As Shenzhen and Guangzhou power ahead, can Hong Kong leapfrog the competition?

An idyllic spot on the border, the Lok Ma Chau Loop, highlights the stark difference in attitudes over the development of high-value IT and R&D activities

On a sunny day earlier this month, egrets roamed abandoned farmland on Hong Kong’s border with Shenzhen and pecked at the fish ponds dotting the landscape in search of food.

This scene would ordinarily cut an idyllic picture. Except that the site where it was taking place was supposed to be Hong Kong’s largest innovation and technology park.

A decade has passed since authorities first singled out the area, known as the Lok Ma Chau Loop, as a major infrastructure development project for the city.

Obviously, little had happened since. But just across the Shenzhen River, the picture was starkly different.

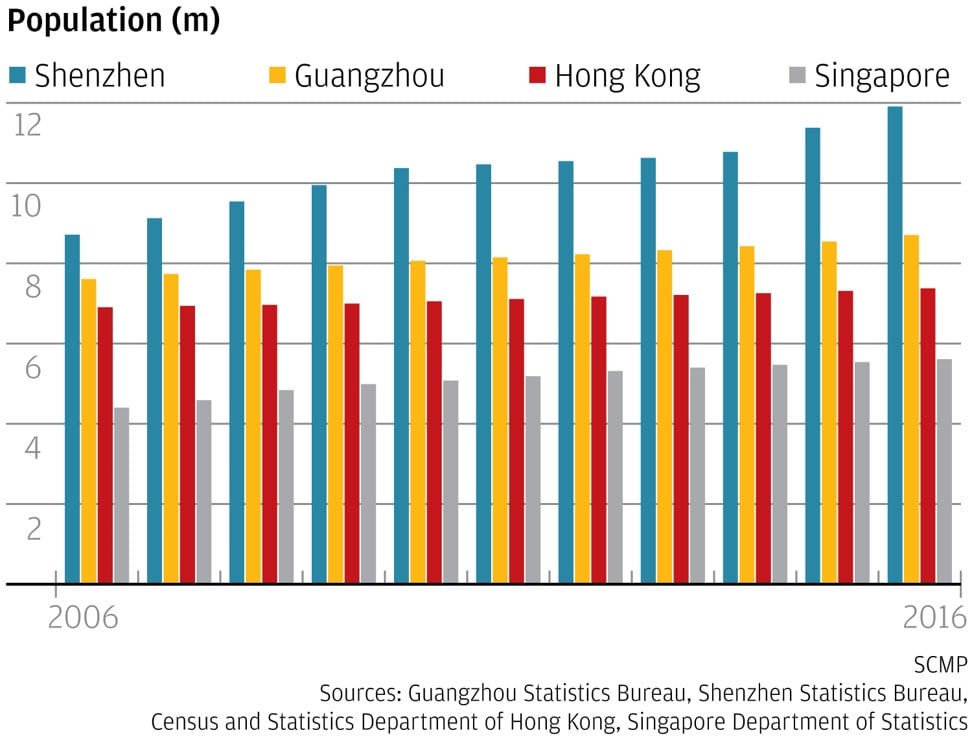

The Shenzhen special economic zone had in recent decades evolved from a fishing village to “factory of the world” to hi-tech hub – and now holds 12 million people and three million businesses, including Chinese technology names known to the world including internet giant Tencent, drone maker DJI and infocomm bigwig Huawei.

Shenzhen start-ups fear slow work on Lok Ma Chau Loop tech park

It was only about a decade ago that the mainland city switched from producing garments and electrical appliances to high-value IT and R&D activities.

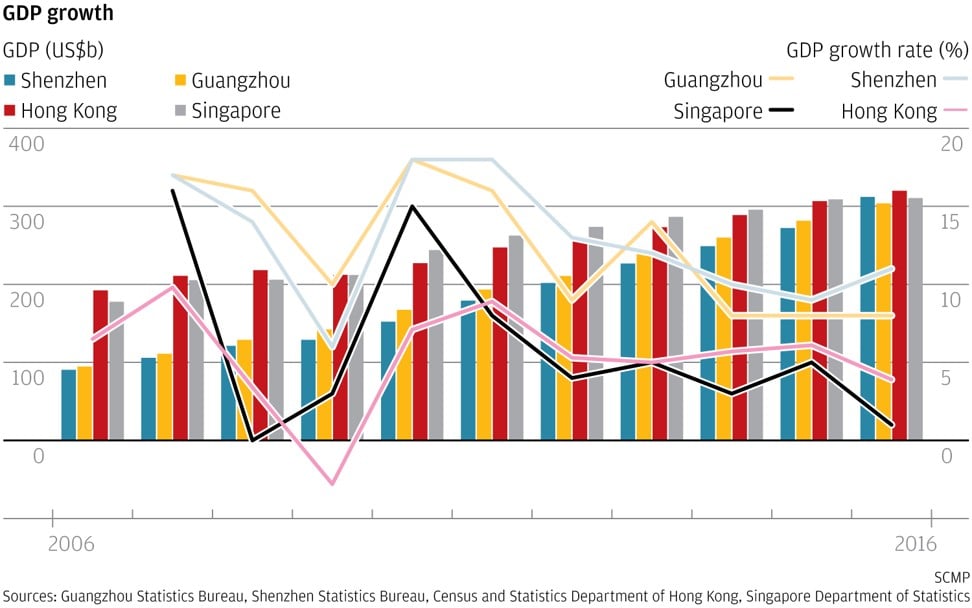

On January 16, state-run media gleefully announced that Shenzhen last year had surpassed Hong Kong’s economic output to hit 2.2 trillion yuan (US$338 billion) on the back of 8.8 per cent growth.

Shortly before, Guangzhou, the municipal city of Guangdong province, trumpeted its economy’s 7 per cent growth, which pushed gross domestic product to an unprecedented 2.15 trillion yuan in 2017.

Hong Kong’s 2017 economic performance will be revealed next month during Financial Secretary Paul Chan’s budget speech. The city was expected to announce growth of 3.7 per cent with GDP at HK$2.58 trillion (US$331 billion), putting it behind Shenzhen and Guangzhou for the first time.

Shenzhen overtakes Guangzhou as biggest economy in Guangdong province

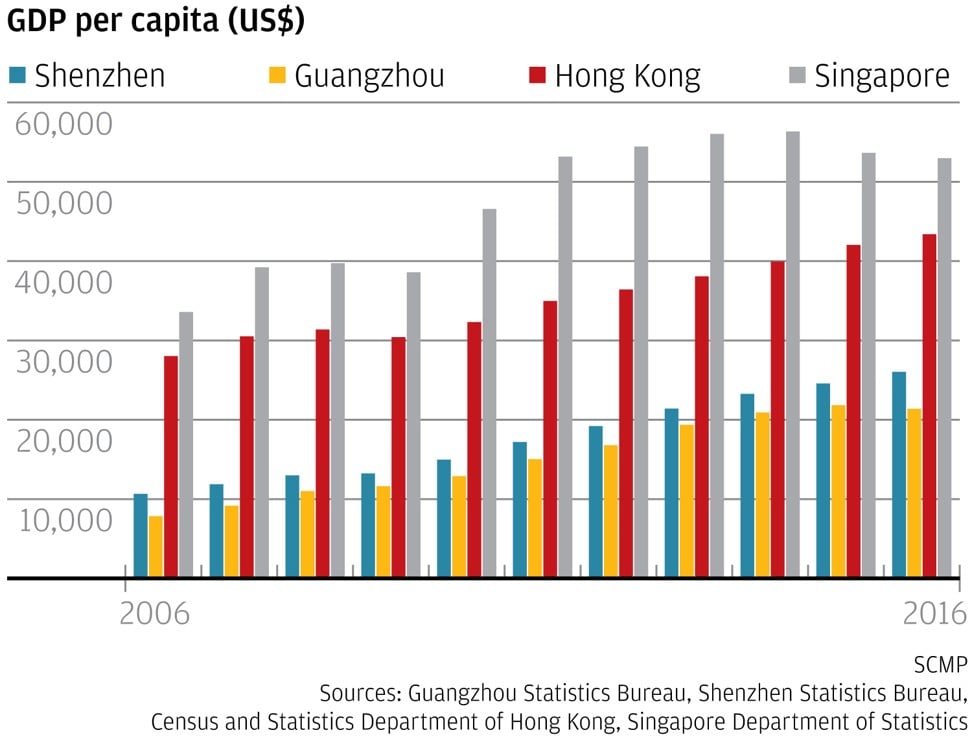

However, analysts said that using GDP alone to compare the cities would be inadequate, with GDP per capita – output divided by population – a better indication of standard of living.

Using this measure, Hong Kong, at US$44,000, was doing better than Shenzhen (US$25,000) and Guangzhou (US$21,000), Ayesha Macpherson Lau, managing partner of professional services firm KPMG’s Hong Kong office, pointed out.

“Hong Kong has the highest standard of living and is still way ahead,” she said.

But lawmakers and entrepreneurs looking to the future said that with neighbouring cities catching up, Hong Kong needed to hustle to maintain its standing as a competitive and vibrant economy. So what could it do to achieve this and even leapfrog the competition?

Building the right ecosystem

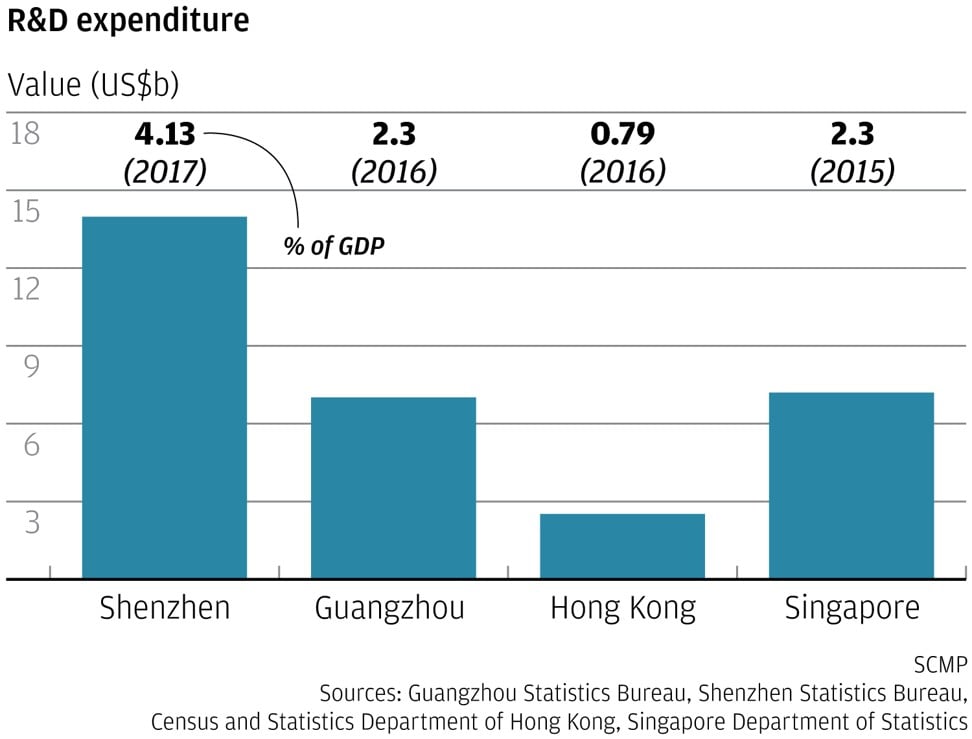

Shenzhen’s manic pace of growth in the last decade was fuelled by an abundance of labour and capital invested in R&D and innovation. In contrast, Hong Kong spent the same period grappling with a tourism downturn, political upheaval and skyrocketing property prices.

It also stubbornly remained reliant on its traditional pillar industries – retail, property, financial services and shipping – and fell behind neighbours such as Japan, South Korea and Singapore when it came to investing in R&D, fostering innovation and nurturing home-grown talent.

The Innovation and Technology Bureau told the Post that since November 2015, the government had injected HK$18 billion to promote innovation and technology development, and had earmarked another HK$10 billion for the purpose.

“Our efforts … are beginning to see results,” a spokesperson said, adding that its expenditure on R&D in 2016 was HK$19.7 billion and had gone up 8 per cent from the year before even though GDP growth in the same period averaged 4 per cent.

IT sector lawmaker Charles Mok acknowledged that it might be unfair to compare the growth of Shenzhen’s tech sector with that of Hong Kong’s, given that the former had “factories in Guangdong and the rest of China to back it up, and it has lots of land and a strong background in manufacturing and electronics”, while the latter had always positioned itself as a finance hub.

But the government still had a duty to attract the right kind of tech companies here, he said.

“The government should invite market leaders from the mainland and abroad to do research and development here. Taiwan and Singapore went out of their way to attract Google and Apple … [so] in this sense Hong Kong has lost to them already,” he said.

Uber boss claims drivers returning three months after police crackdown in Hong Kong

Last year, the city’s financial services regulator launched a “sandbox” for fintech entities to test their offerings on a pilot basis without adhering to the usual supervisory requirements. Mok suggested the government do the same for sharing-economy technology, to encourage firms to pursue innovative and better business models.

At least one entrepreneur who spoke to the Post said the city could still do more to help start-ups grow their business.

Zack, a 28-year-old mainlander who spoke on condition that his full name not be used, said he had high hopes of starting his electrical lab tool business in Hong Kong three years ago – until it became too expensive to do so.

He only got a year’s rental waiver at the city’s technology incubator, Hong Kong Science Park in Sha Tin, and as he struggled to find investors, he found the salaries he was expected to pay employees were too high.

Zack took matters into his own hands and moved to Dongguan, another manufacturing hub in the Pearl River Delta.

Guangdong to set up its version of Silicon Valley on the doorsteps of Hong Kong and Shenzhen

There, he and a team of three other youngsters shared a home office costing 3,000 yuan a month. Each of them spent about 2,500 yuan per month on living costs – which he doubted would be possible if he had remained in Hong Kong.

“There are many policies to support talented and young entrepreneurs who wish to work or start businesses in Shenzhen,” he said. “Other than subsidies, the Shenzhen municipal government supports more than 100 companies with its own investment fund.

“Can Hong Kong offer the same thing?”

Chinese University business school lecturer Simon Lee Siu-por, who regularly taught at the school’s Shenzhen campus, said the mainland city offered an ecosystem that allowed research and entrepreneurship to thrive.

“We are not just talking about research centres, but also offices, residential buildings, hi-tech production factories, and other supporting facilities,” he said.

Airbnb another casualty of high property prices in Hong Kong, destination that bucks global trend for more non-hotel stays

Lee said he had a “revolutionary” suggestion for the government – why not rent a parcel of land on the mainland and provide a similar environment?

“In Hong Kong, it’s so difficult to get land approval from the Legislative Council,” Lee said, adding that the lease idea could be a more practical option.

An optimal talent mix

Chris Wen Weiqiang, a 31-year-old research manager at the Hong Kong office of a multinational company described the city as “a great place for professionals”.

Wen, who completed his postgraduate studies in Guangzhou, said: “All systems, from public utilities to private services, are so well developed and clear-cut and its high wages and low taxes help me earn more and save more.”

Indeed, Hong Kong’s cosmopolitan nature had always attracted international talent but Jeffrey Lam Kin-fung, a pro-establishment lawmaker and a member of Carrie Lam’s Cabinet, said the city still needed more skilled workers. Addressing the skills mismatch in education and easing immigration restrictions to attract skilled talent to the hi-tech and research industries would help.

Educators said young Hongkongers should have better science, technology, engineering and mathematics education, and also hone skills such as the ability to solve complex issues and innovate solutions, which would be necessary for the future economy.

STEM education key to Hong Kong’s ‘smart city’ plan, but long-term steps must be taken now, experts warn

The Academy of Sciences of Hong Kong, which recognises the contributions of local scientists, found in a study last year that almost half of new senior secondary students did not take any science or technology subjects while enrolment in advanced mathematics classes dropped from 23 per cent in 2012 to 14 per cent in 2016, much lower than that of Singapore, Japan, South Korea and Taiwan.

A report by the Economist Intelligence Unit last year found that to “future-proof” students, countries needed a curriculum focused on skills that would be in demand, ways of testing those skills, and well-supported teachers who were equipped to teach them.

Zhu Huawei, principal of Shenzhen Middle School – the best performing secondary school in the municipality – said it was hiring more educated teachers and designing more special curriculums to make it a “world class middle school.”

“I am the fourth teacher with a doctoral degree in this school and there are too few of us here,” he said. “We need to have dozens, even up to 100, PhD graduates from famous universities home and abroad to realise our goal.”

He added that the school had joined forces with Tencent, Huawei and DJI to set up 10 innovation experience centres to expose students to IT.

What Zhu said next could also be instructive for Hong Kong.

“Basic education is part of a city’s core competency. The more high-quality primary and secondary schools Shenzhen has, the more attractive is the city to talents [as their children can get a good education],” he said.

“All these will be important for Shenzhen to become a modern, internationalised and innovative city.”

Chinese University of Hong Kong economics professor Terence Chong Tai-leung urged the government to also look at how to boost local labour force participation.

“Hong Kong is already a very mature and efficient economy. If it wants to have higher economic growth, it must increase inputs, which are capital, labour and efficiency,” Chong said, adding that as an international financial centre, capital was not a problem.

One way would be to improve childcare facilities and urge women who had left the workforce to return. The city’s labour participation rate was 55 per cent for females and 68 per cent for males as of December last year.

Boosting core strengths

While it was crucial to pursue new areas of growth, KPMG’s Lau suggested that the city also ensure that it retained its pole position as a place to raise capital from international investors.

“Hong Kong’s global financial position means the city can be the platform for diversified funding sources such as syndicated loans, private equity funds, bank financing, green bonds and listing on the stock market,” Lau said.

On that note, the Hong Kong stock exchange had proposed allowing dual-class shares to attract new economy companies to list in the city. Multiple-class shareholding structures were more attractive to technology companies as they gave their management not owners more control of the board.

Securities commission backs introduction of dual-class shares on Hong Kong stock exchange

Lau and other analysts stressed that the city should also continue to preserve its strengths as the world’s freest economy, with top-notch professional and financial services talent, strong rule of law and developed transport and logistics links to the rest of the world.

Miles Wen Haofu, the 28-year-old founder of Fano Lab, which provided companies with artificial intelligence solutions for customer service, agreed.

An electrical and electronic engineering PhD graduate from the University of Hong Kong, Wen turned down offers from Silicon Valley firms to start his business, which just last month received funding from property tycoon Li Ka-shing’s investment arm, Horizons Ventures.

Wen said what he valued most was the city’s clear commercial and intellectual property laws, which ensured the contracts he signed stood on firm ground.

“Hong Kong has a small market but it’s a good place for us to sell our software to clients around the world,” Wen said.

“International clients prefer our products to those produced by mainland-based companies because Hong Kong has a better reputation in the global business community.”