Who is the investor with a 9 per cent stake in Cathay Pacific in just six months?

Blue chip Kingboard Chemical has quietly spent HK$3.4 billion on the airline’s shares in recent months, led by its ‘acquisitive’ boss

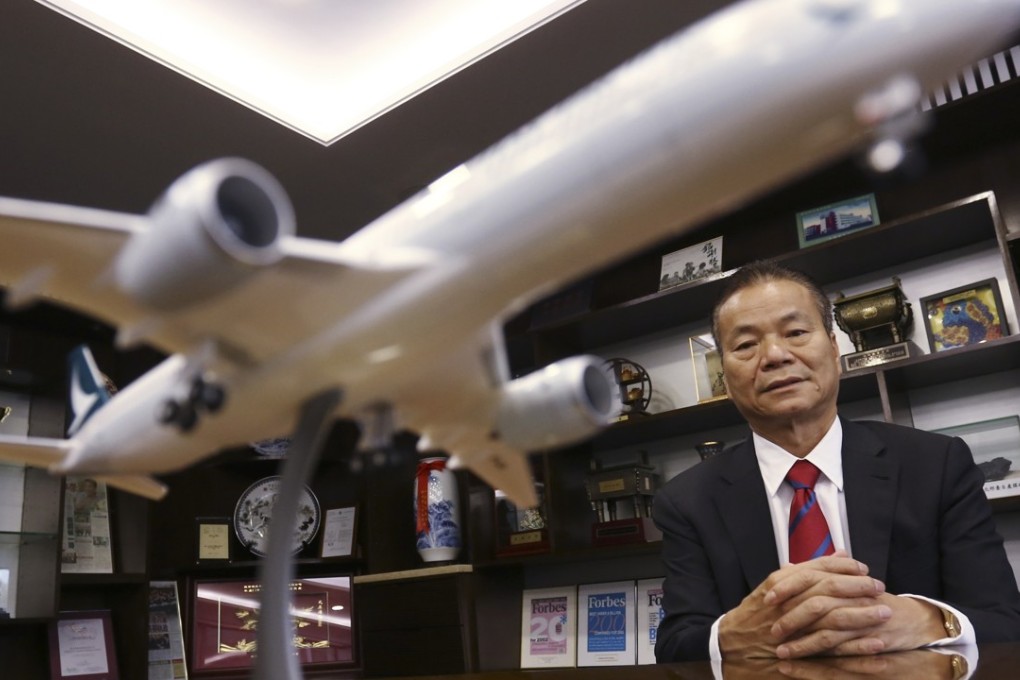

The HK$3.4 billion investment in one of Asia’s premium international airlines through stock market purchases between last December and June 30 marked the start of the 61-year-old chairman’s entry into aviation, despite having no business experience in the sector.

New investor Kingboard urges Swire to get involved in turning around ailing Cathay Pacific

From the oatmeal offered at Cathay Pacific’s lounges to its frontline crew services and global reach, Cheung considers the airline a jewel in Kingboard’s portfolio, which spans industrial, technology and property sectors.

“I have not made any losses in any investments in the past 20 years,” he said confidently. “I made a lot of money in the financial downturn in 2003, and even more in the global financial crisis in 2008.

And, despite its current challenges, Cheung described Cathay Pacific as one of the best companies to invest in.