing the Ministry of Public Security.