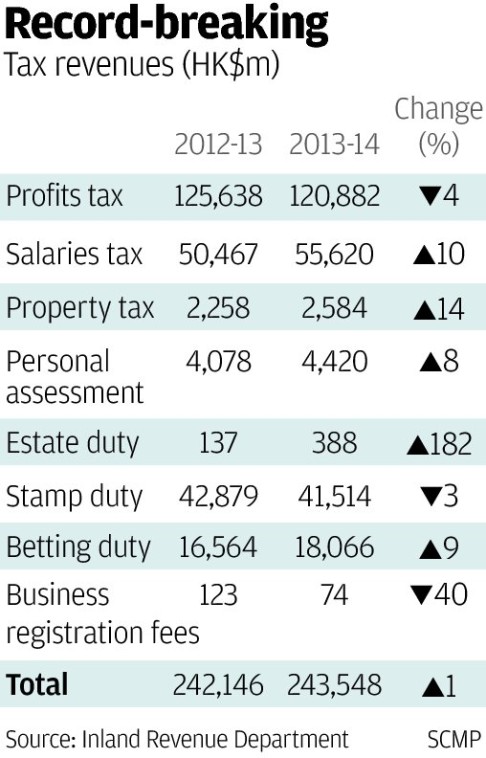

Record year for tax intake - but stamp duty down

Government took in HK$243.5 billion this year, up slightly on last year, as property market cools

The government collected HK$243.5 billion in tax in the 2013-14 fiscal year, breaking the previous year's record, but the revenue chief predicts intake will drop slightly in the current year.

But the revenue from stamp duties fell 3 per cent to HK$41.5 billion from HK$42.8 billion the previous year, continuing a downward trend.

To cool the property market, the government in 2010 imposed an additional special stamp duty of 15 per cent on homes sold within six months of purchase; 10 per cent extra on those resold within a year and 5 per cent on those resold within two years.

In 2012, a 15 per cent tax on home purchases by corporations or by individuals who are not permanent residents was introduced.

Last year, the government proposed doubling the stamp duty for everyone except permanent residents who are first-time buyers.

After the three measures, the property market "gradually turned quiet and trading has been decreasing", said Wong Kuen-fai, commissioner of the Inland Revenue Department.

Wong predicted that tax revenues in the current financial year could fall by 0.3 per cent because salaries tax revenue will rise by less and tax rebates will be bigger under budget proposals by Financial Secretary John Tsang Chun-wah that still await approval in the Legislative Council.

"Hong Kong is still affected by the financial tsunami and the European debt crisis," Wong said. "The stock market is subject to the impact of the surrounding environment, so we expect it to remain quite unstable in the coming year."

How long it would take to pass legislation to double stamp duty would affect how soon the department could start collecting the tax, he said.

Wong said the filibuster in the budget debate had affected progress on the legislation and the approval of the tax rebates.

The rebates include increases in the dependent parent allowance and dependent grandparent allowance, as well as a 75 per cent rebate of salaries and profits tax, subject to financial ceilings.