Bitcoin exchanges have struggled to survive on mainland

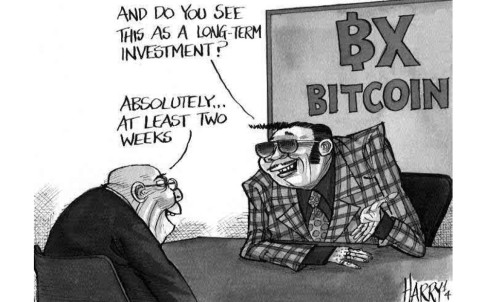

The average lifespan of mainland-based virtual currency businesses is just nine months, indicating Beijing's success in limiting financial activity outside the official banking system.

The average lifespan of mainland-based virtual currency businesses is just nine months, indicating Beijing's success in limiting financial activity outside the official banking system.

"The [People's Bank of China] wants to suppress and control bitcoin so it doesn't go crazy or wild," BTC China chief executive Bobby Lee said in Hong Kong yesterday.

Speaking to about 500 participants in Hong Kong's first bitcoin conference, Lee said the exchange failures had damaged the industry and prevented wider adoption of the currency.

"This is actually a sad story as in each case people lose their money because they've left their money in one of these exchanges," he said at the Inside Bitcoins trade show. "Some run away, some default."

On Sunday, it was revealed that police were investigating the Hong Kong Crypto Exchange, a local industry newcomer, over the alleged disappearance of tens of thousands of dollars worth of the virtual currency.

A handful of exchanges including Huobi, BTC China and OKCoin have circumvented restrictions placed by the People's Bank of China on virtual currencies. The Chinese firms have risen to rank among the biggest - with bitcoins valued globally at US$7 billion. Lee, a former Walmart China executive, said on Monday "ordinary people should not buy bitcoin" and warned price volatility would continue for a decade as the currency tried to grow on a stable footing.

A crackdown by the PBOC has resulted in Hong Kong emerging as a possible haven for the virtual currency community.

Zennon Kapron, author of on the history and future of the currency in China, said: "Hong Kong is both a jumping-in point for companies leaving China and foreign companies coming into China.

"It's a natural bridge for foreign countries and the mainland - so it's natural for exchanges to move to Hong Kong."

Leonhard Weese, president of the newly launched Bitcoin Association of Hong Kong advisory group, said his organisation had brought virtual currency businesses together "to be prepared for the day when Hong Kong does bring in regulation" and to help educate people about bitcoin.

The price of a bitcoin peaked at US$1,242 late last year but tumbled to just US$360 in April.