Occupy Central a danger to the Hong Kong property market, Barclays Bank warns

Barclays Bank says 'shocks' like Central protest could cause a slump from which it will take the city longer to recover than in 2003 and 2008

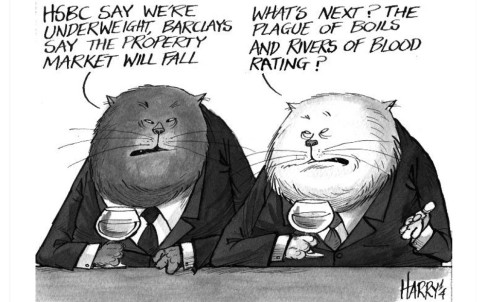

"Unexpected shocks" like the planned Occupy Central protest could trigger a property market slump, leading international bank Barclays warned yesterday.

And it would take Hong Kong longer to recover than after the crashes of 2003 and 2008, it said.

Barclays said prices had deviated too much from fundamentals, making the property market vulnerable to such shocks. Paul Louie, the bank's head of research for property in Asia ex-Japan, said in a report: "If a shock were to occur, we believe the subsequent recovery could take a long time, and better resemble 1998 [than the two later crises]."

In comparison, it took seven months in 2003 after the outbreak of severe acute respiratory syndrome (Sars) and a year in 2008 after the global financial crisis for prices to return to their previous levels.

Louie made only a vague reference to the Occupy Central movement in his report.

But he told the later that the planned blocking of Central streets by pro-democracy protesters "could be one of the unexpected shocks".

The Barclays forecast came a day after the city's biggest bank, HSBC, issued a report that highlighted the risks posed to the stock market by the civil disobedience movement.

HSBC later diluted the report after criticism online.

But many hold different views. Several real estate agents have raised their forecasts for this year after property prices hit a record high.

Joseph Tsang, managing director of Jones Lang LaSalle, said there was no evidence to show political uncertainties such as Occupy Central had affected property market sentiment.

In the Barclays report, Louie did not predict by how much prices could fall. He said only that in such an event, it would take the city longer to recover. According to his analysis, the home-price-to-income multiple, which reflects housing affordability, stands at 13.5.

This is higher than the figures recorded on the eve of all three crises in the past two decades: 13.2 in 1997, 5.1 in 2003 and 8.8 in 2008. He argued that it would take longer for prices to be realigned with the fundamentals.

The Occupy Central organisers have said they may go ahead with the protest as soon as next month if the government does not come up with a universal suffrage proposal that they consider genuine.

Terence Chong Tai-leung, an economics professor at Chinese University, said he did not believe Occupy alone, without changes in interest rates and government policy, could pose a significant threat to the market.

"The impact of the protest, hitting Hong Kong only for a few days, will just be like a typhoon," he said.