In world’s most expensive market, Hong Kong leader Carrie Lam shifts focus on home ownership

Analysts say time is right as housing chief confirms strategy is about more than rentals

Hong Kong’s housing chief confirmed on Friday a marked policy shift was under way, with the focus moving away from a rental market and towards home ownership.

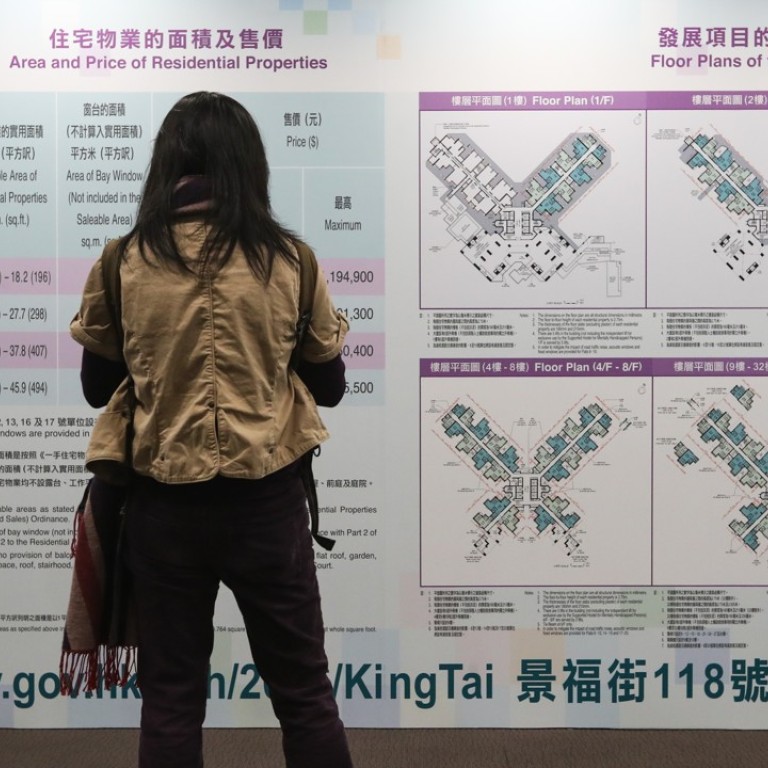

For the first time in more than a decade, the administration has made clear its plans to push initiatives aimed at helping residents achieve the dream of owning their own home in the world’s most expensive housing market.

“The direction and angle of policies have shifted. There is one more dimension offered,” Secretary for Transport and Housing Frank Chan Fan said on a radio programme.

The measures include the “Starter Home” scheme that aims to allow middle-class families who earn too much income for subsidised housing but cannot afford private homes, as well as turning more developments earmarked for public rental housing into the subsidised flats for sale.

7 things you need to know from Hong Kong leader Carrie Lam’s policy address

Converting those developments would be done by regularising the Green Form Subsidised Home Ownership Scheme, which was launched as a pilot programme last year and aims to vacate more public rental units and speed up the waiting period for rental applicants. A public-housing project in San Po Kong was selected and offered 857 units for sale to existing tenants or those eligible for public rental housing.

Chan said there was a “strong home ownership demand” among the some 756,000 households staying in public rental housing.

“Among the some 850 flats sold under the Green Form Subsidised Home Ownership Scheme, more than 820 of them were bought by existing public rental housing tenants,” the housing minister said.

When asked whether the public housing policy had changed from meeting people’s needs in housing only to helping them own a flat, Chan claimed the policies were meeting both needs.

We are solving the needs in housing and demands for home ownership

“We are solving the needs in housing and demands for home ownership.”

Around half (50.4 per cent) of Hongkongers are homeowners, while a third, or more than 2 million people, live in public housing.

The city’s housing policy has seen major changes since the handover to Beijing in 1997. The first chief executive, Tung Chee-hwa, had pledged to build 85,000 public flats a year to cool property prices and had a target of a 70 per cent home ownership rate by 2007. However, the 1997 Asian financial crisis, along with the dotcom crash in 2000, caused property prices to plunge and pushed many homeowners to the brink of bankruptcy. The government decided in 2002 to reposition its housing policy to withdraw its role as a property developer, and stopped construction of any subsidised flats for sale, only focusing on providing public rental housing. The government announced the resumption in 2011.

Chan stressed the government was still trying hard to meet its target of providing public housing for 280,000 households over the next nine years. So far the government has sourced lands for 236,000 units.

“Our ultimate aim is locating the most amount of land to build as many public housing units, for rental and sale, as we can,” he added.

Rebecca Chiu Lai-har, who heads the department of urban planning and design at the University of Hong Kong, said the shift in policy was “on the right track”.

“The target for home ownership was only aborted in 2002 because of the economic environment when the property market crashed, but since the economy has stabilised, there is actually a lot of pent-up demand from public rental housing residents to own a home,” Chiu said.

The suspension of building subsidised flats for sale and expensive property prices meant that higher-income public tenants were stuck living in rental housing in recent years, Chiu said.

However, she added the government had to make it clear that buying a home was a personal choice since there would always be a risk of negative equity – the potential indebtedness when the market value of a property falls below the outstanding amount of a mortgage secured on it.

Hong Kong’s record in negative equity cases stands at 105,697, set at the height of the Severe acute respiratory syndrome (Sars) epidemic in 2003.

Instead of making the pie bigger, she’s just cutting the pie differently, which is very twisted logic

But economist Andy Kwan Cheuk-chiu said he believed Lam’s ownership-oriented policy would not be effective, arguing it had not boosted the public-sector housing supply to benefit more people.

He thought the home ownership problem in Hong Kong related to an insufficient supply of public and subsidised housing – that those who had been waiting years to rent or buy flats from the government, including many young families, had to borrow a lot of money to buy private flats and thus heated up the market.

Kwan said the down payment requirement for the second-hand market – 40 per cent for properties under HK$7 million – was too high for these families. This meant, he believed, they had to opt for first-hand housing estates that were in limited supply and offered at high prices, with developers helping them reduce their down payments to as low as 10 per cent.

Lam’s policy also made no reference to reviving the second-hand market, the economist claimed.

“It’s like a pie,” Kwan said. “Instead of making the pie bigger, she’s just cutting the pie differently, which is very twisted logic. If you have enough supply, you don’t even have to say you’re focusing on ownership and people can own their homes.”

He believed the policy shift would not significantly affect the private market.

Additional reporting by Shirley Zhao