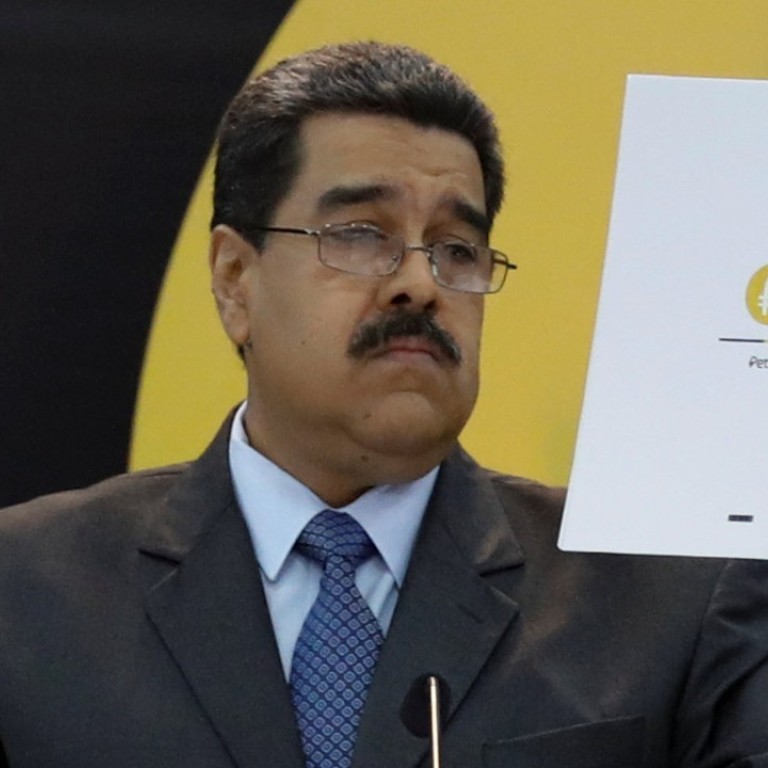

Venezuela says it raised US$735 million at launch of own ‘Petro’ oil-backed cryptocurrency

President Nicolas Maduro hopes the Petro will allow the ailing country to skirt US sanctions as it struggles with hyperinflation and a collapsing socialist economy

Venezuela has formally launched its new oil-backed cryptocurrency in an unconventional bid to haul itself out of a deepening economic crisis.

The leftist Caracas government put 38.4 million units of the world’s first state-backed digital currency, the Petro, on private pre-sale from Tuesday.

During the first 20 hours of the pre-sale, which runs through March 19, Venezuela received “intent to buy” offers to the tune of US$735 million, according to President Nicolas Maduro.

“The Petro reinforces our independence and economic sovereignty and will allow us to fight the greed of foreign powers that try to suffocate Venezuelan families to seize our oil,” he said.

A total of 100 million Petros will go on sale, with an initial value set at US$60, based on the price of a barrel of Venezuelan crude in mid-January – but subject to change.

Economist and cryptocurrency expert Jean-Paul Leidenz said prices during the pre-sale “will be agreed privately,” and will then fluctuate according to the market when the initial coin offering of 44 million Petros is made on March 20.

Meanwhile, the government will reserve the remaining 17.6 million Petros.

Venezuela has the world’s largest proven oil reserves but is facing a crippling economic and political crisis.

Vice-President Tareck El Aissami said the Petro would “generate confidence and security in the national and international market.”

Maduro announced in early December that Venezuela – which is under sanctions from the US as well as the EU – was creating the digital currency.

The Venezuelan leader said he expected the Petro to open “new avenues of financing” in the face of Washington’s sanctions, which prohibit US citizens and companies from trading debt issued by the country and its oil company PDVSA.

But experts were sceptical about the Petro’s chances of success, pointing out that the country’s deep economic imbalances will only serve to undermine confidence in the new currency.

“Theoretically, with cryptocurrencies you could bypass the US financial system … but everything depends on generating confidence,” said economist Henkel Garcia.

Meanwhile, consulting firm Eurasia Group estimated that although Venezuela could raise some US$2 billion in the initial offer, it was “unlikely” that the Petro would be established as “a credible means of exchange,” beyond short term “interest”.

Venezuela is mired in a deep economic crisis triggered in large part by a fall in crude oil prices and a drop in oil production, which accounts for about 96 per cent of the country’s exports.

It is struggling to restructure its external debt, estimated at around US$150 billion by some experts.

Additional reporting by Reuters

.png?itok=arIb17P0)