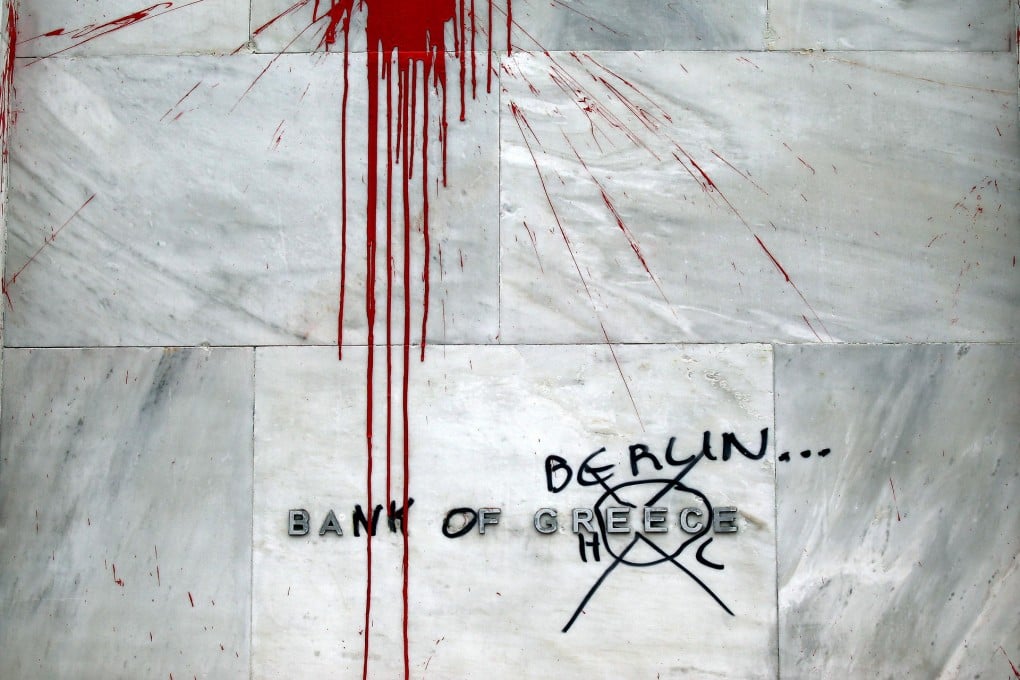

Fears over Greece haunt a recovering euro zone

In a reminder the region is still not out of the woods, Dutch finance minister adds his voice to the belief Athens will need a third bailout

Dutch Finance Minister Jeroen Dijsselbloem has become the latest politician to concede Greece may need a third bailout, casting a shadow over news that euro-zone companies are reporting their best growth for more than two years.

"The problems in Greece won't be solved in 2014, so something more will have to happen," said Dijsselbloem, who heads the Eurogroup of finance ministers.

He said the form and scale of another rescue would depend on Greece's progress with economic reforms.

His admission echoed that of German Finance Minister Wolfgang Schauble, who told an election campaign event earlier this week that the bailed-out country still needed more aid.