Political tensions could undermine Hong Kong as China's top financial centre: Joseph Yam

Amid tensions over electoral reform, former Monetary Authority chief warns of threat to Hong Kong as China's top financial centre

Hong Kong's former central banker Joseph Yam Chi-kwong has warned that the city could lose its status as China's top financial centre if political developments unnerve the country's leaders.

The Hang Seng index dropped 389 points yesterday, its biggest fall in three months, amid growing concerns about political instability.

And Chow Chung-kong, chairman of Hong Kong Exchanges and Clearing, weighed in by warning that the increasingly tense political atmosphere could shake the confidence of international investors.

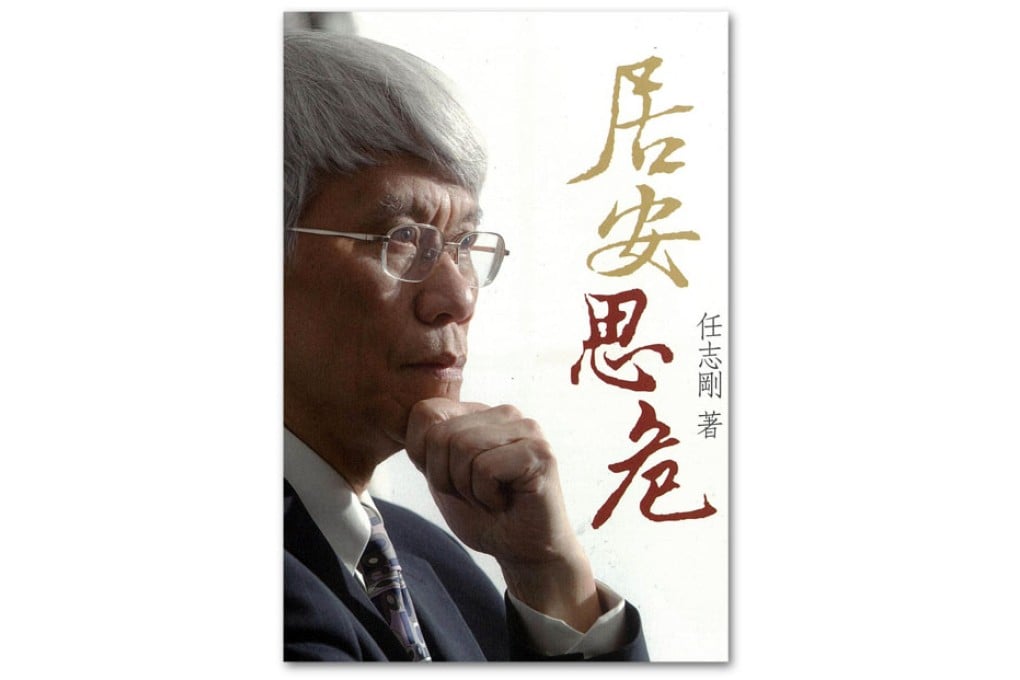

In the preface of his new book, Gui On Si Ngai, Yam writes: "The politics of finance is already complex … It may well be that political developments in Hong Kong are eroding the willingness of the leadership to rely too much on Hong Kong as a venue for the conduct of international financial activities of the mainland. If so, this would be regrettable."

The book, in which Yam comments on global financial affairs and looks back at his time as chief executive of the Hong Kong Monetary Authority from 1993 to 2009, is published this week. Its title roughly translates as "In Prosperity, Think of Adversity".

The warnings come amid growing tensions over electoral reform. More than 720,000 ballots have been cast in the controversial Occupy Central "referendum", which has riled Beijing.