New guidelines will smooth path for firms and foreign investors looking to open Hong Kong bank accounts

Monetary Authority intervenes after complaints that tighter regulations were damaging the city’s reputation as a global financial centre

The Hong Kong Monetary Authority will roll out guidelines in the coming weeks to help companies rebuffed while trying to open accounts at banks under pressure from anti-fraud regulations and new compliance requirements.

Many international banks have strengthened internal due diligence requirements in recent years after a number received hefty fines for transgressions such as money laundering and terrorist financing.

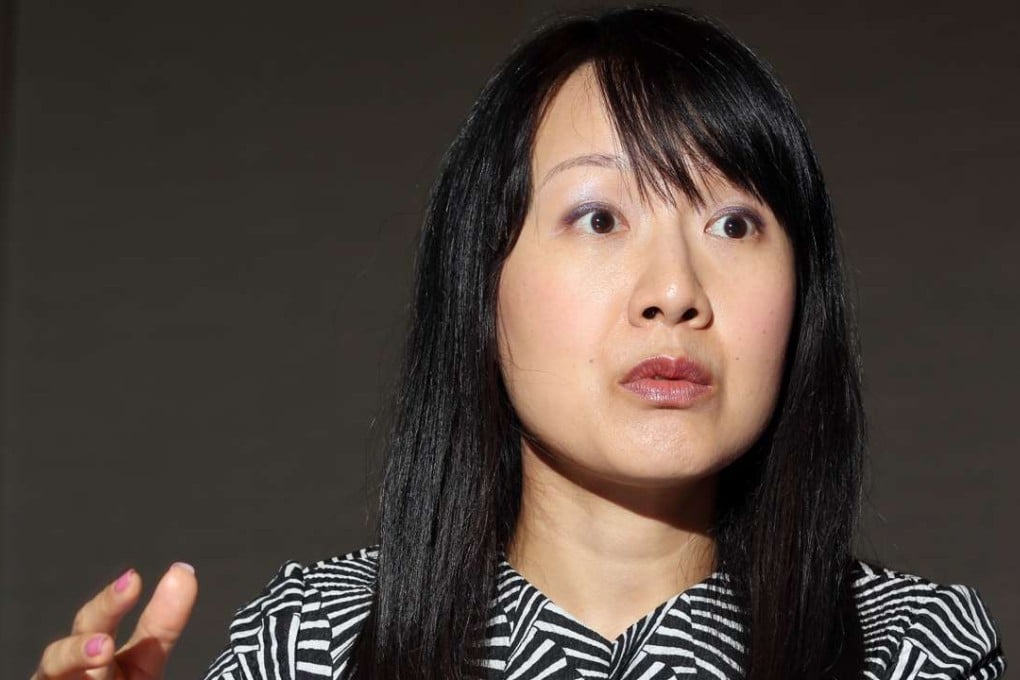

Sarah Kwok, head of the authority’s banking conduct department, said foreign investment had always been welcomed in Hong Kong but the tighter measures could cost the city its reputation as an international financial centre.

A number of lenders in Hong Kong, including HSBC, have made it particularly difficult for foreign small and medium enterprises (SMEs) to open accounts, the Post has learnt.

Kwok told the Post “only one or two international banks” were involved in the recent complaints it had received, without disclosing names. She urged banks to strike a balance between meeting compliance requirements and providing basic services to the public.