HSBC customer forced to make 16,000-kilometre trip to access account after bank blunder

Robert Lewis had to fly from Australia to Hong Kong

When former Hong Kong resident Robert Lewis opened an account with the 'world's local bank' he thought HSBC would be able to cater for all his financial needs, wherever in the world he went.

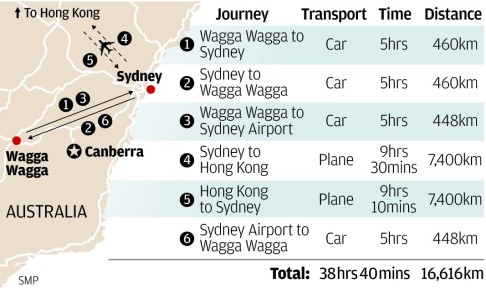

Little did he know that due to a breakdown in communication over his signature, he would be forced to embark on a marathon 16,000-kilometre round-trip from his native Australia to Hong Kong, simply to access his cash.

Now he is seeking AUS$5,000 (HK$36,000) from the bank to cover the cost and inconvenience of his journey.

Lewis's problems started in April when he tried to access his account online from his home in Wagga Wagga, New South Wales.

He had turned to the bank's website after discovering that the ATM card he was issued in Hong Kong was no longer valid due to a security upgrade.

The account had not been used since he returned to Australia in August 2011.

Once online Lewis discovered he was unable to gain access to the account as he did not have an internet security device

Hong Kong Airlines passengers stage 18-hour sit-in on plane over flight cancellation

To get one, the 55-year-old learnt that he would have to travel to an HSBC branch and change his address in person.

This involved a 10-hour round trip to Sydney, 455 kilometres away - an inconvenience that was just the tip of the iceberg.

Two weeks later, and despite being approved by two HSBC officers in Sydney, the Hong Kong branch rejected the change-of-address application on the grounds that his signature did not match the one on its records.

That left the education consultant with no choice but to fly to Hong Kong and confront staff himself.

Lewis said his travails made a mockery of the bank's "world bank" claims and the convenience of its network.

"This has cost me an incredible amount of time and income, inconvenience, stress and anxiety. It is hardly the thing you expect from an international bank."

Lewis is seeking redress for the cost of travel and loss of earnings, as well as a goodwill payment for the hassle.

After the took up his case, HSBC contacted Lewis on Friday to apologise. It indicated the bank had made a mistake in processing his application.

Lewis said he had shown bank officials in Sydney his passport and Hong Kong identity card.

"Hong Kong could have spoken to Sydney and faxed a copy of the documents to confirm they had sight of my forms," he said.

But the confusion continued when he arrived in Hong Kong earlier this month.

Lewis first visited a Sheung Wan branch, and was surprised not to be quizzed about his signature. Staff said it could not give him an internet security device.

Days later he visited another branch and was given one, highlighting the inconsistencies in advice and service the bank gave.

An HSBC spokesman said the bank was checking the case and would not comment on the affairs of individual customers.

The bank, which dropped its claim to be "the world's local bank" in 2012, will decide tomorrow what redress, if any, to give Lewis.

This is not the first time it has faced complaints about its international credentials.

The Hong Kong operation apologised last year after issuing new ATM cards linked to China's UnionPay network rather than the international Plus system, leaving customers struggling to withdraw money abroad.